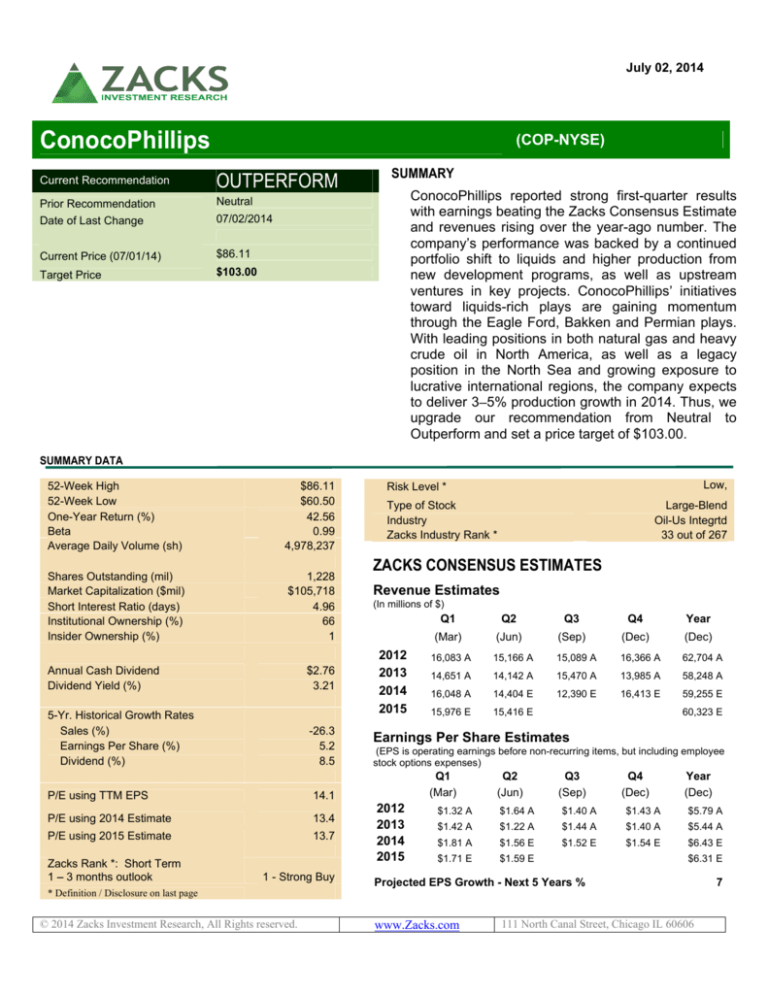

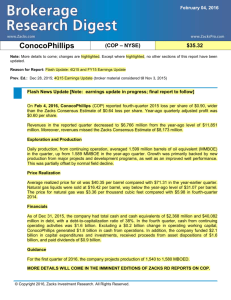

July 02, 2014

ConocoPhillips

(COP-NYSE)

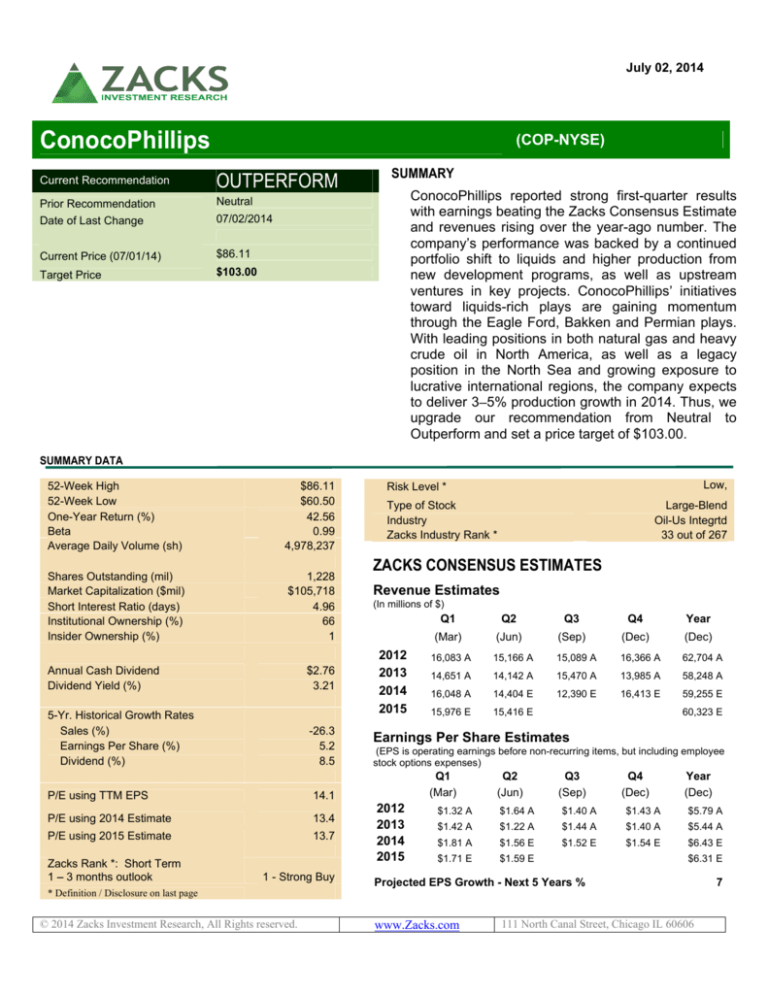

Current Recommendation

OUTPERFORM

Prior Recommendation

Neutral

Date of Last Change

07/02/2014

Current Price (07/01/14)

$86.11

Target Price

$103.00

SUMMARY

ConocoPhillips reported strong first-quarter results

with earnings beating the Zacks Consensus Estimate

and revenues rising over the year-ago number. The

company s performance was backed by a continued

portfolio shift to liquids and higher production from

new development programs, as well as upstream

ventures in key projects. ConocoPhillips initiatives

toward liquids-rich plays are gaining momentum

through the Eagle Ford, Bakken and Permian plays.

With leading positions in both natural gas and heavy

crude oil in North America, as well as a legacy

position in the North Sea and growing exposure to

lucrative international regions, the company expects

to deliver 3 5% production growth in 2014. Thus, we

upgrade our recommendation from Neutral to

Outperform and set a price target of $103.00.

SUMMARY DATA

52-Week High

52-Week Low

One-Year Return (%)

Beta

Average Daily Volume (sh)

$86.11

$60.50

42.56

0.99

4,978,237

Shares Outstanding (mil)

Market Capitalization ($mil)

Short Interest Ratio (days)

Institutional Ownership (%)

Insider Ownership (%)

1,228

$105,718

4.96

66

1

Annual Cash Dividend

Dividend Yield (%)

$2.76

3.21

5-Yr. Historical Growth Rates

Sales (%)

Earnings Per Share (%)

Dividend (%)

-26.3

5.2

8.5

P/E using TTM EPS

14.1

P/E using 2014 Estimate

13.4

P/E using 2015 Estimate

13.7

Zacks Rank *: Short Term

1 3 months outlook

1 - Strong Buy

Low,

Risk Level *

Type of Stock

Industry

Zacks Industry Rank *

Large-Blend

Oil-Us Integrtd

33 out of 267

ZACKS CONSENSUS ESTIMATES

Revenue Estimates

(In millions of $)

2012

2013

2014

2015

Q1

Q2

Q3

Q4

Year

(Mar)

(Jun)

(Sep)

(Dec)

(Dec)

16,083 A

15,166 A

15,089 A

16,366 A

62,704 A

14,651 A

14,142 A

15,470 A

13,985 A

58,248 A

16,048 A

14,404 E

12,390 E

16,413 E

59,255 E

15,976 E

15,416 E

60,323 E

Earnings Per Share Estimates

(EPS is operating earnings before non-recurring items, but including employee

stock options expenses)

Q1

(Mar)

2012

2013

2014

2015

Q2

(Jun)

Q3

(Sep)

Q4

(Dec)

Year

(Dec)

$1.32 A

$1.64 A

$1.40 A

$1.43 A

$5.79 A

$1.42 A

$1.22 A

$1.44 A

$1.40 A

$5.44 A

$1.81 A

$1.56 E

$1.52 E

$1.54 E

$6.43 E

$1.71 E

$1.59 E

$6.31 E

Projected EPS Growth - Next 5 Years %

* Definition / Disclosure on last page

© 2014 Zacks Investment Research, All Rights reserved.

www.Zacks.com

111 North Canal Street, Chicago IL 60606

7

OVERVIEW

Houston, Texas-based ConocoPhillips (COP) is a major global exploration and production (E&P)

company with operations and activities in 30 countries that include the U.S., Canada, UK/Norway, China,

Australia, offshore Timor-Leste, Indonesia, Libya, Nigeria, Algeria, Russia and Qatar.

As of the end of 2013, the company had estimated proved reserves of 8.9 billion oil-equivalent barrels

(BOE) as compared with 8.6 billion BOE at the end of 2012. The company added 1.1 billion BOE of

proved organic reserves in 2013, representing a reserve replacement ratio of 179%. Assets disposition in

2013 reduced reserves by 188 million BOE and total reserve replacement was 147%.

Earlier, in May 2012, ConocoPhillips completed the spin-off of its refining/sales business into a separate,

independent and publicly traded company, Phillips 66. The move had resulted in the creation of the

largest refining company in the U.S. (with a capacity of 2.4 million barrels per day) and the largest

exploration and production player based on oil and gas reserves.

The new downstream company, Phillips 66, is headquartered in Houston, Texas. In addition to the

refining, marketing and transportation businesses, Phillips 66 also include most of the Midstream and

Chemicals segments, as well as power generation and certain technology operations included in the

Emerging Businesses segment, creating an integrated downstream company.

REASONS TO BUY

With leading positions in both natural gas and heavy crude oil in North America, as well as a legacy

position in the North Sea and growing exposure to lucrative international regions, ConocoPhillips

expects to replace reserves and sustain production growth over the long term.

ConocoPhillips initiatives toward liquids-rich plays are gaining momentum through the Eagle Ford,

Bakken and Permian plays. For the first quarter, daily production averaged 1.568 million barrels of

oil equivalent (MMBOE). The company also remains on track to deliver average annual production

as well as margin growth of 3% to 5%, as it focuses on liquid-rich ventures primarily in the U.S. and

Canada, partly offset by the effects of curtailed production from Libya. Organic reserve additions of

about 1.1 billion BOE at year-end 2013 came mainly from Eagle Ford and Bakken in the Lower 48,

oil sands and western Canada as well as APLNG. Going forward, these regions are likely to play an

important part in increasing the company s yield.

ConocoPhillips is also poised to benefit from a pipeline of project in Gulf of Mexico (GoM), Malaysia,

the liquefied natural gas project in Australia, the U.K., Norway, and the Canadian oil sands, besides

the US Lower 48 liquids-rich plays. Oil sands expansion projects are on track. In July, Christina Lake

Phase E witnessed first yield and the output is expected to accelerate over the next six to nine

months. These ramp-up activities are expected to fuel its long-term production growth target.

ConocoPhillips remains on-track with its divestment program, with a total about $12.4 billion

completed. The company raised $10.2 billion from the disposition program in 2013 that includes the

strategic sale of its interest in Kashagan and the Algeria business. This is expected to enable

ConocoPhillips to generate a healthy cash surplus in 2014. The proceeds are also expected to be

utilized for portfolio optimization and to increase shareholder value.

Equity Research

COP | Page 2

RISKS

We remain cautious about the company s weak near-term production level. The volumes decreased

almost 2% year over year, mainly due to normal field decline and weather-related downtime, offset

by new production from development programs. Further, the output is likely to be adversely

impacted due to divestitures. In addition, downtime in the fields is also expected to result in weak

production.

With the completion of the Phillips 66 spin-off, ConocoPhillips has shifted its total focus to upstream

operations. This is likely to reduce its earnings volatility but increase its dependence on oil and gas

prices. At the same time it will lack diversification benefits. Moreover, any price volatility is likely to

affect revenues going forward. Hence, ConocoPhillips remains vulnerable to unstable movements in

crude oil and natural gas prices, as well as the volatile nature of the macro backdrop.

The company faces greater challenges than its larger peers in generating attractive growth, given its

above-average exposure to the mature OECD regions. Again, though Conoco is one of the largest

natural gas companies in North America, it lacks material exposure to the prolific non-conventional

plays.

RECENT NEWS

ConocoPhillips Pushes Back Nigerian Divestment

Jun 30, 2014

ConocoPhillips has entered into an agreement with leading Canadian exploration and production

company, Oando Energy Resources, to extend the date of closing the proposed divestment of its

Nigerian Upstream Oil and Gas business. The new agreement extended the date for completion of the

transaction to Jul 31, 2014. Earlier the parties had expected the transaction to be completed by Jun

2014.

The divestment proposal has already received the consent of the Minister of Petroleum Resources of

Nigeria. The purchase consideration to be dished out by Oando Energy would be $1.65 billion in cash.

Conoco Declares Dividend

Jun 2, 2014

ConocoPhillips paid a quarterly dividend of $0.69 per share to stockholders of record at the close of

business on May 23.

ConocoPhillips' Earnings Beat Aided by New Ventures

May 01, 2014

ConocoPhillips reported first quarter 2014 adjusted earnings of $1.81 per share, surpassing the Zacks

Consensus Estimate of $1.57 per share and increasing 27.5% from the year-earlier profit of $1.42. The

year-over-year growth was mainly attributable to production from new development programs as well as

upstream ventures in key projects.

Revenues in the reported quarter increased to $16,048.0 million from the year-ago level of $14,651.0

million and comfortably surpassed our projection of $15,506.0 million.

Exploration and Production

Daily production averaged 1.568 million barrels of oil equivalent (MMBOE) in the quarter, down 1.8%

from 1.596 MMBOE in the year-ago quarter. The decline was mainly due to the natural decline in fields

and downtime.

Equity Research

COP | Page 3

Price Realization

Overall price realization increased 3.9% to $71.21 per BOE from $68.57 per BOE in the first quarter of

2013.

Average realized price for oil was $101.59 per barrel compared with $105.97 in the year-earlier quarter.

Natural gas liquids (NGL) were sold at $46.52 per barrel, reflecting an increase of 8.3% from the yearago level of $42.95 per barrel.

The price for natural gas was $7.55 per thousand cubic feet (Mcf) versus $6.19 in first quarter 2013,

reflecting an increase of 22%. The company s bitumen prices jumped 44% year over year to $56.47 per

barrel.

Financials

At the end of the first quarter, ConocoPhillips generated $6.3 billion in cash from continuing operating

activities (excluding working capital). As of Mar 31, 2014, the company had total cash and cash

equivalents of $7.5 billion and $21.2 billion in debt, with a debt-to-capitalization ratio of 28%.

ConocoPhillips also paid $0.9 billion in dividends and incurred $3.9 billion in capital expenditures during

the quarter.

Guidance

For the second quarter of 2014, daily production is expected in the band of 1,490 1,540 thousand barrels

of oil equivalent (MBOE), excluding Libya. ConocoPhillips expects to deliver 3 5% production growth in

2014. Excluding Libya, the company s 2014 full-year production remained unchanged at 1,510 1,550

MBOED.

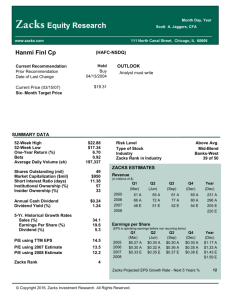

VALUATION

ConocoPhillips current trailing 12-month earnings multiple is 14.1X, compared with the 68.3X industry

average and 18.4X for the S&P 500. Over the last five years, shares have traded in a range of 7.2X to

14.2X trailing 12-month earnings. As of now, the stock is trading at a discount to its peer group, based on

forward earnings estimates.

We appreciate ConocoPhillips emphasis on creating shareholder value through operational excellence,

strong project execution and dividend payout. Furthermore, strong proceeds from asset sales, disposal of

low-profit generating properties and cancellation of potentially less profitable projects add to the

company s efforts to sustain its growth trajectory. The company remains on-track with major growth

projects that are expected to offset production declines and give asset diversification to its portfolio.

These projects include the Eagle Ford and Bakken plays, Canadian Oil Sands, the North Sea projects,

APLNG and the Malaysian deepwater projects.

Thus, we upgrade our recommendation from Neutral to Outperform and set a target price of $103.00

(16.0X of 2014 EPS).

Equity Research

COP | Page 4

Key Indicators

P/E

F1

P/E

F2

Est. 5-Yr

EPS Gr%

P/CF

(TTM)

P/E

(TTM)

P/E

5-Yr

High

(TTM)

ConocoPhillips (COP)

13.4

13.6

6.8

7.1

14.1

14.2

7.2

Industry Average

S&P 500

17.7

16.9

15.6

15.8

6.5

10.7

6.2

14.6

68.3

18.4

76.9

27.7

10.8

12.0

NA

22.1

80.5

NA

9.0

7.9

Rancher Energy Corp. (RNCH)

NA

NA

NA

NA

NA

Occidental Petroleum Corporation (OXY)

14.2

14.2

5.4

7.6

14.6

Murphy Oil Corporation (MUR)

19.3

18.7

7.6

7.2

19.8

TTM is trailing 12 months; F1 is 2014 and F2 is 2015, CF is operating cash flow

P/E

5-Yr

Low

(TTM)

P/B

Last

Qtr.

P/B

5-Yr High

P/B

5-Yr Low

ROE

(TTM)

D/E

Last Qtr.

Div Yield

Last Qtr.

(COP)

1.8

1.8

1.0

14.6

0.4

3.5

5.1

Industry Average

S&P 500

1.5

4.7

1.5

9.8

1.5

3.2

9.0

23.3

-0.1

1.4

1.9

5.2

EV/EBITDA

(TTM)

ConocoPhillips

Equity Research

COP | Page 5

Earnings Surprise and Estimate Revision History

Equity Research

COP | Page 6

DISCLOSURES & DEFINITIONS

The analysts contributing to this report do not hold any shares of COP. The EPS and revenue forecasts are the Zacks Consensus

estimates. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts personal

views as to the subject securities and issuers. Zacks certifies that no part of the analysts compensation was, is, or will be, directly or indirectly,

related to the specific recommendation or views expressed by the analyst in the report. Additional information on the securities mentioned in this

report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to

accuracy and does not purport to be complete. Because of individual objectives, the report should not be construed as advice designed to meet

the particular investment needs of any investor. Any opinions expressed herein are subject to change. This report is not to be construed as an

offer or the solicitation of an offer to buy or sell the securities herein mentioned. Zacks or its officers, employees or customers may have a

position long or short in the securities mentioned and buy or sell the securities from time to time. Zacks uses the following rating system for the

securities it covers. Outperform- Zacks expects that the subject company will outperform the broader U.S. equity market over the next six to

twelve months. Neutral- Zacks expects that the company will perform in line with the broader U.S. equity market over the next six to twelve

months. Underperform- Zacks expects the company will under perform the broader U.S. Equity market over the next six to twelve months. The

current distribution of Zacks Ratings is as follows on the 1090 companies covered: Outperform - 14.9%, Neutral - 79.7%, Underperform 4.9%.

Data is as of midnight on the business day immediately prior to this publication.

Our recommendation for each stock is closely linked to the Zacks Rank, which results from a proprietary quantitative model using trends in

earnings estimate revisions. This model is proven most effective for judging the timeliness of a stock over the next 1 to 3 months. The model

assigns each stock a rank from 1 through 5. Zacks Rank 1 = Strong Buy. Zacks Rank 2 = Buy. Zacks Rank 3 = Hold. Zacks Rank 4 = Sell. Zacks

Rank 5 = Strong Sell. We also provide a Zacks Industry Rank for each company which provides an idea of the near-term attractiveness of a

company s industry group. We have 264 industry groups in total. Thus, the Zacks Industry Rank is a number between 1 and 264. In terms of

investment attractiveness, the higher the rank the better. Historically, the top half of the industries has outperformed the general market. In

determining Risk Level, we rely on a proprietary quantitative model that divides the entire universe of stocks into five groups, based on each

th

stock s historical price volatility. The first group has stocks with the lowest values and are deemed Low Risk, while the 5 group has the highest

values and are designated High Risk. Designations of Below-Average Risk, Average Risk, and Above-Average Risk correspond to the

second, third, and fourth groups of stocks, respectively.

Equity Research

COP | Page 7