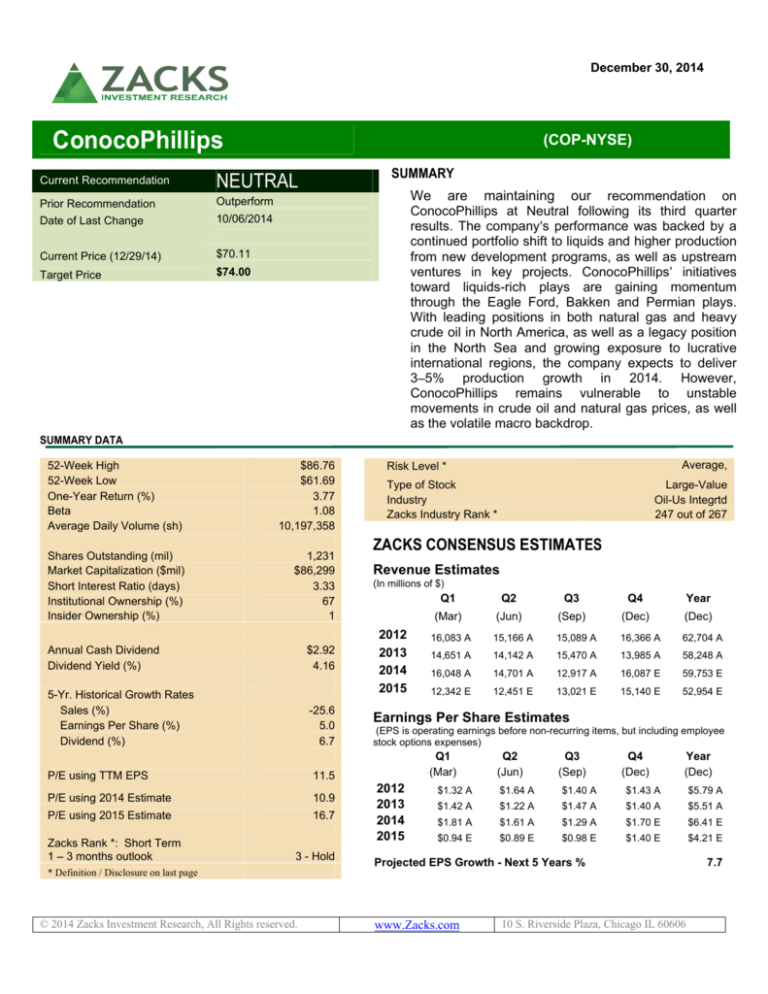

December 30, 2014

ConocoPhillips

(COP-NYSE)

Current Recommendation

NEUTRAL

Prior Recommendation

Outperform

Date of Last Change

10/06/2014

Current Price (12/29/14)

$70.11

Target Price

$74.00

SUMMARY

We are maintaining our recommendation on

ConocoPhillips at Neutral following its third quarter

results. The company s performance was backed by a

continued portfolio shift to liquids and higher production

from new development programs, as well as upstream

ventures in key projects. ConocoPhillips initiatives

toward liquids-rich plays are gaining momentum

through the Eagle Ford, Bakken and Permian plays.

With leading positions in both natural gas and heavy

crude oil in North America, as well as a legacy position

in the North Sea and growing exposure to lucrative

international regions, the company expects to deliver

3 5% production growth in 2014. However,

ConocoPhillips remains vulnerable to unstable

movements in crude oil and natural gas prices, as well

as the volatile macro backdrop.

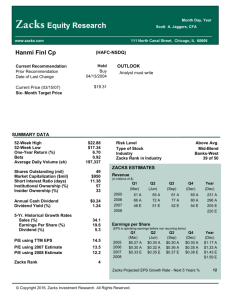

SUMMARY DATA

52-Week High

52-Week Low

One-Year Return (%)

Beta

Average Daily Volume (sh)

$86.76

$61.69

3.77

1.08

10,197,358

Shares Outstanding (mil)

Market Capitalization ($mil)

Short Interest Ratio (days)

Institutional Ownership (%)

Insider Ownership (%)

1,231

$86,299

3.33

67

1

Annual Cash Dividend

Dividend Yield (%)

$2.92

4.16

5-Yr. Historical Growth Rates

Sales (%)

Earnings Per Share (%)

Dividend (%)

-25.6

5.0

6.7

P/E using TTM EPS

11.5

P/E using 2014 Estimate

10.9

P/E using 2015 Estimate

16.7

Zacks Rank *: Short Term

1 3 months outlook

3 - Hold

Average,

Risk Level *

Type of Stock

Industry

Zacks Industry Rank *

Large-Value

Oil-Us Integrtd

247 out of 267

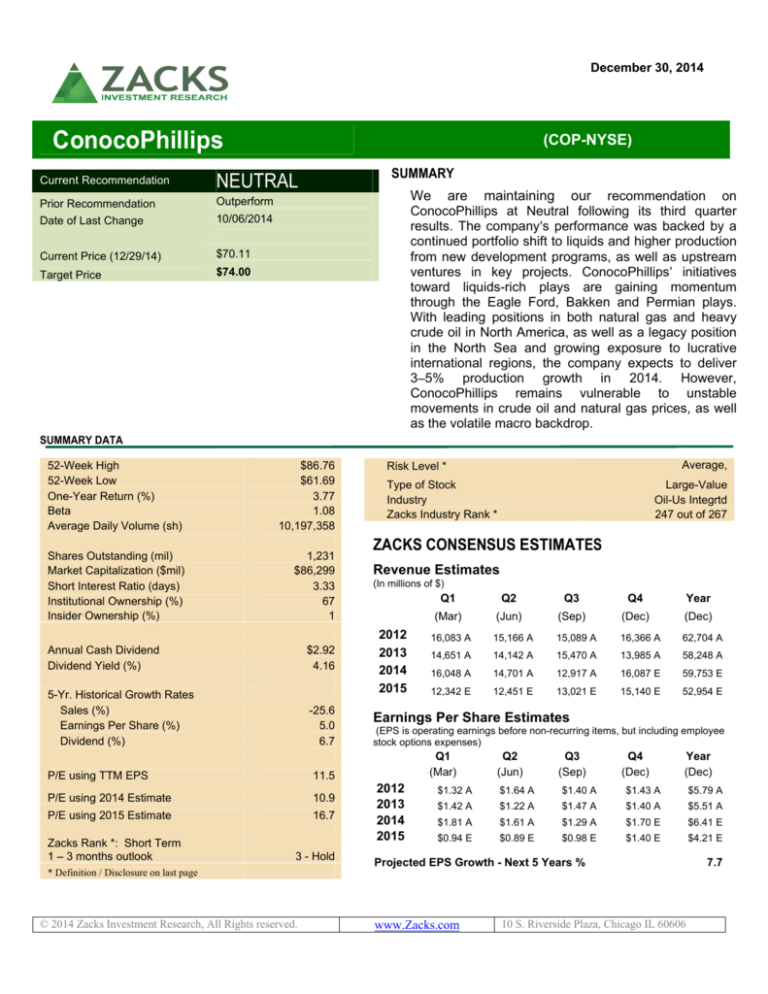

ZACKS CONSENSUS ESTIMATES

Revenue Estimates

(In millions of $)

2012

2013

2014

2015

Q1

Q2

Q3

Q4

Year

(Mar)

(Jun)

(Sep)

(Dec)

(Dec)

16,083 A

15,166 A

15,089 A

16,366 A

62,704 A

14,651 A

14,142 A

15,470 A

13,985 A

58,248 A

16,048 A

14,701 A

12,917 A

16,087 E

59,753 E

12,342 E

12,451 E

13,021 E

15,140 E

52,954 E

Earnings Per Share Estimates

(EPS is operating earnings before non-recurring items, but including employee

stock options expenses)

Q1

(Mar)

2012

2013

2014

2015

Q2

(Jun)

Q3

(Sep)

Q4

(Dec)

Year

(Dec)

$1.32 A

$1.64 A

$1.40 A

$1.43 A

$5.79 A

$1.42 A

$1.22 A

$1.47 A

$1.40 A

$5.51 A

$1.81 A

$1.61 A

$1.29 A

$1.70 E

$6.41 E

$0.94 E

$0.89 E

$0.98 E

$1.40 E

$4.21 E

Projected EPS Growth - Next 5 Years %

* Definition / Disclosure on last page

© 2014 Zacks Investment Research, All Rights reserved.

www.Zacks.com

10 S. Riverside Plaza, Chicago IL 60606

7.7

OVERVIEW

Houston, TX-based ConocoPhillips (COP) is a major global exploration and production (E&P) company

with operations and activities in 30 countries that include the U.S., Canada, UK/Norway, China, Australia,

offshore Timor-Leste, Indonesia, Libya, Nigeria, Algeria, Russia and Qatar.

As of the end of 2013, the company had estimated proved reserves of 8.9 billion oil-equivalent barrels

(BOE) as compared with 8.6 billion BOE at the end of 2012. The company added 1.1 billion BOE of

proved organic reserves in 2013, representing a reserve replacement ratio of 179%. Assets disposition in

2013 reduced reserves by 188 million BOE and total reserve replacement was 147%.

Earlier, in May 2012, ConocoPhillips completed the spin-off of its refining/sales business into a separate,

independent and publicly traded company, Phillips 66. The move had resulted in the creation of the

largest refining company in the U.S. (with a capacity of 2.4 million barrels per day) and the largest

exploration and production player based on oil and gas reserves.

The new downstream company, Phillips 66, is headquartered in Houston, TX. In addition to the refining,

marketing and transportation businesses, Phillips 66 also includes most of the Midstream and Chemicals

segments, as well as power generation and certain technology operations included in the Emerging

Businesses segment, creating an integrated downstream company.

REASONS TO BUY

With leading positions in both natural gas and heavy crude oil in North America, as well as a legacy

position in the North Sea and growing exposure to lucrative international regions, ConocoPhillips

expects to replace reserves and sustain production growth over the long term.

ConocoPhillips initiatives toward liquids-rich plays are gaining momentum through the Eagle Ford,

Bakken and Permian plays. For the third quarter, daily production averaged 1.481 million barrels of

oil equivalent (MMBOE). The company is on track to deliver average annual production as well as

margin growth of 3 5%, with its focus on liquid-rich ventures primarily in the U.S. and Canada,

although partially offset by the curtailed production from Libya. Organic reserve additions of about

1.1 billion BOE at year-end 2013 came mainly from Eagle Ford and Bakken in the Lower 48, oil

sands and western Canada as well as APLNG. Going forward, these regions are likely to play an

important part in increasing the company s yield.

ConocoPhillips is also poised to benefit from a pipeline of project in the Gulf of Mexico (GoM),

Malaysia, the liquefied natural gas project in Australia, the U.K., Norway, and the Canadian oil

sands, besides the US Lower 48 liquids-rich plays. Oil sands expansion projects are on track. In

Sep, Foster Creek Phase F and the Britannia Long-Term Compression Project witnessed first yield,

while the Gumusut floating production system achieved first production in October. These ramp-up

activities are expected to fuel its long-term production growth.

REASONS TO SELL

We remain cautious about the company s weak near-term production level as the output is likely to

be adversely impacted due to divestitures. Additionally, downtime in the fields might result in weak

production. Further, the company has slashed its capital expenditure budget from the dystopian

2015 oil space based on the assumptions of lower expected oil prices. ConocoPhillips cut its 2015

capital budget by a fifth of its 2014 level to $13.5 billion.

Equity Research

COP | Page 2

With the completion of the Phillips 66 spin-off, ConocoPhillips has shifted its total focus to upstream

operations. This is likely to reduce its earnings volatility but increase its dependence on oil and gas

prices. At the same time it will lack diversification benefits. Moreover, any price volatility is likely to

affect revenues going forward. Hence, ConocoPhillips remains vulnerable to unstable movements in

crude oil and natural gas prices, as well as the volatile nature of the macro backdrop.

The company faces greater challenges than its larger peers in generating attractive growth, given its

above-average exposure to the mature OECD regions. Again, though Conoco is one of the largest

natural gas companies in North America, it lacks material exposure to the prolific non-conventional

plays.

RECENT NEWS

ConocoPhillips Slashes Budget as Oil Slump Continues

Dec 8, 2014

ConocoPhillips slashed its capital expenditure budget by a fifth versus its 2014 level to $13.5 billion. The

exploration and production major reduced spending on major projects alongside deferring spending on

North American unconventional plays. However, the company expects production from continuing

operations, excluding Libya, to grow about 3%, despite lesser investment.

The company would focus its capital budget mainly on base maintenance and corporate expenditures,

development drilling programs, major projects, and exploration and appraisal spending.

The lower planned spending in several producing assets across the portfolio will see a slightly reduced

budget allocation of about $1.9 billion for base maintenance and corporate expenditures. Development of

drilling programs will spend about $5 billion from the budget, down from $6.5 billion last year.

Meanwhile, budget allocation for major projects will be about $4.8 billion in 2015, including substantial

spending on the APLNG and Surmont Phase 2 projects in 2014. About $1.8 billion has been allocated for

exploration and appraisal programs.

With leading positions in both natural gas and heavy crude oil in North America, as well as a legacy

position in the North Sea and growing exposure to lucrative international regions, ConocoPhillips expects

to replace reserves and sustain production growth over the long term. The company s exploration

initiatives toward liquids-rich plays are gaining momentum through the Eagle Ford, Bakken and North

Barnett shale plays.

We believe that any downtrend in the global economy will affect the supply-demand fundamentals of oil

and gas, hurting the sales prices of crude oil and natural gas.

Conoco s Kebabangan Gas Development in Malaysia Comes Online

Nov 12, 2014

ConocoPhillips announced the commissioning of gas production from the Kebabangan (KBB) gas field.

Production will increase as pipeline capacity becomes available.

Located about 60 miles offshore Malaysia, KBB, represents the third major project startup in Malaysia

this year. The company s production volumes are likely to be augmented by around 60,000 barrels of oil

equivalent per day through project startups in Malaysia by 2017. These high-margin barrels form a vital

part of the company's overall plan to deliver annual 3 5% production and margin growth.

The Kebabangan integrated drilling and production platform is located in a water depth of approximately

450 feet. Production from the field will initially utilize six wells with gas exported via pipeline to the Sabah

Oil and Gas Terminal in Kimanis.

Equity Research

COP | Page 3

The field is operated by Kebabangan Petroleum Operating Company, a jointly-operated company with

ConocoPhillips Sabah Ltd. and Shell Energy Asia Ltd. each holding a 30% interest and PETRONAS

Carigali Sdn Bhd holding a 40% interest.

ConocoPhillips Q3 Earnings Beat Estimates, Revenues Miss - Oct 30, 2014

ConocoPhillips reported third-quarter 2014 adjusted earnings of $1.29 per share, surpassing the Zacks

Consensus Estimate of $1.17 per share and decreasing from the year-earlier profit of $1.47.

Revenues in the reported quarter decreased to $12,917 million from the year-ago level of $15,470 million

and missed our projection of $13,984 million.

Exploration and Production

Daily production averaged 1.481 million barrels of oil equivalent (MMBOE) in the quarter, up from 1.470

MMBOE in the year-ago quarter.

Price Realization

The company s total realized price was $64.78 per BOE compared with $69.68 per BOE in the third

quarter of 2013, reflecting lower average realized prices across all products.

Average realized price for oil was $96.67 per barrel compared with $106.74 in the year-earlier quarter.

Natural gas liquids were sold at $37.66 per barrel, down from the year-ago level of $40.47 per barrel. The

price for natural gas was $5.91 per thousand cubic feet compared with $5.88 in third-quarter 2013.

Financials

At the end of the third quarter, ConocoPhillips generated $4.2 billion in cash from continuing operating

activities (excluding working capital). As of Sep 30, 2014, ConocoPhillips had $5.8 billion in cash and

short-term investments, including $5.4 billion in cash and cash equivalents. The company ended the

quarter with a debt of $21.2 billion and a debt-to-capitalization ratio of 28%.

Guidance

For the fourth quarter of 2014, daily production is expected in the band of 1,545 1,575 MBOE, excluding

Libya. ConocoPhillips expects to deliver 3 5% production growth in 2014. Excluding Libya, the

company s 2014 daily production is expected in the band of 1,525 1,535 MBOE.

VALUATION

ConocoPhillips current trailing 12-month earnings multiple is 11.5X, compared with the 11.8X industry

average and 19.2X for the S&P 500. Over the last five years, shares have traded in a range of 8.7X to

14.2X trailing 12-month earnings.

We appreciate ConocoPhillips emphasis on creating shareholder value through operational excellence,

strong project execution and dividend payout. Furthermore, strong proceeds from asset sales, disposal of

low-profit generating properties and cancellation of potentially less profitable projects add to the

company s efforts to sustain its growth trajectory. The company remains on-track with major growth

projects that are expected to offset production declines and give asset diversification to its portfolio.

These projects include the Eagle Ford and Bakken plays, Canadian Oil Sands, the North Sea projects,

APLNG and the Malaysian deepwater projects.

Equity Research

COP | Page 4

However, with the completion of the spin-off, ConocoPhillips has shifted its total focus to upstream

operations. Therefore, oil and gas prices play a major role in determining its performance. In particular,

the company remains vulnerable to unstable movements in crude oil and natural gas prices. Therefore,

we are maintaining recommendation on ConocoPhillips at Neutral. Our $74.00 price objective reflects a

P/E of 11.5 on our 201e EPS estimate, which is at the higher-end of the historical trading range.

Key Indicators

P/E

F1

P/E

F2

Est. 5-Yr

EPS Gr%

P/CF

(TTM)

P/E

(TTM)

P/E

5-Yr

High

(TTM)

P/E

5-Yr

Low

(TTM)

ConocoPhillips (COP)

10.9

16.7

7.7

5.7

11.5

14.2

8.7

Industry Average

S&P 500

12.6

17.8

23.2

16.6

7.9

10.7

4.1

16.1

11.8

19.2

28.3

19.6

7.6

12.0

Occidental Petroleum Corporation (OXY)

Hess Corporation (HES)

13.3

16.1

23.8

37.0

3.8

9.8

6.0

5.4

12.0

15.0

21.5

30.7

9.0

7.9

TTM is trailing 12 months; F1 is 2014 and F2 is 2015, CF is operating cash flow

P/B

Last

Qtr.

P/B

5-Yr High

P/B

5-Yr Low

ROE

(TTM)

D/E

Last Qtr.

Div Yield

Last Qtr.

(COP)

1.5

1.9

1.0

14.0

0.4

4.2

4.4

Industry Average

S&P 500

1.1

7.2

1.1

9.8

1.1

3.2

9.2

23.3

-0.1

1.9

1.9

4.2

EV/EBITDA

(TTM)

ConocoPhillips

Equity Research

COP | Page 5

Earnings Surprise and Estimate Revision History

Equity Research

COP | Page 6

DISCLOSURES & DEFINITIONS

The analysts contributing to this report do not hold any shares of COP. The EPS and revenue forecasts are the Zacks Consensus

estimates. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts personal

views as to the subject securities and issuers. Zacks certifies that no part of the analysts compensation was, is, or will be, directly or indirectly,

related to the specific recommendation or views expressed by the analyst in the report. Additional information on the securities mentioned in this

report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to

accuracy and does not purport to be complete. Because of individual objectives, the report should not be construed as advice designed to meet

the particular investment needs of any investor. Any opinions expressed herein are subject to change. This report is not to be construed as an

offer or the solicitation of an offer to buy or sell the securities herein mentioned. Zacks or its officers, employees or customers may have a

position long or short in the securities mentioned and buy or sell the securities from time to time. Zacks uses the following rating system for the

securities it covers. Outperform- Zacks expects that the subject company will outperform the broader U.S. equity market over the next six to

twelve months. Neutral- Zacks expects that the company will perform in line with the broader U.S. equity market over the next six to twelve

months. Underperform- Zacks expects the company will under perform the broader U.S. Equity market over the next six to twelve months. The

current distribution of Zacks Ratings is as follows on the 1141 companies covered: Outperform - 15.8%, Neutral - 78.2%, Underperform 5.7%.

Data is as of midnight on the business day immediately prior to this publication.

Our recommendation for each stock is closely linked to the Zacks Rank, which results from a proprietary quantitative model using trends in

earnings estimate revisions. This model is proven most effective for judging the timeliness of a stock over the next 1 to 3 months. The model

assigns each stock a rank from 1 through 5. Zacks Rank 1 = Strong Buy. Zacks Rank 2 = Buy. Zacks Rank 3 = Hold. Zacks Rank 4 = Sell. Zacks

Rank 5 = Strong Sell. We also provide a Zacks Industry Rank for each company which provides an idea of the near-term attractiveness of a

company s industry group. We have 264 industry groups in total. Thus, the Zacks Industry Rank is a number between 1 and 264. In terms of

investment attractiveness, the higher the rank the better. Historically, the top half of the industries has outperformed the general market. In

determining Risk Level, we rely on a proprietary quantitative model that divides the entire universe of stocks into five groups, based on each

th

stock s historical price volatility. The first group has stocks with the lowest values and are deemed Low Risk, while the 5 group has the highest

values and are designated High Risk. Designations of Below-Average Risk, Average Risk, and Above-Average Risk correspond to the

second, third, and fourth groups of stocks, respectively.

Equity Research

COP | Page 7