Lecture 6 (Chapter 4) - it

advertisement

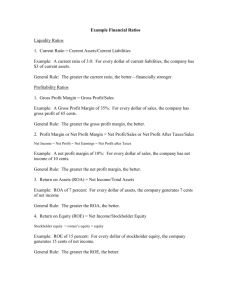

ANALYSIS OF FINANCIAL STATEMENTS Chapter 4 Outline Why are ratios useful? Ratios standardize numbers and facilitate comparisons. Ratios are used to highlight weaknesses and strengths. Ratio comparisons should be made through time and with competitors. Trend analysis. Peer (or industry) analysis. Major categories of ratios LIQUIDITY Liquidity ratios Current assets Current ratio= Current liabilities Current assets −inventory Quick ratio= Current liabilities Net working capital Net working capital = Revenues to sales Net working capital=Current assets − current liabilities Dell Quick ratio Net working capital to sales Current or quick ratio 1.6 18% 16% 14% 12% 10% 8% 6% 4% 2% 0% 1.4 1.2 1.0 0.8 0.6 0.4 0.2 0.0 2006 2007 2008 Fiscal year 2009 2010 NWC to sales Current ratio Operating cycle Operating cycle: The length of time it takes for the investment of cash in inventory to be returned in the form of payments from customers. The longer the operating cycle, the greater the need for liquidity Number of days Accounts receivable Days sales outstanding DSO = Credit sales 365 Inventory Days sales in inventory (DSI)= COGS/365 Accounts payable Days purchases (DPO)= outstanding Purchases 365 Beg. Inv. + Purchases = COGS + End. Inv. Operating cycle Operating cycle = DSO + DSI Cash conversion cycle = DSO + DSI - DPO Number of days Dell 120 100 80 60 40 20 0 -20 -40 -60 Days sales outstanding Days sales in inventory Days sales in purchases Operating cycle Cash conversion cycle 2006 Assumed all sales on credit 2007 2008 Fiscal year 2009 2010 ASSET EFFICIENCY Turnovers COGS Inventory turnover= Inventory Credit sales Accounts receivable turnover= Accounts receivable Revenues Fixed asset turnover= Fixed assets Revenues Total asset turnover= Total assets Dell Inventory turnover Fixed asset turnover Total asset turnover 2.5 Number of times 70 2.0 60 50 1.5 40 1.0 30 20 0.5 10 0 0.0 2006 2007 2008 Fiscal year 2009 2010 Total asset turnover 80 Relationships 365 Days sales in inventory= Inventory turnover 365 Days sales outstanding= Accounts receivable turnover PROFITABILITY Profit margins Gross profit Gross profit margin= Revenues Operating profit Operating profit margin= Revenues Net profit Net profit margin= Revenues Dell Gross profit margin 25% Operating profit margin Net profit margin Profit margin 20% 15% 10% 5% 0% 2006 2007 2008 Fiscal year 2009 2010 FINANCIAL LEVERAGE Debt management ratios Debt Debt−to−equity (D/E)= Equity Debt Debt−to−assets= Assets Assets Equity multiplier = Equity Debt management ratios, cont. EBIT Times interest earned (TIE)= Interest expense EBIT + Pfd div Fixed charge coverage= Fixed charges Fixed charges: Interest, preferred dividends, lease payments Coverage 0.9 Debt-equity Debt to total assets Equity multiplier Times interest earned 40 0.8 35 0.7 30 0.6 25 0.5 20 0.4 15 0.3 0.2 10 0.1 5 0.0 0 2006 2007 2008 Fiscal year 2009 2010 Multiplier and times interest earned Dell Returns The return on assets is the net profit relative to total assets: Net profit Return on assets (ROA)= Total assets The return on equity is the net profit relative to equity: Net profit Return on equity (ROE)= Equity Returns, cont. The return on invested capital is the net profit to invested capital: Net profit Return on invested = capital (ROIC) Invested capital Invested capital = Debt + equity The basic earning power ratio is the operating return on assets: Operating profit Basic earning power= Total assets Returns on assets and equity Return on equity Return on assets Operating profit margin Equity multiplier Net profit margin Total asset turnover 1- Tax burden 1- Interest burden Returns on assets and equity Return on equity 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 𝐸𝑞𝑢𝑖𝑡𝑦 Return on assets 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 𝐴𝑠𝑠𝑒𝑡𝑠 Net profit margin 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 𝑅𝑒𝑣𝑒𝑛𝑢𝑒𝑠 Operating profit margin 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑝𝑟𝑜𝑓𝑖𝑡 𝑅𝑒𝑣𝑒𝑛𝑢𝑒𝑠 1-Tax burden 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑏𝑒𝑓𝑜𝑟𝑒 𝑡𝑎𝑥𝑒𝑠 Equity multiplier 𝑇𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠 𝐸𝑞𝑢𝑖𝑡𝑦 Total asset turnover 𝑅𝑒𝑣𝑒𝑛𝑢𝑒𝑠 𝑇𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠 1- Interest burden 𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑏𝑒𝑓𝑜𝑟𝑒 𝑡𝑎𝑥𝑒𝑠 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑝𝑟𝑜𝑓𝑖𝑡 Du Pont: Dell, FY2010 Return on equity 33.93% Return on assets Equity multiplier 6.83% 4.97 𝑡𝑖𝑚𝑒𝑠 Net profit margin 4.29% Operating profit margin 5.00% 1-Tax burden 78.66% Total asset turnover 1.59 𝑡𝑖𝑚𝑒𝑠 1-Interest burden 97.58% Du Pont: Dell, 2006-2010 Return on equity Equity multiplier Return on assets Total asset turnover 8 80% 7 Number of times 70% 60% Return Net profit margin 50% 40% 30% 20% 10% 5% 6 4% 5 4 3% 3 2% 2 1% 1 0% 2006 2007 2008 2009 2010 Fiscal year 6% 0 0% 2006 2007 2008 2009 2010 Fiscal year Margin 90% Example: Borders 4% 5% 2% 0% 0% Net profit margin 10% Return -5% -10% -15% -20% -25% -30% 2.5 Total asset turnover Total assets Net income (loss) Total revenues FY2005 FY2006 FY2007 FY2008 FY2009 FY2010 $2,572.2 $2,613.4 $2,302.7 $1,609.0 $1,425.2 $964.7 $101.0 -$151.3 -$157.4 -$186.7 -$109.4 -$299.0 $4,079.2 $4,113.5 $3,820.9 $3,275.4 $2,823.9 $2,274.9 -2% -4% -6% -8% -10% -12% -35% 2005 2006 2007 2008 2009 2010 Fiscal year -14% 2005 2006 2007 2008 2009 2010 Fiscal year Filed for bankruptcy 2011 2.0 1.5 1.0 0.5 0.0 2005 2006 2007 2008 2009 2010 Fiscal year Problems with ROE ROE and shareholder wealth are correlated, but problems can arise when ROE is the sole measure of performance. ROE does not consider risk. ROE does not consider the amount of capital invested. Might encourage managers to make investment decisions that do not benefit shareholders. ROE focuses only on return and a better measure would consider risk and return. 1963 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 Return Example: KO Return on assets Return on equity Fiscal year Return on stock 80% 60% 40% 20% 0% -20% -40% -60% -80% Example: GM Year 2005 2006 2007 2008 2009 2010 End of year market value of equity (in millions) $10,982 $17,377 $14,089 $1,954 $236 $55,295 ROA -2.22% -1.06% -26.02% -33.89% 76.91% 4.44% ROE -72.39% 36.35% 104.42% 35.82% 371.09% 17.06% Stock return -51.49% 58.23% -18.92% -86.13% -87.94% NMF MULTIPLES Analyzing the market value ratios Price-earnings ratio (P/E): How much investors are willing to pay for $1 of earnings. Market to book value of equity ratio (M/B): How much investors are willing to pay for $1 of book value equity. Issues: What is the meaning of the book value of equity? What is the Molodovsky effect? Beyond ratios Common size analysis Qualitative analysis Common size analysis Common size analysis provides a “big picture” of the changing relationships among accounts over time by standardizing the data. Two forms: Vertical: Each account as % of total Horizontal: Each account as % of base year Vertical Example: Apple Assets 100% 90% 80% Net Property Plant & Equip 70% Other Assets 60% Deferred Long-term Assets Prepayments Long-term 50% Intangible Assets 40% Long-term Investments 30% Other Current Assets 20% Prepayments, short-term 10% Current Tax Assets Inventories 09/30/1982 09/30/1983 09/28/1984 09/27/1985 09/26/1986 09/25/1987 09/30/1988 09/29/1989 09/28/1990 09/27/1991 09/25/1992 09/24/1993 09/30/1994 09/29/1995 09/27/1996 09/26/1997 09/25/1998 09/25/1999 09/30/2000 09/29/2001 09/28/2002 09/27/2003 09/25/2004 09/24/2005 09/30/2006 09/29/2007 09/27/2008 09/26/2009 09/25/2010 0% Fiscal year end Receivables Cash & Equivs & ST Investments Vertical example: Apple, cont. Liabilities and equity 100% 90% 80% Retained Earnings 70% Other Equity 60% For Curr Trans (BS) 50% Accum Other Comprehensive Income Preferred Share Capital 40% Common Share Capital 30% Other Liabilities Deferred LT Liabilities 20% LT Debt & Leases Total Current Liabilities 10% Fiscal year 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 0% 18000% 09/30/1982 09/30/1983 09/28/1984 09/27/1985 09/26/1986 09/25/1987 09/30/1988 09/29/1989 09/28/1990 09/27/1991 09/25/1992 09/24/1993 09/30/1994 09/29/1995 09/27/1996 09/26/1997 09/25/1998 09/25/1999 09/30/2000 09/29/2001 09/28/2002 09/27/2003 09/25/2004 09/24/2005 09/30/2006 09/29/2007 09/27/2008 09/26/2009 09/25/2010 Percentage of FY 1982 Horizontal example: Apple Cash & Equivs & ST Investments Receivables 16000% Inventories 14000% Net Property Plant & Equip 12000% 10000% 8000% 6000% 4000% 2000% 0% ISSUES (1) A single ratio is meaningless Ratios must be put in context: in context of other firms, historical, and company-specific events. A given value of a ratio is neither good or bad; rather, it helps paint a picture of the company’s health and performance. (2) Comparisons to industry ratios may be helpful First challenge: identify the industry Second challenge: identify comparables Third challenge: construct industry ratios Equal v. value weighted ratios (3) Trends break M&A Divestitures Regulation change Product line changes $70,000,000 $60,000,000 $50,000,000 $40,000,000 $30,000,000 $20,000,000 $10,000,000 $0 09/30/1982 09/27/1985 09/30/1988 09/27/1991 09/30/1994 09/26/1997 09/30/2000 09/27/2003 09/30/2006 09/26/2009 Apple’s Sales Revenue In thousands Analysis must be put in context of company-specific events, e.g.,: Fiscal year (4) Seasonality and FY choice can distort ratios Companies select FY-end based on the lowpoint of their seasonal cycle. Therefore, working capital accounts are likely at their lowest levels Fix: Quarterly or monthly averages of accounts instead of FY balance sheet levels. (5) Window dressing “Window dressing” techniques can make statements and ratios look better. Compensation plans can result in distortions/dressing. (6) Different methods of accounting Companies have some choices in accounting method (e.g., FIFO v. LIFO): Makes comparisons difficult (across firms and across time) Makes interpretation challenging (because may not have all the data). QUALITATIVE ANALYSIS Qualitative factors Are the firm’s revenues tied to one key customer, product, or supplier? What percentage of the firm’s business is generated overseas? Which countries? The firm’s competitive environment: degree of competitiveness Future prospects / opportunities Legal and regulatory environment Product life cycle Sources of qualitative information 10-K filings with the SEC Annual reports Press releases Trade groups/associations Government databases (e.g., Census, FTC, BEA) THE END