Unit 5- Taxes

advertisement

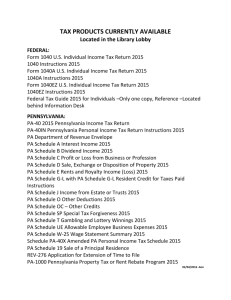

5.2 File a Tax Return Tax Return Form W-2 Form 1099-INT Form 1040EZ Dependent Deduction Social Security Number Taxable income A tax return is a set of forms that taxpayers use to calculate their tax obligation. (how much income taxes they owe.) Is everyone required to file a tax return? No, only if you have income above the minimum amount set each year by the government. Salary or wages Tips Investments/Capital Gains Interest Jobs paid in cash Lottery winnings Your Aunt Sue gave you $200 for your birthday, is this taxable income? No, you are not required to pay taxes on gifts unless they exceed the amount allowed by the government. You must calculate and file your tax return by April 15th for the previous year. For Example: For the work year January 1, 2010- December 31, 2010 W-2 Form provided by employers by January 31, 2011 Form 1099-INT provided by banks by January 31, 2011 Tax returns due to IRS by April 15, 2011 For most young people these two forms are enough to complete your income tax returns. 1. Form W-2: a summary of your earnings and withholdings for the year. 2. Comes from your employer Must be provided by employers by January 31 When you file a tax return you must enclose a copy of your W-2 form. (the IRS also receives one from your employer) Form 1099-INT: a statement of the interest your bank paid on your savings for the year. All individual tax payers must use one of the following three basic forms for filing a federal income tax return: 1. 2. 3. 1040 1040A 1040EZ Most young people qualify to use the simplest form which is the F0rm 1040EZ. When you are older and your financial life is likely to be more complicated- you will use a 1040 or 1040A. These forms allow you to itemize deductions to reduce the amount of tax you owe. Deductions are expenses you can legally subtract from your income before calculating your taxes. 1. Label (Identify yourself) 1. 2. Name & Address Social Security Number – a unique number assigned to you by the federal government. Memorize this number, you will have to write it on many official documents. 2. Income 1. Works you through to your taxable income-the income figure that is used to determine your taxes. 3. Payment and Tax 1. 2. Federal withholdings + (EIC) = Total Payment Tax- use table to calculate your total tax for the year 4. Refund or Amount you Owe Calculated 1. 5. Sign Here 1. 6. Refunds can be deposited electronically Signature, Date & Occupation (your signature declares the information is true) Check for Accuracy and File your Return 1. 2. 3. 4. 5. Always check your tax forms Pay amount owed by check or credit card (fee for credit card) Send tax form along with W-2 & check Keep copy for your records Send by April 15th Do people who work for themselves pay income tax? If so, how? Yes, they must file at 1040. Self employed individuals pay estimated taxes in quarterly installments based upon the income they receive each quarter. Self-employed individuals are required to complete and attach a Schedule C or C-EZ to their 1040 form. Most important thing to remember about the self- employed- they pay the same taxes that employees pay and they must “withhold” their own taxes and make the payments themselves. You may file your tax return online. Biggest advantage- you get your refund faster. FAST SLOW On-line returns take 3-4 weeks to process Snail mail returns can take 6 weeks or more. Simulation for payroll taxes & federal income tax withholding and filing an EZ1040EZ: http://www.irs.gov/app/understandingTaxe s/student/hows_mod01.jsp After you complete the last step the Assessment, print out your score and hand it in for a grade.