March 16, 2005

Research Digest

Shalini Jindal, Research Associate

Editor: Ian Madsen, MBA, CFA

imadsen@zacks.com

Tel: 1-800-767-3771, x 417

www.zackspro.com

155 North Wacker Drive

Horace Mann Educators Corp (NYSE: HMN)

Chicago, IL 60606

$18.46

Note to the reader: This report contains substantially new material. Subsequent editions will have new or

revised material highlighted

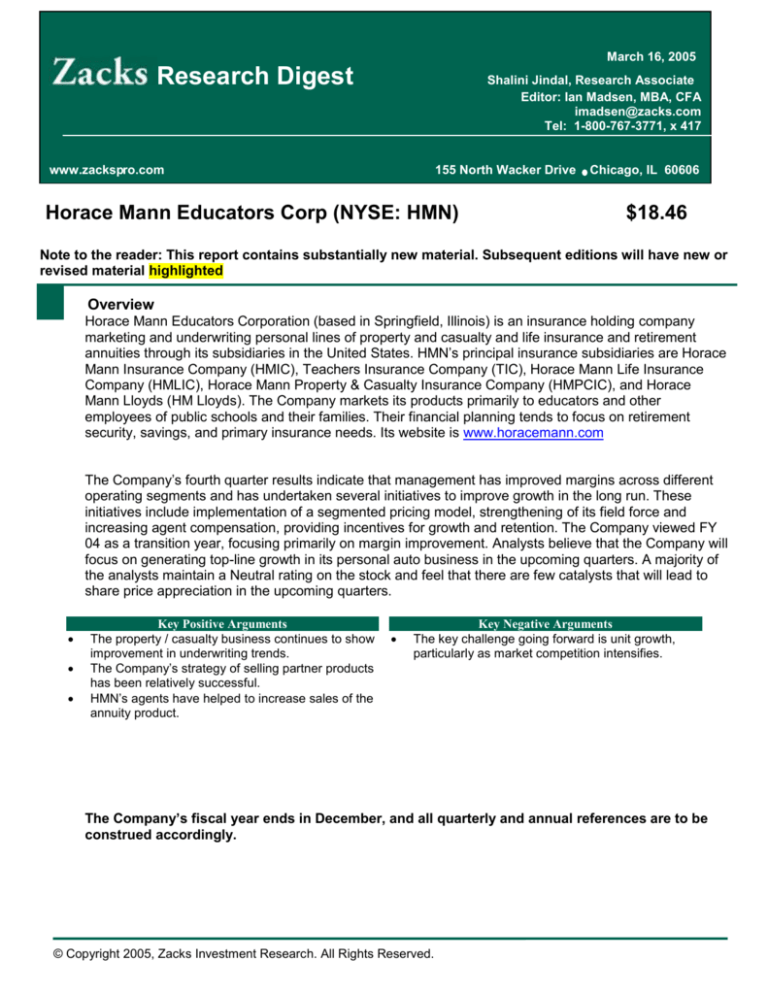

Overview

Horace Mann Educators Corporation (based in Springfield, Illinois) is an insurance holding company

marketing and underwriting personal lines of property and casualty and life insurance and retirement

annuities through its subsidiaries in the United States. HMN’s principal insurance subsidiaries are Horace

Mann Insurance Company (HMIC), Teachers Insurance Company (TIC), Horace Mann Life Insurance

Company (HMLIC), Horace Mann Property & Casualty Insurance Company (HMPCIC), and Horace

Mann Lloyds (HM Lloyds). The Company markets its products primarily to educators and other

employees of public schools and their families. Their financial planning tends to focus on retirement

security, savings, and primary insurance needs. Its website is www.horacemann.com

The Company’s fourth quarter results indicate that management has improved margins across different

operating segments and has undertaken several initiatives to improve growth in the long run. These

initiatives include implementation of a segmented pricing model, strengthening of its field force and

increasing agent compensation, providing incentives for growth and retention. The Company viewed FY

04 as a transition year, focusing primarily on margin improvement. Analysts believe that the Company will

focus on generating top-line growth in its personal auto business in the upcoming quarters. A majority of

the analysts maintain a Neutral rating on the stock and feel that there are few catalysts that will lead to

share price appreciation in the upcoming quarters.

Key Positive Arguments

The property / casualty business continues to show

improvement in underwriting trends.

The Company’s strategy of selling partner products

has been relatively successful.

HMN’s agents have helped to increase sales of the

annuity product.

Key Negative Arguments

The key challenge going forward is unit growth,

particularly as market competition intensifies.

The Company’s fiscal year ends in December, and all quarterly and annual references are to be

construed accordingly.

© Copyright 2005, Zacks Investment Research. All Rights Reserved.

Revenue*

FY ends December($mm)

Net premiums earned

Net Investment Income

Total Operating Revenue

4Q04

$173

$48

$221

1QE05

2QE05

2004A

$675

$191

$866

2005E

2006E

*Estimates were not given.

The 4Q 04 Operating Revenue figure was $221 mm (4.3% YOY growth)

The different components of revenue can be analyzed as follows:

Net Premium Earned

The 4Q 04 net premium earned figure was $173 mm (4.5% YOY growth).

One analyst (Cochran, Caronia) believes that premium growth will be flat in FY 05 and will be in the low

single digits in FY 06. The analyst anticipates steady, but unspectacular, growth in sales in the life and

annuity business in the upcoming quarters.

FY ends December($mm)

Total P-C Op.Inc.( After tax)

Total Annuity Op.Inc.

Total Life Op. Income

Total Corporate & Other Op. Income

4Q04

$20

$3

$4

$0

1QE05

2QE05

2004A

$27

$12

$15

-$4

2005E

$43

$16

$15

-$4

2006E

*Estimates were not given.

The revenue from different segments can be analyzed as follows:

Property/Casualty

The 4Q 04 P/C Operating Income figure was $20 mm. This figure compares favorably to $2 mm in 4Q

03.

One analyst (Cochran, Caronia) believes that growth is a challenge in the P&C segment in the upcoming

quarters.

Annuity

The 4Q 04 Annuity Operating Income figure was $3 mm, compared to $ 6mm in the year earlier quarter.

One analyst (Cochran, Caronia) believes that HMN has a high persistency ratio, in the low to mid 90%

range, which is a significant positive for the Company and helps it to retain deposits.

Life

The 4Q 04 Life Operating Income figure was $4 mm, in line with the prior year total.

The Company indicated that it has benefited from partner company product sales (eg, the Jefferson Pilot

universal life product), favorable mortality, and improved group earnings.

Please see the separately saved spreadsheet for more details

Zacks Investment Research

Page 2

www.zacks.com

Margin

Net Operating Income

FY ends December($mm)

Digest High

Digest Low

Digest Average

4Q04

$26

$26

$26

1QE05

2QE05

2004A

$49

$49

$49

2005E

$69

2006E

$69

*Estimates were not given.

The 4Q 04 Net Operating Income figure was $26 mm (157.6 % YOY growth).

In 4Q 04 the reported combined ratio was 88.2%, with a loss ratio of 66.2% and an expense ratio of 22%.

Excluding catastrophes, the combined ratio would have been 79.8%. The loss ratio, excluding

catastrophes and reserve development, was 55.3%, compared with 67.9% a year ago and 65.7% in the

third quarter.

Investment Portfolio

In the Property & Casualty operations, the pre tax yield on the investment portfolio was 4.6%.

Reserve Addition

Prior year reserve strengthening totaled $3.8 mm and related to the personal auto segment. This follows

three quarters in which the Company, on a consolidated basis, did not have adverse reserve

development after having posted 11 consecutive quarters with prior year reserve development.

One analyst (Deutsche Bank) believes that in the P&C segment the reemergence of adverse reserve

development in personal auto was a significant negative. The personal auto reserve strengthening in the

quarter related to a single claim from over 10 years ago.

Earnings per Share

EPS

FY ends December

Digest High

Digest Low

Digest Avg.

Digest YoY growth

Zacks Consensus

4Q04

$0.54

$0.54

$0.54

145.45%

$0.54

1QE05

$0.45

$0.41

$0.43

0.00%

$0.41

2QE05

$0.42

$0.41

$0.42

-7.78%

$0.42

2004A

$1.04

$1.04

$1.04

1633.33%

$1.04

2005E

$1.66

$1.55

$1.62

55.77%

$1.60

2006E

$1.62

$1.45

$1.56

-3.91%

$1.53

Fourth quarter EPS was $0.54, compared to $0.22 in the year-earlier quarter (145.5% YOY growth). The

consensus was $0.42. A majority of the analysts had expected a lower 4Q 04 EPS figure. Implementation

of EITF 04-08, which requires that contingently convertible securities be included in the computation of

diluted earnings per share, reduced operating EPS by $0.04. The reported Operating EPS also included

$0.15 per share of catastrophe losses related to the re-estimation of 3Q hurricane losses, although this

was offset by $0.18 per share of favorable reserve development related to non-catastrophe business

written in the first three quarters of FY 04.

Management has given EPS guidance of $1.55 - 1.65 for FY 05. The earnings guidance factors in a

personal auto and property combined ratio in the low 90% range in FY 05. The projected guidance

factors in the assumption that top-line growth in personal auto and property will be driven by policies in

force, as management implements various sales initiatives. The guidance also assumes that Annuity

Zacks Investment Research

Page 3

www.zacks.com

earnings are ahead of the FY 04 level of $13.2 mm (excluding deferred acquisition costs) and Life

segment earnings are estimated to be between the FY 03 and FY 04 levels.

Some of the analysts (Deutsche Bank, Janney Montgomery) have increased their projected EPS

estimates for FY 05. The analyst (Deutsche Bank) has increased the projected EPS estimate and

believes that the Company has restored margin in its P&C operations and is focusing on driving top-line

growth in the upcoming quarters.

Please see the separately saved spreadsheet for more details.

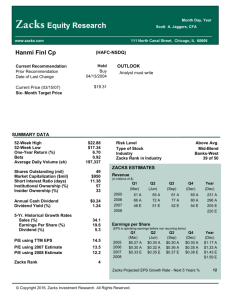

Target Price/Valuation

The average target price for HMN is $20.50.

The Excel spreadsheet associated with this report contains a complete breakdown of ratings, price

targets, and valuation methods by individual analysts. Most of the analysts (67%) have given a Neutral

rating to the stock, and the remaining analysts (33%) have given a Negative rating. One analyst

(Deutsche Bank) has given a projected price target of $20.50 for FY 05.

Ratings Distribution

Positive

Neutral

Negative

Average Price Objective

Number of Analysts

0%

67%

33%

$20.50

3

Risks to the target price objective are reserve additions, catastrophe losses, and a potential downturn in

the equities market.

Please see the separately saved spreadsheet for more details

Long-Term Growth

Digest long-term growth rate is 10% (Deutsche Bank).

The Company Management indicated that its primary goal in FY 05 will be to grow its personal auto

insurance business. The Company has also increased agent compensation that provides incentives for

growth and retention. HMN has implemented a segmented pricing model, which enables the company to

select preferred risks that are more profitable. One analyst (Deutsche Bank) believes that the above

mentioned factors are important to drive growth in the long run.

Zacks Investment Research

Page 4

www.zacks.com

Individual Analyst Opinions

POSITIVE RATINGS

There are no analysts with positive ratings on the stock currently.

NEUTRAL RATINGS

Cochran, Caronia-Market Perform- report date 2/14/2005

The analyst believes that Management has taken the right steps to improve the Company’s operating

performance and franchise value. The analyst feels that top-line premium growth may slow in the

upcoming quarters, as premium rates are expected to decline, and there are few catalysts that will

produce share price appreciation.

Deutsche Bank-Hold-($20.50) - report date 2/11/2005

The analyst believes that the stock is currently trading at 1.6x book value. The analyst has projected a

target price of $20.50, which is based on 1.6 x projected year end FY 05 estimated book value,

compared with the historical average multiple of 1.9 x.

NEGATIVE RATINGS

Janney Montgomery-Underweight- report date 2/14/2005

The analyst believes that other personal line companies are targeting more aggressive unit growth in the

upcoming quarters. The analyst also feels that the 4Q 04 earnings represent the peak level of profitability

for the industry. According to the analyst, the shares are fully valued at 12x FY 05 earnings and 1.4x

book value.

Zacks Investment Research

Page 5

www.zacks.com