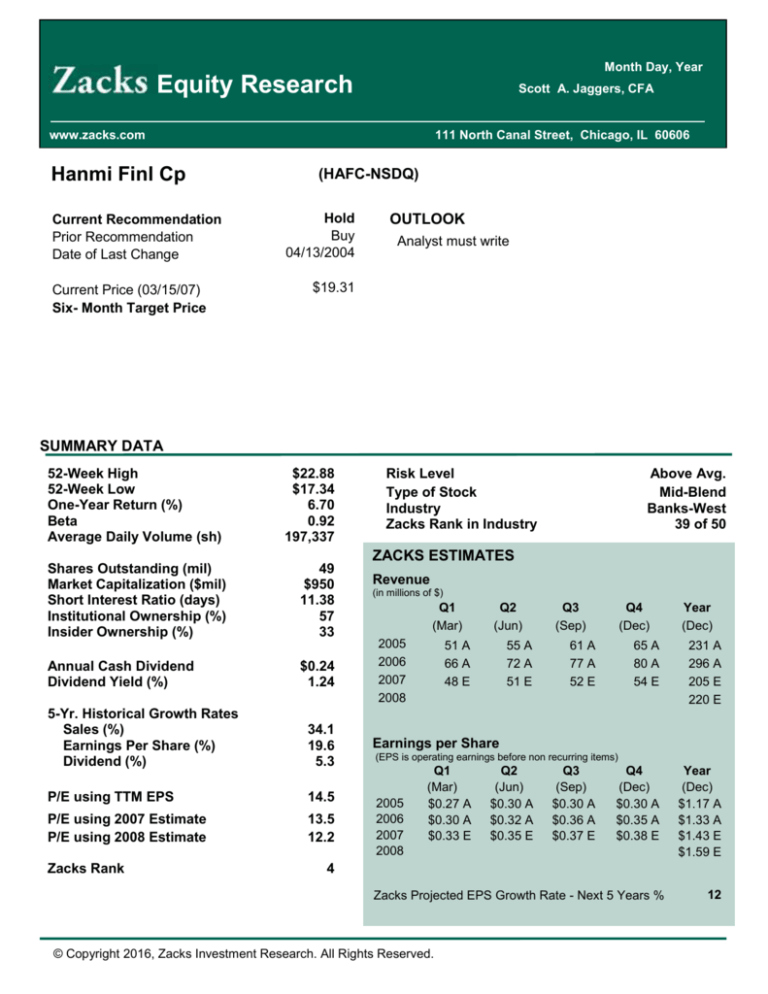

Month Day, Year

Equity Research

Scott A. Jaggers, CFA

www.zacks.com

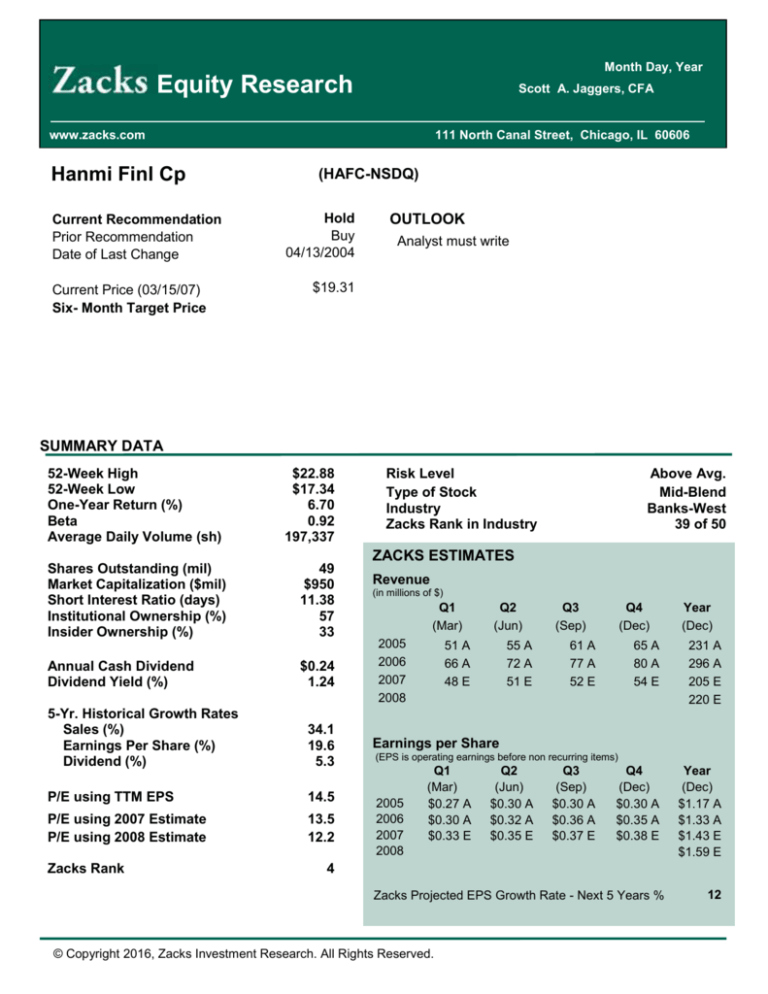

Hanmi Finl Cp

Current Recommendation

Prior Recommendation

Date of Last Change

Current Price (03/15/07)

Six- Month Target Price

111 North Canal Street, Chicago, IL 60606

(HAFC-NSDQ)

Hold

Buy

04/13/2004

OUTLOOK

Analyst must write

$19.31

SUMMARY DATA

52-Week High

52-Week Low

One-Year Return (%)

Beta

Average Daily Volume (sh)

Shares Outstanding (mil)

Market Capitalization ($mil)

Short Interest Ratio (days)

Institutional Ownership (%)

Insider Ownership (%)

Annual Cash Dividend

Dividend Yield (%)

$22.88

$17.34

6.70

0.92

197,337

49

$950

11.38

57

33

$0.24

1.24

5-Yr. Historical Growth Rates

Sales (%)

Earnings Per Share (%)

Dividend (%)

34.1

19.6

5.3

P/E using TTM EPS

14.5

P/E using 2007 Estimate

P/E using 2008 Estimate

13.5

12.2

Zacks Rank

Risk Level

Type of Stock

Industry

Zacks Rank in Industry

Above Avg.

Mid-Blend

Banks-West

39 of 50

ZACKS ESTIMATES

Revenue

(in millions of $)

Q1

(Mar)

2005

2006

2007

2008

Q2

(Jun)

51 A

66 A

48 E

55 A

72 A

51 E

Q3

(Sep)

Q4

(Dec)

61 A

77 A

52 E

Year

(Dec)

65 A

80 A

54 E

231 A

296 A

205 E

220 E

Q4

(Dec)

$0.30 A

$0.35 A

$0.38 E

Year

(Dec)

$1.17 A

$1.33 A

$1.43 E

$1.59 E

Earnings per Share

(EPS is operating earnings before non recurring items)

2005

2006

2007

2008

Q1

(Mar)

$0.27 A

$0.30 A

$0.33 E

Q2

(Jun)

$0.30 A

$0.32 A

$0.35 E

Q3

(Sep)

$0.30 A

$0.36 A

$0.37 E

4

Zacks Projected EPS Growth Rate - Next 5 Years %

© Copyright 2016, Zacks Investment Research. All Rights Reserved.

12

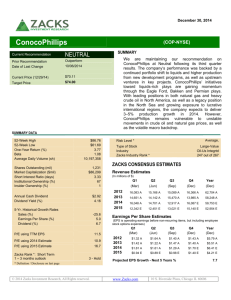

KEY POINTS

Analyst must write

OVERVIEW

Analyst must write

Zacks Investment Research

Page 2

www.zacks.com

INDUSTRY OUTLOOK

INDUSTRY OUTLOOK - NEUTRAL

Our outlook for the regional banks and thrifts remains neutral. Interest rates will continue to move up, but

the pace of future increases from the Federal Reserve is a matter of debate as economic indicators

remain mixed. Long-term rates are not moving up in tandem, so increases in the short end will likely

create more flattening of the curve as well. Though an increasing rate environment as a rule is not the

best scenario for bank stocks, this increase from recent historic lows is most likely favorable (though

offset by the flatter curve). A slow, measured increase from here would provide the optimal atmosphere

for increasing interest margins and spread revenues.

The changing environment implies a changing mix of business for the banks and thrifts. Consumer

lending, the bread-and-butter of many regional and local institutions, will face significant headwinds to

revenue growth, as the mortgage business has seen record production. Home equity lending may

provide some offset, though, as consumers seek to continue drawing value from their residences.

Deposit fees are also expected to struggle, as the strong deposit growth of recent periods is likely to slow

as depositors seek higher returns in a rising-rate environment. Commercial and industrial lending (C&I)

seems to have bottomed, and increasing demand is on the way.

The small- and mid-cap banks will be more challenged to show earnings growth in this environment. C&I

improvement will only partially offset slowing consumer demand for many, as mortgage business has

been a significant portion of their business during the boom. Most have less exposure to marketsensitive businesses, such as capital markets and asset management, and generally less exposure to

C&I lending than the average large-cap bank. Credit quality has generally improved, and reduced

provisioning has provided a boost for some, though this will be less of a factor going forward. Even those

with improving fundamentals will face investor sentiment issues, as rising rates sometimes coincide with

falling bank stock prices. The strongest institutions might see share prices rise from here, along with the

weakest (more likely take-out candidates), but the majority will struggle.

INDUSTRY POSITION

Analyst must write

Top 5 Public Companies in the

Ticker

Zacks Investment Research

industry

Market Share

Company

Page 3

Zacks

Rec

www.zacks.com

RECENT NEWS

Analyst must write

VALUATION

Analyst must write

Industry Comparables

Pr

Chg

YTD

P/E

CurrFY

EPS

Gr

5Yr

Est

12.0

Price/

Book

Price/

Sales

Price/

CF

2.0

3.2

14.0

HANMI FINL CP

-15.8

13.1

Industry Mean

Industry Median

S&P 500

-3.8

-2.4

-2.2

14.8

14.5

15.3

12.0

11.0

2.7

2.2

4.2

3.0

2.8

2.7

15.5

14.0

13.9

-6.5

15.0

6.7

3.4

4.8

13.4

-4.0

17.2

10.0

2.7

4.0

16.4

-12.3

15.6

10.0

2.9

4.1

15.9

-9.2

17.9

Page 4

17.0

2.1

3.4

21.8

www.zacks.com

WESTAMER

BANCP

GLACIER

BANCORP

FRONTIER FINL

WESTERN

ALLIANC

Zacks Investment Research

RISKS

Analyst must write.

INSIDER TRADING AND OWNERSHIP

Analyst must write.

PROJECTED INCOME STATEMENT & BALANCE SHEET

Hanmi Finl Cp

Income Statement and Balance Sheet

(Dollars in millions, except EPS data)

Sales

Cost of Goods Sold

SG&A

Other operating

expenses

Interest and other

Zacks Adjusted Income

before NRI

Net Income

Diluted EPS before NRI

Reported EPS

Cash & Marketable

Securities

Current Assets

Current Liabilities

Long Term Debt

Shareholder's Equity

12/02

91

0

43

12/03

97

0

45

12/04

162

0

69

12/05

231

54

72

12/06

296

93

81

12/07E

205

65

56

0

0

0

3

4

2

30

33

56

44

57

39

17

34

38

58

66

70

17

0.61

0.61

19

1.21

0.67

37

0.88

0.85

58

1.17

1.17

66

1.33

1.33

70

1.43

1.43

123

63

127

163

144

144

1,132

1,295

34

124

1,320

1,454

180

139

2,377

2,540

152

400

2,655

2,846

129

427

3,006

3,058

169

487

3,006

3,058

169

557

HISTORICAL ZACKS RECOMMENDATIONS

Zacks Investment Research

Page 5

www.zacks.com

DISCLOSURES

The analysts contributing to this report do not hold any shares of HAFC. Zacks EPS and revenue forecasts are not consensus

forecasts. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts’ personal

views as to the subject securities and issuers. Zacks certifies that no part of the analysts’ compensation was, is, or will be, directly or indirectly,

Zacks Investment Research

Page 6

www.zacks.com

related to the specific recommendation or views expressed by the analyst in the report. Additional information on the securities mentioned in this

report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to

accuracy and does not purport to be complete. Because of individual objectives, the report should not be construed as advice designed to meet

the particular investment needs of any investor. Any opinions expressed herein are subject to change. This report is not to be construed as an

offer or the solicitation of an offer to buy or sell the securities herein mentioned. Zacks or its officers, employees or customers may have a

position long or short in the securities mentioned and buy or sell the securities from time to time. Zacks uses the following rating system for the

securities it covers. Buy- Zacks expects that the subject company will outperform the broader U.S. equity market over the next one to two

quarters. Hold- Zacks expects that the company will perform in line with the broader U.S. equity market over the next one to two quarters. SellZacks expects the company will under perform the broader U.S. Equity market over the next one to two quarters. The current distribution of

Zacks Ratings is as follows on the 1159 companies covered: Buy- 22.2%, Hold- 72.8%, Sell – 4.1%. Data is as of midnight on the business day

immediately prior to this publication.

Zacks Investment Research

Page 7

www.zacks.com