Ratio Analysis: Financial Ratio Guide

advertisement

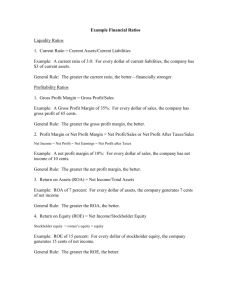

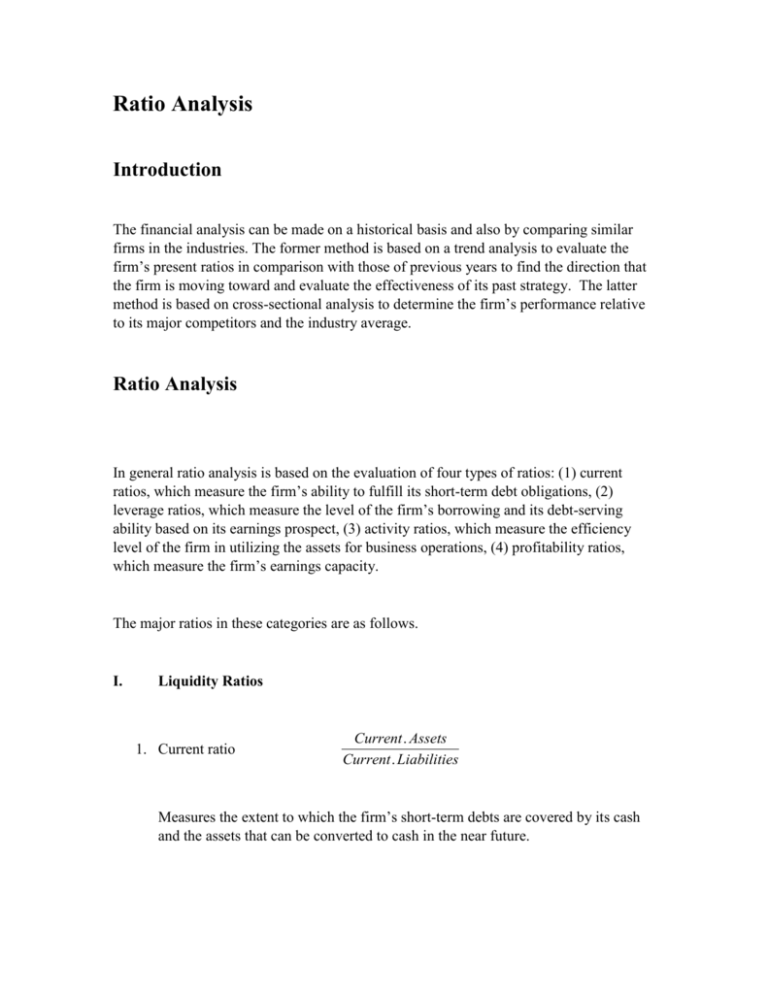

Ratio Analysis Introduction The financial analysis can be made on a historical basis and also by comparing similar firms in the industries. The former method is based on a trend analysis to evaluate the firm’s present ratios in comparison with those of previous years to find the direction that the firm is moving toward and evaluate the effectiveness of its past strategy. The latter method is based on cross-sectional analysis to determine the firm’s performance relative to its major competitors and the industry average. Ratio Analysis In general ratio analysis is based on the evaluation of four types of ratios: (1) current ratios, which measure the firm’s ability to fulfill its short-term debt obligations, (2) leverage ratios, which measure the level of the firm’s borrowing and its debt-serving ability based on its earnings prospect, (3) activity ratios, which measure the efficiency level of the firm in utilizing the assets for business operations, (4) profitability ratios, which measure the firm’s earnings capacity. The major ratios in these categories are as follows. I. Liquidity Ratios 1. Current ratio Current . Assets Current . Liabilities Measures the extent to which the firm’s short-term debts are covered by its cash and the assets that can be converted to cash in the near future. 2. Quick ratio Current . Assets Inventory Current . Liabilities A measure of a firm’s ability to pay its short-term debt without relying on the sales of its inventory II. Leverage Ratios 3. Debt to assets ratio Total. Debts Total. Assets An indication of the extent to which the business is financed by the borrowed funds. 4. Debt to equity ratio Total. Debts Owner ' s. Equity An alternative measure of the firm’s debt using, comparing the fund financed by debts and that provided by the owner. 5. Time interest earned Income. before. Taxes Interest Interest . Ch arg es A multiple of earnings available to pay interest costs and the interest cost, which measures the level of comfort for the firm to serve its interest obligations based on its earnings prospect. 6. Fixed charge coverage Income. before. Taxes.&. Interest Lease Lease. Ch arg es 2 An alternative measure with the purpose similar to Time Interest Earned, showing the firm’s capacity to serve its debt obligations plus fixed obligation charges. III. Activity Ratios 7. Inventory turnover Sales Inventory Based on a comparison with the industry average, it shows whether the firm has excess inventory stock or inadequate inventory. 8. Total asset turnover Sales Total. Assets It shows the relation between sales and the assets employed to generate the sales, which measures the efficiency of business operations. 9. Account receivable turnover Sales Account . Re ivable Based on a comparison of sales with the credit granted to generate the sales, it shows the average length of time to collect the credit. IV. Profitability Ratios 10. Gross profit margin Sales Cost . of . Goods. Sold Sales A measure of the margin to cover operation costs and yield profits. 3 Net . Income Sales 11. Net profit margin Reflecting the profit per dollar of sales. Net . Income Total. Assets 12. Return on total assets A measure of the profit generated from each dollar of fund employed for business operations. Net . Income Owner ' s. Equity 13. Return on equity A measure of the profit earned by the owner for each of his/her dollar invested in the business. V. Du Pont Analysis Du Pont Analysis provides another perspective on how combined activities and financial leverage determined the profitability of the firm. Net . Income Sales × Sales Total. Assets = Net . Income . Total. Assets Consequently, Net profit margin × Total asset turnover = Return on assets. 4 Furthermore, Total. Debts Net . Income Net . Income × (1 + ) = . Total. Assets Owner ' s. Equity Owner ' s. Equity In other words, Return on Assets × ( 1 + Debt-Equity Ratio) = Return on Equity. 5