Zacks Research Digest

March 30, 2007

Research Analyst: Sweta Killa, M. Fin.

Sr. Ed.: Ian Madsen, CFA: imadsen@zacks.com 1-800-767-3771, x9417

www.zackspro.com

Swift Transportation

111 N. Canal Street, Suite 1101 Chicago, IL 60606

(SWFT-NASDAQ)

$31.16

Note: All new or revised material since the last report is highlighted.

Reason for Report: Change in EPS Estimate

Previous Edition: February 7, 2007

Overview

Swift Transportation Co., Inc. (SWFT), a holding company, operates the largest truckload fleet in the

United States combining strong regional operations, an expedited transcontinental operation, various

specialty and dedicated offerings and a comprehensive intermodal package.

The principal

commodities that it transports include retail and discount department store merchandise, manufactured

goods, paper products, non-perishable and perishable food products, beverages and beverage

containers and building material. SWFT has a growing cross-border operation into Mexico that ships

through every commercial border crossing. It also has a strategic network of regional terminals and

offices located in areas that have strong and diverse economies and provide access to key population

centers.

SWFT, founded in 1965, is headquartered in Phoenix, Arizona.

website is

www.swifttrans.com. SWFT’s fiscal year coincides with the calendar year.

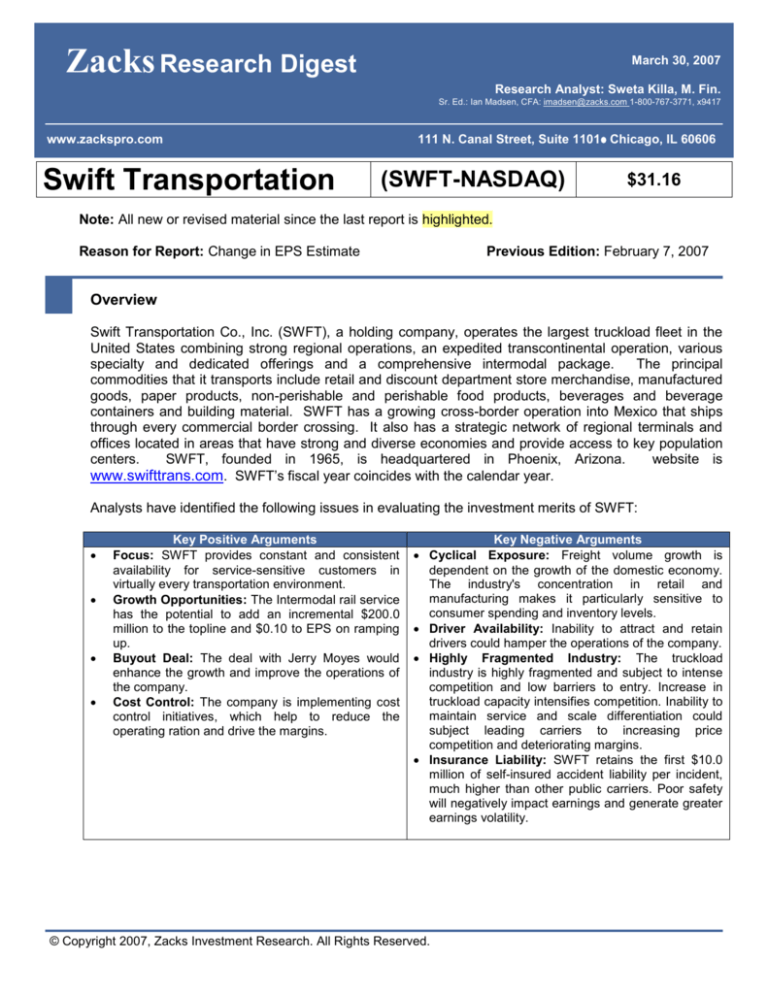

Analysts have identified the following issues in evaluating the investment merits of SWFT:

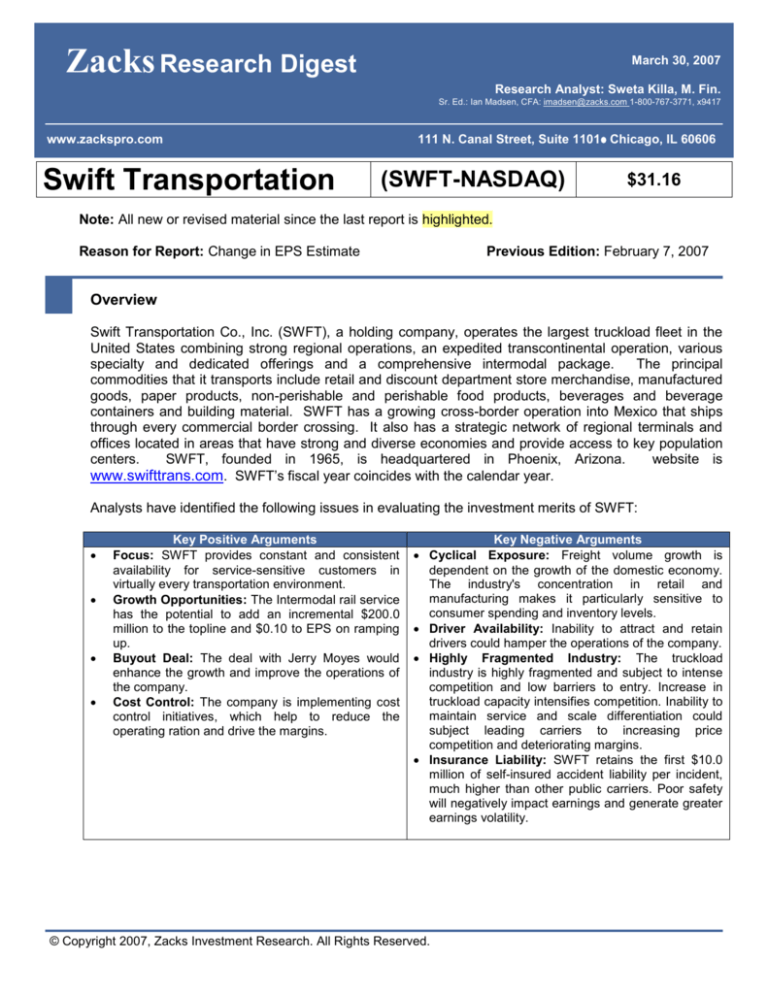

Key Positive Arguments

Focus: SWFT provides constant and consistent

availability for service-sensitive customers in

virtually every transportation environment.

Growth Opportunities: The Intermodal rail service

has the potential to add an incremental $200.0

million to the topline and $0.10 to EPS on ramping

up.

Buyout Deal: The deal with Jerry Moyes would

enhance the growth and improve the operations of

the company.

Cost Control: The company is implementing cost

control initiatives, which help to reduce the

operating ration and drive the margins.

Key Negative Arguments

Cyclical Exposure: Freight volume growth is

dependent on the growth of the domestic economy.

The industry's concentration in retail and

manufacturing makes it particularly sensitive to

consumer spending and inventory levels.

Driver Availability: Inability to attract and retain

drivers could hamper the operations of the company.

Highly Fragmented Industry: The truckload

industry is highly fragmented and subject to intense

competition and low barriers to entry. Increase in

truckload capacity intensifies competition. Inability to

maintain service and scale differentiation could

subject leading carriers to increasing price

competition and deteriorating margins.

Insurance Liability: SWFT retains the first $10.0

million of self-insured accident liability per incident,

much higher than other public carriers. Poor safety

will negatively impact earnings and generate greater

earnings volatility.

© Copyright 2007, Zacks Investment Research. All Rights Reserved.

Recent Events

On January 24, 2007, SWFT announced 4Q06 and FY06 earnings results. Highlights of 4Q06 are as

follows:

Total revenue decreased 7.2% y-o-y to $782.8 million.

Pro forma EPS was $0.46 as compared to $0.52 in 4Q05.

Highlights of FY06 are as follows:

Total revenue decreased 0.8% y-o-y to $3,172.8 million.

Pro forma EPS increased 39.4% y-o-y to $2.00

On January 19, 2007, SWFT announced it would be acquired by Jerry Moyes, the company's founder

and largest shareholder, and his family members in an all cash deal valued at approximately $2.74

billion, including $332.0 million of net debt, which equates to $31.55 per share. The transaction is

expected to close during 2Q07.

Revenue

Both the Zacks Research Digest and the company recorded total operating revenue of $782.8 million in

4Q06, down 7.2% y-o-y from $843.6 million in 4Q05. Excluding fuel surcharge revenue, net revenue

decreased 5.1% to $679.0 million in 4Q06 from $716.0 million in 4Q05. This decline was primarily

attributable to the soft freight environment and an increase in truckload capacity.

According to the press release, total operating revenue in FY06 decreased 0.8% y-o-y to $3,172.8

million from $3,197.5 million in FY05. Excluding fuel surcharge revenue, net revenue decreased 3.4%

y-o-y to $2.71 billion from $2.81 billion in FY05. This decline was primarily attributable to a 5.3%

reduction in the average fleet size y-o-y. The Zacks Research Digest total operating revenue was

$3,173.8 million in FY06, down 0.7% y-o-y from $3,197.5 million in FY05.

Provided below is the summary of revenue as compiled by Zacks Research Digest:

Revenue ($ in

Millions)

Zacks Consensus

Total Revenue

Digest High

Digest Low

YOY Growth

Sequential Growth

3Q06A

4Q06A

FY06A

1Q07E

2Q07E

3Q07E

$815.0

$815.1

$815.0

0.3%

0.2%

$782.8

$782.8

$782.8

-7.2%

-4.0%

$3,173.8

$3,174.0

$3,172.8

-0.7%

$771.0

$753.8↓

$772.2

$733.6

-1.2%

-3.7%

$819.9↓

$830.1

$800.7

0.8%

8.8%

$847.7↑

$854.9

$840.6

4.0%

3.4%

FY07E

FY08E

$3,305.0

$3,335.9↓

$3,880.1

$3,152.0

5.1%

$3,389.0

$3,397.4↓

$3,558.7

$3,238.7

1.8%

The Zacks Research Digest model projects revenues of $3,335.9 and $3,397.4 million in FY07 and

FY08, respectively, both are lower than the previous report. Only four firms (Wall Street Strategies, B.

of America, BB&T, Bear Stearns, Wachovia) have provided FY07 revenue estimates.

One firm (BB&T) believes the company is positioned well in its Intermodal business to take advantage

of recent supply management trends. SWFT currently has approximately 3,000 intermodal containers,

and now plans to take hold of another 2,500-3,000 in FY07 depending on the economic environment.

Please refer to the Zacks Research Digest spreadsheet of SWFT for more details on revenue

estimates.

Zacks Investment Research

Page 2

www.zackspro.com

Margins

The Zacks Research Digest operating margins were 6.1% in 4Q06, down 240 bps y-o-y, and 8.1% in

FY06, down 160 bps y-o-y. The weaker margin performance is primarily attributable to the increased

empty mile percentage, decreased equipment utilization, weaker fuel cost recovery (via the fuel

surcharge mechanism), and a deceleration in the rate of increase in revenue per loaded mile (net of

fuel surcharge).

The company's operating ratio increased to 95.7% in 4Q06 from 91.5% in 4Q05. The impairment of

notes receivable, the very soft freight environment, the increase in capacity, the changes made to the

company's depreciable lives for tractors and the net impact of fuel expense are the primary causes for

the increase in the operating ratio during the quarter.

SWFT benefited from cost reduction initiatives implemented in early 2006 in several expense

categories. Administrative salaries and wages declined y-o-y as a result of reduced average non-driver

workforce by approximately 6.7%. Salaries, Wages and Employee benefits also decreased in part due

to the reduction in the number of miles driven by company drivers associated with the smaller fleet size,

which was partially offset by an increase in the average rate per mile paid to drivers. Equipment

maintenance expense declined y-o-y associated with the smaller average fleet size and changes made

in the shop infrastructure. In addition, travel and other discretionary expenses also decreased as a

result of an increased focus on cost control. These reductions were partially offset by an increase in

hiring expense resulting from the tight driver market in 2006, as well as an increase in expenses related

to the growing Intermodal business. The company also experienced a reduction in expenses related to

workers compensation as previously reported. This increased focus on cost control helped the

company improve its operating ratio by 180 bps to 92.3% in FY06 from 94.1% in FY05.

Provided below is the summary of margins as compiled by Zacks Research Digest:

Margins

Operating

Pre-Tax

Net

3Q06A

8.7%

7.9%

4.8%

4Q06A

6.1%

6.0%

4.0%

FY06A

8.1%

7.4%

4.6%

1Q07E

5.9%↓

4.8%↓

3.3%↓

2Q07E

7.6%↓

6.5%↓

4.3%

3Q07E

6.9%↓

6.4%

3.9%

FY07E

7.0%↑

5.8%

3.8%

FY08E

7.6%↑

6.6%

4.1%

The Zacks Research Digest model projects operating margin of 7.0% and 7.6% for FY07 and FY08,

respectively, up from the previous report.

Please refer to the Zacks Research Digest spreadsheet of SWFT for more details on margin estimates.

Earnings per Share

The company reported GAAP EPS of $0.31 in 4Q06 compared to $0.53 in 4Q05. GAAP results include

a pre-tax impairment charge of $18.4 million for the write-off of a note receivable, and other outstanding

amounts related to the company's sale of its auto haul business in April 2005. Excluding this

impairment and the pre-tax benefit of the change in market value of an interest rate derivative of $2.2

million in 4Q06, the company recorded pro forma EPS of $0.46 in 4Q06 as compared to $0.52 in 4Q05.

According to Zacks Research Digest, pro forma EPS was $0.43 in 4Q06, down 17.54% y-o-y, and

GAAP EPS was $0.31, down 41.5% y-o-y.

In FY06, the company recorded GAAP EPS of $1.86 compared to $1.37 in FY05. The results for 2006

include a pre-tax impairment charge of $18.4 million for the write-off of a note receivable, and other

outstanding amounts related to the company's sale of its auto haul business in April 2005. Excluding

Zacks Investment Research

Page 3

www.zackspro.com

this impairment and the impact of the change in market value of the interest rate derivatives of $1.1

million in 2006, pro forma EPS increased 39.4% y-o-y to $2.00 from $1.47 in FY05. According to the

Zacks Research Digest, GAAP EPS was $1.85, up 35.0% y-o-y, and pro forma EPS was $1.95, up

32.7% y-o-y.

Provided below is the summary of EPS as compiled by Zacks Research Digest:

3Q06A

EPS

Zacks Consensus

Digest High

Digest Low

Digest Average

YOY growth

Sequential Growth

Company Guidance before

FAS123 (ESOE)

Company Guidance after FAS123

(ESOE)

Company Guidance(GAAP)

$0.52

$0.44

$0.51

55.8%

-7.1%

4Q06A

$0.46

$0.31

$0.43

-17.5%

-16.6%

FY06A

1Q07E

2Q07E

$2.00

$1.86

$1.95

32.7%

$0.34

$0.38

$0.28

$0.34↓

-25.6%

-21.9%

$0.47

$0.52

$0.43

$0.48

-13.0%

43.9%

3Q07E

$0.52

$0.40

$0.47↓

-9.1%

-3.0%

FY07E

FY08E

$1.86

$1.95

$1.47

$1.76↓

-9.8%

$2.09

$2.19

$1.79

$2.01↑

14.3%

Highlights from the chart are as follows:

2007 EPS forecasts (7 total) range from $1.47 to $1.95; average is $1.76.

2008 EPS forecasts (5 total) range from $1.79 to $2.19; average is $2.01.

One firm (Bear Stearns) expects Jerry Moyes will once again emphasize growth for SWFT once he

regains operating control, as he grew the fleet at a CAGR of 21.4% per year for the past decade,

compared to the past two years when the fleet has declined 5.2% under the stewardship of Bob

Cunningham.

Please refer to the Zacks Research Digest spreadsheet of SWFT for more extensive EPS figures.

Target Price/Valuation

The average Zacks Digest price target is $32.51 (↑ from the previous report and approximately 4%

upside from the current price). The price target ranges from $27.00 (↑ from the previous report and

approximately 13% downside from the current price) to $40.00 (↔ to the previous report and

approximately 28% upside from the current price), with the median price target of $32.00 (↑ from the

previous report).

The firm (Wall Street Strategies) with the Digest low price target does not provide any valuation

methodology. The firm (BB&T) with the Digest high price target used 21x FY07 EPS estimate of $1.93

to value the shares.

Of the ten firms covering the stock, one (BB&T) has a provided positive rating and eight gave neutral

ratings. One firm (Wall Street Strategies) has rated the stock negatively.

One firm (B. of America) derives its target price based on acceptance of Moyes’s proposal to acquire all

shares at $31.55. Deal implies a 16x P/E multiple to FY08 EPS estimate. The firm notes multiples can

range from as low as 11-12x to as high as 17-19x, depending on the strength of economic cycle and

the direction of Fed Funds and interest rate policy of the Fed.

Provided below is the summary of valuation or target price as compiled by Zacks Research Digest:

Zacks Investment Research

Page 4

www.zackspro.com

Rating Distribution

Positive

Neutral

Negative

Avg. Target Price

Median Price Target

Upside from Current

Upside from High Target

Downside from Low Target

Total No. of Analysts with Target Price/Total

10%

80%

10%

$32.51↑

$32.00↑

4.3%

28.4%

13.4%

5/10

Please refer to the Zacks Research Digest Spreadsheet of SWFT for further details on valuation.

Capital Structure/Solvency/Cash Flow/Governance/Other

The company's balance sheet remains strong. In 2006, cash flow from operations and free cash flow

were $365.4 million and $226.2 million, respectively. The company's operating lease adjusted debt-tototal capitalization ratio improved dramatically from 41.3% at year-end 2005 to 27.3% at the end of

2006. With no fleet growth, the company was able to keep up with required maintenance capital

expenditures, while generating significant free cash flow that was used for paying down debt.

Discussion on Moyes Deal

Jerry Moyes and his family (buyout group) own approximately 39% of shares outstanding, which means

the buyout group only needs an additional 8.7 million votes (or 18.7% of the remaining votes) to obtain

a majority vote. The deal will be financed through debt commitments from Morgan Stanley, and

Goldman Sachs will act as financial adviser to Swift's special committee. One firm (Morgan Keegan)

would not be surprised if Mr. Moyes recapitalizes the company over the next 24 months through a

public offering.

If either party terminates the definitive merger agreement, then the buyout group would be required to

pay a $20.0-$40.0 million termination fee to walk away from the merger agreement. On the other hand,

SWFT would be required to pay a $10.0-$40.0 million termination fee if the proposed transaction is not

consummated, depending on whether or not SWFT was purchased by another financial or strategic

buyer within 12 months.

Potentially Severe problems

At this point the price very much reflects the buyout offer. If the deal does not go through, the price will

be impacted.

Long-Term Growth

The company’s long term growth rate as provided by Zacks Research Digest, ranges from 10.0% (Bear

Stearns, Wachovia) to 14.0% (BB&T), with an average of 11.3%.

The company is in the middle of a transition from a revenue growth-oriented model to a focus on

margin improvement and bottom line performance. Cost controls and operating efficiency are priorities

for the company.

Zacks Investment Research

Page 5

www.zackspro.com

Most firms expect minimal growth in SWFT’s over-the-road fleet over the next two years, as it focuses

on profitability. There are two emerging growth areas: Mexico operations, though representing less than

5% of revenue, Mexico operations are expected to grow 15%; Dedicated Operations, which is

estimated 15% of revenue, is now a focus of growth.

According to most of the firms, Swift’s move to expand into Intermodal rail service is a positive strategic

move, as the company could leverage its existing relationships with large retailers, who are the largest

users of Intermodal rail. One firm (R W. Baird) finds SWFT’s Intermodal rail service a positive strategic

move, given SWFT's relationships with large retailers and desire to divest asset ownership.

Some firms are concerned that driver shortage problem may worsen for the public carriers in the long

term.

Individual Analyst Opinions

POSITIVE RATINGS (10.0%)

BB&T – Buy ($40.00 target price) – 03/19/07: The firm has maintained Buy rating with the price target

of $40.00.

NEUTRAL RATINGS (80.0%)

B. of America – Neutral ($32.00 target price) – 03/23/07: The firm has maintained the price target of

$32.00. INVESTMENT SUMMARY: Despite the on-going positive turnaround at the company, the firm

believes margins will decline in the near-term owing to increasing cost pressure in TL (truckload)

sector.

Bear Stearns – Peer perform (no target price) – 03/23/07. INVESTMENT SUMMARY: The firm

believes the stock will not trade on the company’s fundamentals, but on the likelihood of the deal with

Jerry Moyes.

Deutsche Bank – Hold ($31.55 target price) – 03/01/07. INVESTMENT SUMMARY: The firm

believes the shares will trade close to the accepted tender offer of $31.55 per share.

J.P. Morgan – Neutral (no target price) – 02/06/07.

Morgan Keegan – Market perform (no target price) – 02/01/07: The firm has maintained a Market

perform rating on the stock.

R W. Baird – Neutral ($32.00 target price) – 01/25/07: The firm has maintained a Neutral rating on

the stock.

Stifel Nicolaus – Hold (no target price) – 01/25/07: The firm has maintained a Hold rating on stock of

SWFT. INVESTMENT SUMMARY: While arbitrageurs may find SWFT’s shares an interesting company

to trade and make profits, the firm believes mainstream investors will find more attractive longer-term

investment opportunities available elsewhere in the freight transportation space.

Wachovia – Market perform (no target price) – 01/26/07: The firm has suspended its valuation range

as a result of the definitive merger agreement with Jerry Moyes. INVESTMENT SUMMARY: It expects

the stock to trade around the $31.55 per share buyout price.

Zacks Investment Research

Page 6

www.zackspro.com

NEGATIVE RATINGS (10.0%)

Wall Street Strategies – Sell ($27.00 target price) – 02/01/07: The firm has maintained Sell rating

with the price target of $27.00. INVESTMENT SUMMARY: It believes the shares have a limited upside

at the current levels and SEC will approve the transaction with Jerry Moyes. The firm finds better

investment opportunities elsewhere given the pending buyout offer.

Research Analyst: Sweta Killa

Reviewed By:

Copy Editor: Oindrila Banerjee

Zacks Investment Research

Page 7

www.zackspro.com