Month Day, Year

Equity Research

Ken Nagy

www.zacks.com

Natl Semicon

111 North Canal Street, Chicago, IL 60606

(NSM-NYSE)

NSM: Zacks Company Report OUTPERFORM

OUTLOOK

Analyst must write

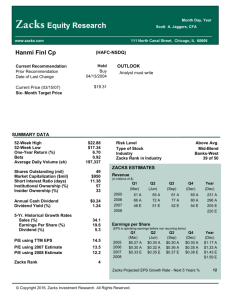

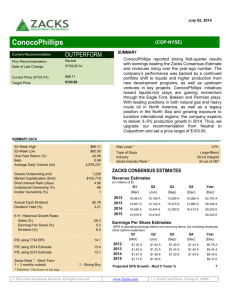

Current Recommendation

Prior Recommendation

Date of Last Change

Current Price (03/05/10)

Six- Month Target Price

Outperform

Neutral

12/11/2005

$14.67

SUMMARY DATA

52-Week High

52-Week Low

One-Year Return (%)

Beta

Average Daily Volume (sh)

Shares Outstanding (mil)

Market Capitalization ($mil)

Short Interest Ratio (days)

Institutional Ownership (%)

Insider Ownership (%)

$15.98

$9.40

36.03

1.30

4,250,404

238

$3,487

4.09

76

5

Annual Cash Dividend

Dividend Yield (%)

$0.32

2.18

5-Yr. Historical Growth Rates

Sales (%)

Earnings Per Share (%)

Dividend (%)

-7.7

-29.4

39.6

P/E using TTM EPS

122.3

P/E using 2010 Estimate

P/E using 2011 Estimate

Zacks Rank

24.9

15.3

3

Risk Level

Type of Stock

Industry

Zacks Rank in Industry

Low,

Mid-Growth

Semi-Analog & M

10 of 12

ZACKS ESTIMATES

Revenue

(in millions of $)

Q1

(Aug)

2008

2009

2010

2011

Q2

(Nov)

472 A

466 A

314 A

365 E

499 A

422 A

345 A

377 E

Q3

(Feb)

Q4

(May)

453 A

292 A

305 E

377 E

Year

(May)

462 A

281 A

317 E

1,886 A

1,460 A

1,281 E

1,498 E

Q4

(May)

$0.35 A

-$0.26 A

$0.14 E

Year

(May)

$1.27 A

$0.28 A

$0.59 E

$0.96 E

Earnings per Share

(EPS is operating earnings before non recurring items)

2008

2009

2010

2011

Q1

(Aug)

$0.29 A

$0.33 A

$0.14 A

$0.24 E

Q2

(Nov)

$0.34 A

$0.14 A

$0.20 A

$0.25 E

Q3

(Feb)

$0.29 A

$0.04 A

$0.11 E

Zacks Projected EPS Growth Rate - Next 5 Years %

© Copyright 2016, Zacks Investment Research. All Rights Reserved.

11

KEY POINTS

Analyst must write

OVERVIEW

Analyst must write

Zacks Investment Research

Page 2

www.zacks.com

INDUSTRY OUTLOOK

INDUSTRY OUTLOOK - POSITIVE

We believe that the semiconductor industry is a positive story in the second half of 2005, as inventory

issues have been resolved and seasonal consumer demand drives seasonally strong sales. The

Semiconductor Industry Association (SIA) released its annual forecast for 2004-2007, with record 2004

sales of $213 billion rising 6% to $227 billion in 2005. The forecast projects that sales will grow at a

compound annual growth rate of 9.8% to $309 billion in 2008. According to the SIA, expected areas of

application strength include PCs (up 10%), digital cameras (up 15%) and digital TVs (up 65%).

We also believe there is a fundamental shift in the semiconductor industry from Corporate IT to

Consumer Demand. According to the SIA, more than 50% of the $213 billion in semiconductors sold in

2004 went into products purchased by consumers, rather than corporate IT departments. This proportion

will continue to grow in the years ahead, as consumers all over the world are captivated by the richness

and portability of digital media. Advances in computing, digital media processing and wireless technology

are enabling the industry to create lifestyle-changing devices and gadgets that could only be imagined a

few years ago. The changing nature of customers will affect every aspect of the business, from product

design to marketing to demand forecasting.

INDUSTRY POSITION

Analyst must write

Top 5 Public Companies in the

Ticker

ADI

ONNN

MXIM

NSM

FCS

Zacks Investment Research

industry

Market Share

Company

Analog Devices

On Semicon Corp

Maxim Intg Pdts

Natl Semicon

Fairchild Semi

19.49085%

17.11113%

15.92238%

14.12691%

11.48706%

Page 3

Zacks

Rec

Neutral

Neutral

Neutral

Outperform

Outperform

www.zacks.com

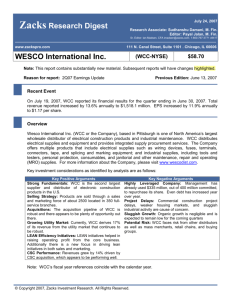

RECENT NEWS

Analyst must write

VALUATION

Analyst must write

Industry Comparables

Pr

Chg

YTD

P/E

CurrFY

EPS

Gr

5Yr

Est

10.8

Price/

Book

Price/

Sales

Price/

CF

11.7

2.8

18.2

NATL SEMICON

-4.8

20.6

Industry Mean

Industry Median

S&P 500

-4.3

-7.3

0.7

22.5

20.5

14.8

11.7

12.5

3.5

3.4

3.8

3.6

3.7

2.4

17.6

17.1

12.6

MAXIM INTG PDTS

ON SEMICON

CORP

FAIRCHILD SEMI

MICROCHIP TECH

-7.6

20.4

13.5

2.3

3.5

26.5

-8.2

10.5

12.0

3.4

2.0

12.4

4.0

-7.1

10.0

24.6

-1.6

10.7

1.3

3.4

1.1

5.9

8.0

15.8

RISKS

Analyst must write.

Zacks Investment Research

Page 4

www.zacks.com

INSIDER TRADING AND OWNERSHIP

Analyst must write.

PROJECTED INCOME STATEMENT & BALANCE SHEET

Natl Semicon

Income Statement and Balance Sheet

(Dollars in millions, except EPS data)

Sales

Cost of Goods Sold

SG&A

Other operating

expenses

Interest and other

Zacks Adjusted Income

before NRI

Net Income

Diluted EPS before NRI

Reported EPS

Cash & Marketable

Securities

Current Assets

Current Liabilities

Long Term Debt

Shareholder's Equity

05/05

1,913

892

256

05/06

2,158

885

274

05/07

1,930

758

311

05/08

1,886

672

316

05/09

1,460

544

136

05/10E

1,281

477

120

333

327

364

363

309

271

16

223

122

204

110

96

383

479

382

336

65

140

415

1.02

1.12

449

1.41

1.32

375

1.14

1.12

332

1.27

1.26

73

0.28

0.31

140

0.59

0.59

1,022

1,043

829

737

700

700

1,441

285

23

2,054

1,541

398

21

1,926

1,291

300

21

1,749

1,172

309

1,415

197

1,087

276

1,227

177

1,087

276

1,227

317

HISTORICAL ZACKS RECOMMENDATIONS

Zacks Investment Research

Page 5

www.zacks.com

DISCLOSURES

The analysts contributing to this report do not hold any shares of NSM. Zacks EPS and revenue forecasts are not consensus

forecasts. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts’ personal

views as to the subject securities and issuers. Zacks certifies that no part of the analysts’ compensation was, is, or will be, directly or indirectly,

related to the specific recommendation or views expressed by the analyst in the report. Additional information on the securities mentioned in this

report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to

accuracy and does not purport to be complete. Because of individual objectives, the report should not be construed as advice designed to meet

Zacks Investment Research

Page 6

www.zacks.com

the particular investment needs of any investor. Any opinions expressed herein are subject to change. This report is not to be construed as an

offer or the solicitation of an offer to buy or sell the securities herein mentioned. Zacks or its officers, employees or customers may have a

position long or short in the securities mentioned and buy or sell the securities from time to time. Zacks uses the following rating system for the

securities it covers. Outperform- Zacks expects that the subject company will outperform the broader U.S. equity market over the next one to

two quarters. Neutral- Zacks expects that the company will perform in line with the broader U.S. equity market over the next one to two quarters.

Underperform- Zacks expects the company will under perform the broader U.S. Equity market over the next one to two quarters. The current

distribution of Zacks Ratings is as follows on the 1104 companies covered: Outperform- 14.6%, Neutral- 78.3%, Underperform – 6.5%. Data is

as of midnight on the business day immediately prior to this publication.

Zacks Investment Research

Page 7

www.zacks.com