Webquest

advertisement

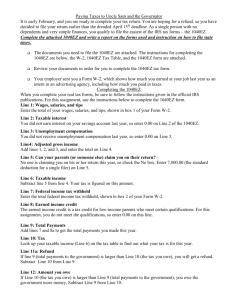

Enter Name Here: To enter your name here, double click where it says name and delete the rest of these words. To continue using the Word document, either double click outside this header or hit the “esc” key. Income Taxes Webquest Directions: Use the following links to (1) answer the questions and (2) complete the simulation. To access the link, hold down the “ctrl” key and click on the link. These simulations will expose you to and give you practice at completing tax documents such as the W-2, 1099-INT, 1040EZ, 1040A, etc. This will better prepare you to complete your taxes this year correctly so you do not have “miscommunications” with the IRS. Module 1 Tax Tutorial: Payroll Taxes and FIT 1. Social security tax is also called: a. 2. List three things federal income taxes finance: a. b. c. 3. Why do employees complete the W-4? a. Simulation 1: Completing Form W-4 1. Does Lawrence Red Owl have more than one job? Yes (to select yes, double click the gray box and mark “checked” under default value) No (follow the same instructions above to select no if this is your answer) 2. Is Lawrence Red Owl married? Yes No 3. Does Lawrence Red Owl have children or others who you will claim as dependents on your tax return? Yes No 4. How many allowances will Lawrence Red Owl claim? 1 2 3 4 5. What is the relationship between the number of allowances claimed on Form W-4 and the amount of tax withheld? a. Take the Module 1 assessment and show Mr. Robinson your grade Enter Name Here: To enter your name here, double click where it says name and delete the rest of these words. To continue using the Word document, either double click outside this header or hit the “esc” key. Module 2 Tax Tutorial: Wage and tip income 1. Bold each of the following that is taxable a. Wages b. Salaries c. Bonuses d. Commission 2. To whom does an employer send a Form W-2? a. Simulation 2: Using Your W-2 to File Your 1040EZ 1. What is Cicely King’s wages, salary, and tips? a. $ 2. How much federal income tax was withheld for Cicely? a. $ 3. What is the tax for the year as found on line 10 of Cicely’s 1040EZ tax form? a. $ 4. Is Cicely getting a refund or does she owe more taxes? Refund Owe more taxes 5. How much? a. $ 6. If you would actually e-file your taxes, what options do you have to receive your refund? a. b. 7. How do you “sign” your tax return when you e-file it? a. Take the Module 2 assessment and show Mr. Robinson your grade Enter Name Here: To enter your name here, double click where it says name and delete the rest of these words. To continue using the Word document, either double click outside this header or hit the “esc” key. Module 3 Tax Tutorial: Interest income 1. Why is interest income considered unearned income? a. 2. What is an example of where taxable interest income can come from? a. 3. What form is interest income reported on? a. Simulation 3: Using Your W-2 and Form 1099-INT to File Your 1040EZ 1. What is Tasha Miller’s wages, salary, and tips? a. $ 2. How much federal income tax was withheld for Tasha? a. $ 3. How much interest income does Tasha need to claim? a. $ 4. What is the tax for the year as found on line 10 of Tasha’s 1040EZ tax form? a. $ 5. Is Tasha getting a refund or does she owe more taxes? Refund Owe more taxes 6. How much? a. $ Take the Module 3 assessment and show Mr. Robinson your grade Enter Name Here: To enter your name here, double click where it says name and delete the rest of these words. To continue using the Word document, either double click outside this header or hit the “esc” key. Module 7 Tax Tutorial: Standard deduction 1. What does the standard deduction do? a. 2. In 2011, the standard deduction if you were single was… a. 3. What are the two reasons the standard deduction can be increased? a. b. Simulation 7A: Completing a tax return as a dependent 1. What is Monica Lindo’s filing status? Single Married filing jointly Married filing separately Qualifying widow(er) with dependent child Head of household (with qualifying person) 2. Can she be claimed as a dependent on someone else’s tax return? Yes No 3. What is Monica Lindo’s wages, salary, and tips? a. $ 4. How much federal income tax was withheld for Monica? a. $ 5. Based on the completed tax form, how many exemptions is Monica claiming? a. 6. What is the standard deduction for Monica? a. $ 7. What is the total tax as found on line 35 of Monica’s 1040A tax form? a. $ 8. Is Monica getting a refund or does she owe more taxes? Refund Owe more taxes 9. How much? a. $ Take the Module 7 assessment and show Mr. Robinson your grade Enter Name Here: To enter your name here, double click where it says name and delete the rest of these words. To continue using the Word document, either double click outside this header or hit the “esc” key. Simulation 12: Completing a tax return using form 1040A to claim a dependent 1. What is Jacob Hasting’s filing status? Single Married filing jointly Married filing separately Qualifying widow(er) with dependent child Head of household (with qualifying person) 2. Can Jacob claim his daughter, Linda, as a dependent? Yes No 3. What is Jacob’s wages, salary, and tips? a. $ 4. How much federal income tax was withheld for Jacob? a. $ 5. How much interest income does Jacob need to claim? a. $ 6. What is the total tax as found on line 35 of Jacob’s 1040A tax form? b. $ 7. Is Jacob getting a refund or does she owe more taxes? Refund Owe more taxes 8. How much? a. $ Take the Module 12 assessment and show Mr. Robinson your grade