Chapter 9 Power Point Presentation 2

advertisement

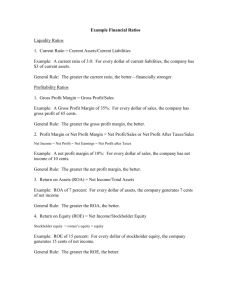

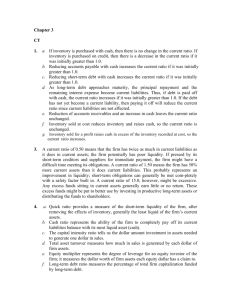

Chapter 9 Analysis of Financial Statements 1 VII. Ratio Analysis Builds on firm's financial statements Easy to understand Used by both equity investors and creditors 2 VII. Ratio Analysis A. Liquidity Ratios – Indicate the ability of the firm to meet its short-term obligations as they come due. B. Activity or Asset Utilization Ratios – Are concerned with the amount of assets a firm uses to support its sales. C. Profitability Ratios – Are a measure of performance. 3 VII. Ratio Analysis D. Leverage Ratios – Are concerned with the firm’s capital structure, or the extent to which debt is used to finance the firm’s assets. E. Coverage Ratios – Indicate the extent to which the firm generates operating income to cover an expense. 4 VII. Ratio Analysis F. Time series analysis 1.Analysis of a firm over a period of time G. Cross Sectional Analysis 1.Analysis of several firms in the same industry at a point in time 5 VII. Ratio Analysis H. Liquidity Ratios 1. Current Ratio a) Ratio of current assets to current liabilities: measure of liquidity. Indicates how well the current liabilities, which must be paid within a year, are “covered.” Rule of thumb 2:1. The answer is how many dollar’s worth of current assets you have for every dollar in current liabilities. (1) Current Ratio = Current assets / current liabilities 2. Quick Ratio (AKA, acid test). Rule of thumb 1:1 a) (Current assets - inventory) / current liabilities 6 Current Ratio Current assets / current liabilities $698.2 / $279.9 = 2.49 7 Quick Ratio (Current assets - inventory) / current liabilities ($698.2 - $373.9) / $279.9 = 1.16 8 VII. Ratio Analysis I. Activity Ratios – How fast a company is turning its assets into cash 1. Inventory Turnover a) Speed to which inventory is sold (1) Sales (Cost of Goods Sold)/ average inventory 2. Receivables Turnover a) Speed with which accounts receivables are collected (1) Sales / average accounts receivable b) Average Collection Period (days sales outstanding) (1) Accounts receivable / sales per day 9 VII. Ratio Analysis 3. Fixed Asset Turnover a) Ratio of sales to fixed assets; measure of fixed assets necessary to generate sales (1) Sales / fixed assets 4. Total Asset Turnover a) Ratio of sales to total assets (1) Sales / total assets 10 Inventory Turnover Sales / average inventory $1,868.2 / $353.6 = 5.3 Inventory turns over 5.3 times a year or about every 2.3 months. 11 Receivables Turnover Sales / accounts receivable $1,868,243 / $58,557 = 31.9 31.9 times a year is about every 11 days. This rapid turnover is simply the result of the fact that Pier 1 Imports has few receivables. Most sales are cash or credit cards (different). 12 Fixed Asset Turnover Sales / fixed assets $1,868 / $290.4 = 6.4 This indicates that sales are 6.4 times fixed assets. The more rapidly fixed assets turn over (the higher the ratio), the smaller the amount of plant and equipment the firm is employing. Industry specific. 13 Total Asset Turnover Sales / total assets $1,868 / $1,052.2 = 1.8 This indicates the firm needs $1.00 in assets for every $1.80 generated in revenues. 14 VII. Ratio Analysis J. Profitability Ratios 1. Gross Profit Margin a) Ratios of revenues minus cost of goods sold to sales; percentage earnings on sales before considering operating expenses, interest, and taxes (1) (revenues - cost of goods sold) / sales 2. Operating Profit Margin a) Ratio of operating income to sales; percentage earned on sales before deducting interest expense and taxes (1) Operating earnings / sales 15 VII. Ratio Analysis 3. Net Profit Margin a) Ratio of earnings after interest and taxes to sales; percentage earned on sales (1) Earnings after taxes / sales 4. Return on Assets a) Ratio of earnings to total assets; percentage earned on assets (1) Earnings after taxes / total assets 16 VII. Ratio Analysis 5. Return on Equity a) Ratio of earnings to owners equity (1) Earnings after taxes / equity 6. Basic Earning Power a) Ratio of operating income to total assets; measure of the firms ability to generate income before considering interest and taxes (1) EBIT / total assets 17 Gross Profit Margin (revenues - cost of goods sold) / sales $781.6 / $1,868 = 41.8% This ratio indicates that the firm earns $0.42 on every dollar of sales before considering operating expenses. 18 Operating Profit Margin Operating earnings / sales $186.2 / $1,868 = 9.96% This indicates that the company earns $0.0996 before interest and taxes for every dollar of sales. 19 Net Profit Margin Earnings after taxes / sales $118.0 / $1,868 = 6.3% This indicates that the company earns $0.0632 after interest and taxes for every dollar of sales. 20 Return on Assets Earnings after taxes / total assets $118.0 / $1,052 = 11.2% This indicates that the firm returns $0.112 for every dollar invested in assets. 21 Return on Equity Earnings after taxes / equity $118.0 / $683.6 = 17.3% This indicates that the firm returns $0.173 for every dollar invested by the common stockholders. 22 Basic Earning Power EBIT (earnings before interest and taxes)/ total assets $186.2 / $1,052 = 17.7% This indicates that $1 of the firm’s assets generates $0.177 in operating income (that is, income before paying interest and taxes) 23 VII. Ratio Analysis K. Leverage Ratios 1. Debt Ratio a) Total debt divided by total assets; proportion of assets financed by debt (1) Debt / total assets 2. Debt to Equity Ratio a) Debt / equity 3. DuPont System of Analysis a) Measure of earning capacity that combines asset turnover, profitability, and financial leverage b) Helps identify source of weakness 24 Debt Ratio Debt / total assets $368.5 / $1,052.2 = 35.0% This debt-to-assets ratio indicates that debt is financing 35.0 percent of the firm’s assets. 25 Debt to Equity Ratio Debt / equity $368.5 / $683.6 = 53.9% The debt-to-equity ratio indicates that there is $0.542 for every dollar of equity. 26 DuPont System of Analysis Combines –Net profit margin –Turnover –Leverage Helps identify source of weakness 27 DuPont System of Analysis 28 VII. Ratio Analysis L. Coverage Ratios 1. Times-interest-earned a) Ratios of operating income to interest expense; measure of safety of a debt instrument (1) Earnings before interest and taxes / interest (2) Negative Number - Interest earned exceeds interest paid. 29 Times-interest-earned Earnings before interest and taxes / interest $186,157 / $-1,159 = -160.6 Interest earned exceeds interest paid. This means that Pier 1 is in the enviable position of earning more interest on its shortterm investments than it paid on borrowed funds. 30 VIII. Ratio Comparisons A. Ratios of firms within an industry B. Tend to have similar numerical values C. Differences in numerical values are reasons for further analysis 31 Problems in Interpretation Different definitions for the same ratio Internet sources differ 32