Analyzing Financial Statements

advertisement

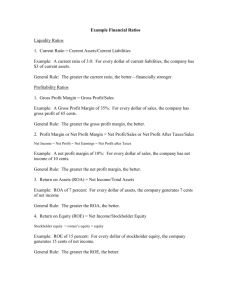

Analyzing Financial Statements Some Users of Financial Statements Individuals Government regulatory agencies Businesses Taxing authorities Investors and creditors Nonprofit organizations Understanding The Business Individual Company Factors Industry Factors No Lend? Sell on credit? Invest? Economy-wide Factors Yes Analyzing Financial Statements Analytical techniques used to examine relationships among financial statement items Dollar and percentage changes on statements (Horizontal Analysis)/ Trend Analysis Common-size statements (Vertical Analysis) Ratios Horizontal Analysis Horizontal analysis shows the changes between years in the financial data in both dollar and percentage form. Horizontal Analysis CLOVER CORPORATION Comparative Balance Sheets December 31 2013 2012 Increase (Decrease) Amount % Assets Current assets: Cash $ 12,000 $ 23,500 $ (11,500) (48.9) Accounts receivable, net 60,000 40,000 Inventory 80,000 100,000 Prepaid expenses 3,000 1,200 $12,000 – $23,500 164,700 = $(11,500) Total current assets 155,000 Property and equipment: Land 40,000 40,000 ($11,50085,000 ÷ $23,500) × 100% = 48.9% Buildings and equipment, net 120,000 Total property and equipment 160,000 125,000 Total assets $ 315,000 $ 289,700 Horizontal Analysis CLOVER CORPORATION Comparative Balance Sheets December 31 2013 Assets Current assets: Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Property and equipment: Land Buildings and equipment, net Total property and equipment Total assets $ 12,000 60,000 80,000 3,000 155,000 40,000 120,000 160,000 $ 315,000 $ 2012 Increase (Decrease) Amount % 23,500 40,000 100,000 1,200 164,700 $ (11,500) 20,000 (20,000) 1,800 (9,700) (48.9) 50.0 (20.0) 150.0 (5.9) 35,000 35,000 $ 25,300 0.0 41.2 28.0 8.7 40,000 85,000 125,000 $ 289,700 Horizontal Analysis CLOVER CORPORATION Comparative Income Statements For the Years Ended December 31 2013 Sales $ 520,000 Cost of goods sold 360,000 Gross margin 160,000 Operating expenses 128,600 Net operating income 31,400 Interest expense 6,400 Net income before taxes 25,000 Less income taxes (30%) 7,500 Net income $ 17,500 2012 $ 480,000 315,000 165,000 126,000 39,000 7,000 32,000 9,600 $ 22,400 Increase (Decrease) Amount % $ 40,000 8.3 45,000 14.3 (5,000) (3.0) 2,600 2.1 (7,600) (19.5) (600) (8.6) (7,000) (21.9) (2,100) (21.9) $ (4,900) (21.9) Trend Analysis Trend Percentages Trend percentages state several years’ financial data in terms of a base year, which equals 100 percent. Trend Analysis Trend Percentage = Current Year Amount Base Year Amount × 100% Trend Analysis Berry Products Income Information For the Years Ended December 31 Item Sales Cost of goods sold Gross margin 2013 145% 150% 135% 2012 129% 132% 124% Year 2011 116% 118% 112% 2010 105% 104% 108% By analyzing the trends for Berry Products, we can see that cost of goods sold is increasing faster than sales, which is slowing the increase in gross margin. 2007 100% 100% 100% Vertical Analysis Vertical analysis focuses on the relationships among financial statement items at a given point in time. A common-size financial statement is a vertical analysis in which each financial statement item is expressed as a percentage. Common-Size Statements CLOVER CORPORATION Comparative Income Statements For the Years Ended December 31 Common-Size Percentages 2011 2010 2011 2010 Sales $ 520,000 $ 480,000 100.0 100.0 Cost of goods sold 360,000 315,000 Sales is usually the base and is Gross margin 160,000 165,000 expressed as Operating expenses 128,600 126,000 100%. Net operating income 31,400 39,000 Interest expense 6,400 7,000 Net income before taxes 25,000 32,000 Less income taxes (30%) 7,500 9,600 Net income $ 17,500 $ 22,400 Common-Size Statements CLOVER CORPORATION Comparative Income Statements For the Years Ended December 31 Common-Size Percentages 2011 2010 2010 2009 Sales $ 520,000 $ 480,000 100.0 100.0 Cost of goods sold 360,000 315,000 69.2 65.6 Gross margin 160,000 165,000 30.8 34.4 Operating expenses 128,600 126,000 24.8 26.2 Net operating income 31,400 39,000 6.0 8.2 Interest expense 6,400 7,000 1.2 1.5 Net income before taxes 25,000 32,000 4.8 6.7 Less income taxes (30%) 7,500 9,600 1.4 2.0 Net income $ 17,500 $ 22,400 3.4 4.7 Common-Size Statements In balance sheets, all items usually are expressed as a percentage of total assets (or total liabilities+equity). Ratio Analysis Interpreting Ratios Ratios may be interpreted by comparison with ratios of earlier periods, other companies, or with industry average ratios. Ratios may vary because of the company’s industry characteristics, nature of operations, size, and accounting policies. Limitations of Financial Statement Analysis Differences in accounting methods between companies sometimes make comparisons difficult. We use the LIFO method to value inventory. We use the average cost method to value inventory. Limitations of Ratio Analysis Analysts should look beyond the ratios. Industry trends Technological changes Changes within the company Consumer tastes Economic factors Profitability Ratios (The Common Stockholder) Gross Margin Percentage Gross Margin Percentage = Gross Margin Sales This measure indicates how much of each sales dollar is left after deducting the cost of goods sold to cover expenses and provide a profit. Earnings per (Common) Share (EPS) EPS = Net Income* Average Number of Shares Outstanding for the Period *If there are preferred dividends, the amount is subtracted from net income. EPS = $5,761 (1,970 + 2124) ÷ 2 = $2.81 Average number of shares based on the number of shares at the beginning and end of the year. Earnings per share is probably the single most widely watched financial ratio. Price/Earnings (P/E) Ratio Market tests relate the current market price of a share of stock to an indicator of the return that might accrue to the investor. P/E Ratio = P/E Ratio = Current Market Price Per Share Earnings Per Share $45 $2.35 = 19X This ratio measures the relationship between the current market price of the stock and its earnings per share. Dividend Payout Ratio Dividend Payout Ratio Dividend Payout Ratio = Dividends Per Share Earnings Per Share = $2.00 $2.42 = 82.6% This ratio gauges the portion of current earnings being paid out in dividends. Investors seeking dividends (market price growth) would like this ratio to be large (small). Dividend Yield Ratio Dividend Yield Dividend Yield = = Dividends Per Share Market Price Per Share $0.675 $34 = 2% This ratio is often used to compare the dividendpaying performance of different investment alternatives. Return on Total Assets Return on Assets Return on Assets = = Net Income + Interest Expense (net of tax) Average Total Assets $5,761 + ($392 × (1 - .34)) ($52,263 + $44,405) ÷ 2 = 12.5% Corporate tax rate is 34%. This ratio is generally considered a measure of a company’s profitability. Return on Common Stockholders’ Equity Return on Common Stockholders’ Equity = Return on Common Stockholders’ Equity = Net Income – Preferred Dividends Average Stockholders’ Equity $53,690 – $0 ($180,000 + $234,390) ÷ 2 = 25.91% This measure indicates how well the company used the owners’ investments to earn income. Book Value Per Share Book Value per = Share Book Value per = Share Common Stockholders’ Equity Number of Common Shares Outstanding $234,390 27,400 = $8.55 This ratio measures the amount that would be distributed to holders of each share of common stock if all assets were sold at their balance sheet carrying amounts after all creditors were paid off. Financial Leverage Financial leverage involves acquiring assets with borrowed funds. Return on investment in > assets Return on investment in assets < Interest rate on borrowed funds Interest rate on borrowed funds = Positive financial leverage = Negative financial leverage Financial Leverage Percentage Financial Leverage 9.7% = = Return on Equity – Return on Assets 22.2% – 12.5% Financial leverage is the advantage or disadvantage that occurs as the result of earning a return on equity that is different from the return on assets. Liquidity Ratios (The Short-Term Creditor) Working Capital The excess of current assets over current liabilities is known as working capital. Working capital is not free. It must be financed with long-term debt and equity. Current Ratio Current Ratio Current Ratio = = Current Assets Current Liabilities $18,000 $12,931 = 1.39 to 1 This ratio measures the ability of the company to pay current debts as they become due. Quick Ratio (Acid Test) Quick Ratio = Quick Assets Current Liabilities Quick Ratio = $3,837 $9,554 Cash & Cash Equivalents Receivables, net Short-term Investments Quick Assets = 0.40 to 1 $ 600 3,223 14 $ 3,837 This ratio is like the current ratio but measures the company’s immediate ability to pay debts. Receivable Turnover Receivable Turnover Receivable Turnover = = Net Credit Sales Average Net Receivables $90,837 ($3,223 + $2,396) ÷ 2 This ratio measures how quickly a company collects its accounts receivable. = 32.3 Times Average Collection Period Average Collection Period Average Collection Period = Days in Year Receivable Turnover = 365 32.3 = 11.3 Days This ratio measures the average number of days it takes to collect receivables. Inventory Turnover Inventory Turnover Cost of Goods Sold = Average Inventory Inventory Turnover $61,054 = ($12,822 + $11,401) ÷ 2 = 5.0 Times This ratio measures how quickly the company sells its inventory. Average Sale Period Average Sale Period Average Sale Period = Days in Year Inventory Turnover = 365 5.0 = 73 Days This ratio measures the average number of days it takes to sell the inventory. Solvency Ratios (The Long-Term Creditor) Times Interest Earned Tests of solvency measure a company’s ability to meet its long-term obligations. Times Interest Earned = Times Interest Earned = Net Interest Income Tax + + Income Expense Expense Interest Expense $5,761 + $392 + $3,547 $392 = 24.7 Times This ratio indicates a margin of protection for creditors. Debt-to-Equity Ratio Debt-to-Equity Ratio Debt-to-Equity Ratio = Total Liabilities Stockholders’ Equity = $27,233 $25,030 = 1.09 This ratio measures the amount of liabilities that exists for each $1 invested by the owners. End of Chapter 15