Basic Steps to Starting a Business

advertisement

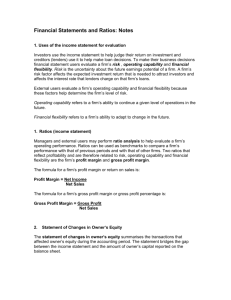

Financial Ratios In analyzing the financial statements it is common to use a number of ratios to determine what strengths or problem areas a business might have. There are also ratios published for different types of businesses, which can be used for comparison. These will show how your business compares with similar established businesses. LIQUIDITY RATIOS 1. Current Ratio = Current Assets Current Liabilities This measures the availability of liquid assets to meet current debts due within the year. 2. Quick Ratio = Cash+Receivables+Marketable Securities Current Liabilities This measures the immediate debt paying ability of the business. The assets used in this calculation are those readily converted to cash. 3. Inventory Turnover = Net Sales Inventory This ratio indicates the number of times the inventory is replaced in a given period of time. This gives an indication of how well the inventory is controlled. A slow turnover indicates that too much is invested in merchandise. A high turnover rate reflects favorably on the business. 4. Receivable Turnover = Net Sales Accounts and Notes Receivable This ratio indicates the number of times receivables turnover in a year. The higher the turnover, the shorter the time between the sale and the collection of cash. 5. Ratio of Net Sales to Net Working Capital = Net Sales Net Working Capital Net working capital equals current assets less current liabilities. Since working capital reflects the ability to finance current operations, relating sales to Net Working Capital measures how efficiently working capital is employed. OPERATING RATIOS 1. 2. Return On Equity (%) = Net Income Before Taxes X 100 Net Worth The above ratio is your return on investment, the percentage of investment being returned through profit. This ratio indicates the ability of management to increase stockholders investment. Return on Assets (%) = Net Income Before Taxes X 100 Total Assets This relationship of net income to total assets indicates the amount of income generated for every dollar tied up in assets. Small Business Development Center at the Santa Fe Higher Education Center 505-428-1343 3. Fixed Asset Turnover = Net Sales Fixed Assets This is a measure of the capital investment needed to earn revenue. For example, a 1.0 turnover rate indicates that company uses $1.00 in capital to produce $1.00 of revenue (sales). PROFITABILITY RATIO Profit Margin (%) = Net Income Before Taxes X 100 Net Sales Profit margin represents the amount of profit resulting from each dollar of sales. For example, a 20% profit margin indicates that for every $1.00 in sales, a $.20 in profit was generated. Again, the ratios are useful in indicating a company’s financial position as related to others in a similar business. They are also used to indicate historical trends within the same company; for example, are the ratios consistent over a number of years, or are there points at which a change has occurred or is occurring. ADDITIONAL RATIOS Working Capital = Current Assets – Current Liabilities Acid Test Ratio = Current Assets (Current Assets – Inventory) Current Liabilities Days Sales in A/R = Accounts Receivable Net Sales Days Inventory = Inventory X Cost of Sales X Days in Period Days in Period Days CGS in A/P = Accounts Payable Cost of Sales X Days in Period Gross Profit Margin = Net Sales – Cost of Goods Net Sales Operating Expense Margin = Operating Expenses Net Sales Interest Coverage = Net Income Before Interest and Taxes + Depreciation Interest Expense Debt Service Coverage = Cash Flow from Operations Interest Expense + Current Portion of LT Debt Leverage Ratio = Total Liabilities Total Equity Small Business Development Center at the Santa Fe Higher Education Center 505-428-1343