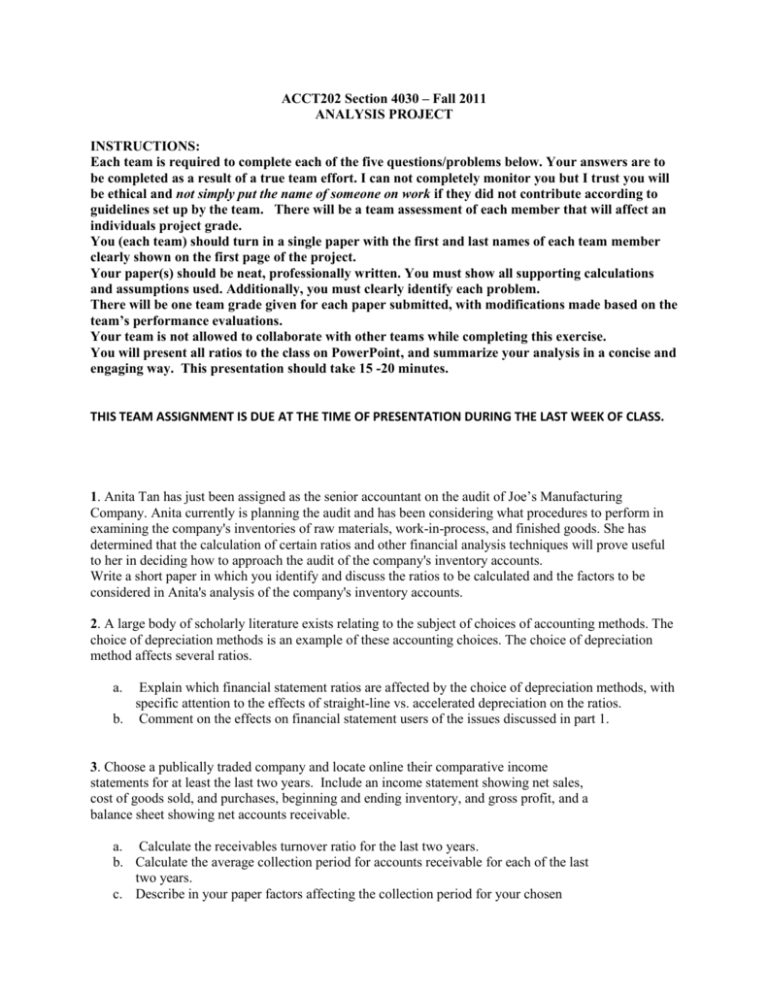

ACCT202 Section 4030 – Fall 2011 ANALYSIS PROJECT

advertisement

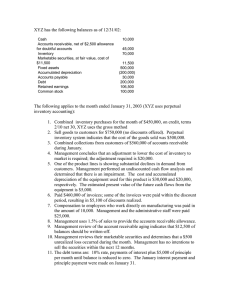

ACCT202 Section 4030 – Fall 2011 ANALYSIS PROJECT INSTRUCTIONS: Each team is required to complete each of the five questions/problems below. Your answers are to be completed as a result of a true team effort. I can not completely monitor you but I trust you will be ethical and not simply put the name of someone on work if they did not contribute according to guidelines set up by the team. There will be a team assessment of each member that will affect an individuals project grade. You (each team) should turn in a single paper with the first and last names of each team member clearly shown on the first page of the project. Your paper(s) should be neat, professionally written. You must show all supporting calculations and assumptions used. Additionally, you must clearly identify each problem. There will be one team grade given for each paper submitted, with modifications made based on the team’s performance evaluations. Your team is not allowed to collaborate with other teams while completing this exercise. You will present all ratios to the class on PowerPoint, and summarize your analysis in a concise and engaging way. This presentation should take 15 -20 minutes. THIS TEAM ASSIGNMENT IS DUE AT THE TIME OF PRESENTATION DURING THE LAST WEEK OF CLASS. 1. Anita Tan has just been assigned as the senior accountant on the audit of Joe’s Manufacturing Company. Anita currently is planning the audit and has been considering what procedures to perform in examining the company's inventories of raw materials, work-in-process, and finished goods. She has determined that the calculation of certain ratios and other financial analysis techniques will prove useful to her in deciding how to approach the audit of the company's inventory accounts. Write a short paper in which you identify and discuss the ratios to be calculated and the factors to be considered in Anita's analysis of the company's inventory accounts. 2. A large body of scholarly literature exists relating to the subject of choices of accounting methods. The choice of depreciation methods is an example of these accounting choices. The choice of depreciation method affects several ratios. a. Explain which financial statement ratios are affected by the choice of depreciation methods, with specific attention to the effects of straight-line vs. accelerated depreciation on the ratios. b. Comment on the effects on financial statement users of the issues discussed in part 1. 3. Choose a publically traded company and locate online their comparative income statements for at least the last two years. Include an income statement showing net sales, cost of goods sold, and purchases, beginning and ending inventory, and gross profit, and a balance sheet showing net accounts receivable. a. Calculate the receivables turnover ratio for the last two years. b. Calculate the average collection period for accounts receivable for each of the last two years. c. Describe in your paper factors affecting the collection period for your chosen company. 4. For the same company for the last two years: a. Calculate the inventory turnover rate. b. Calculate the number of day’s sales in inventory. c. Calculate the gross profit margin in sales. 5. For the same company for the last two years: a. b. c. d. e. Calculate the current ratio. Calculate the net profit margin on sales. Calculate the debt to equity ration. Calculate the times interest earned. Describe in your paper the financial health as reflected by your analysis.