How to Read International Trader Alerts

advertisement

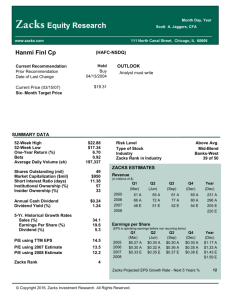

www.zacks.com/Internationaltrader Guide Zacks Investment Research, Inc | 111 North Canal Street, Suite 1101 | Chicago Illinois 60606 Contents Introduction2 Section 1: The Mental Aspect3 Section 2: Investment Philosophy & Trade Selection4 Section 3: Getting the Most Out of the International Trader7 Section 4: Follow the Leader8 Section 5: How to Read International Trader Alerts9 Section 6: How to Read International Trader Daily Summary10 Section 7: Virtues of Money Management11 Section 8: Tying it All Together12 1 Introduction Congratulations! You have now joined the International Trader daily newsletter and trading service. I’m John Blank, Chief Equity Strategist here at Zacks Investment Research. I’m prepared to guide you towards the most exciting and overlooked investment opportunities in the world. The International Trader is not a get rich quick scheme. Any person promising “overnight riches” is a charlatan and doesn’t respect the years it took for you to build your nest egg. Instead, I am going to show you how to prudently apply the power of the Zacks Rank combined with value investing and a dash of market timing in the non-U.S. space. This blended approach will help us profit no matter what the market throws our way. Like most investors, you are probably wary of putting money into foreign enterprises. Many Americans believe it’s safer to restrict their trades to companies located inside the borders of the U.S. I understand why you might feel this way. It’s certainly important to be familiar with the companies, products, services, and concepts you’re investing in. And it’s smart to avoid countries where the economic and political landscapes are highly unstable. But it’s also essential to recognize the danger of putting all your investment dollars into a single country ...even if that country is the United States of America. Please be sure to read this guide from start to finish. In the pages that follow are important tips that will help you get the most out of this service. The more you know, the better your odds of success. Again, welcome to Zacks International Trader. I look forward to sharing investment success with you for many years to come. John J. Blank, Ph.D. International Trader Editor Chief Equity Strategist, Zacks Investment Research, Inc. 2 1 The Mental Aspect It is important to realize how much investment success is related to what goes on between your ears. There are so many ways to get distracted and to question yourself while trading. You must be in the right frame of mind and have reasonable expectations to achieve success with this or any investment service. Be sure to pay attention to the tips in this section carefully. They will get you headed in the right direction. NOBODY IS 100% PERFECT First of all, there will be losing picks. Perhaps 40% or more of the trades will be closed for a loss. But if we cut them out early to minimize losses and maximize gains on winners, then we can achieve phenomenal results. A little known fact is that the Zacks Rank, even with its 26% annual return, is only right 56% of the time. We are extremely confident that over time we will produce substantial returns, but it is important that you learn to take losing picks in stride. TIMELINESS INCREASES ROI Let me ask you a question. Would you rather make +10% or +20% on a trade? Yes it’s a trick question. The missing piece of the puzzle is how long each trade was held. Now let’s say that the +10% gain was made in 3 months time, which computes to a +40% annual return. Whereas the +20% winner took 2 years to achieve and is really only good for a 10% annual gain. This example solidifies the power of timely stock trading that we will harness with this service. Often, we will be holding for 3 to 6 months and look to string together a series of +10%, +20%+ winners. From time to time, we will let winners run long enough to net +50% to +100% gains on the trade. DON’T CHERRY PICK You should only subscribe to this service if you intend to fully investigate and act upon these opportunities. The best results from this service can be obtained by following every recommendation, with properly proportioned amounts invested in each selection. Picking and choosing among the selections is rarely successful and is a leading cause of dissatisfaction amongst subscribers. 3 2 Investment Philosophy & Trade Selection The International Trader will follow hand-picked trades by John J. Blank, Ph.D., Chief Equity Strategist of Zacks Investment Research. The best way to understand his investment philosophy and trade selection process is to first understand John’s background and trading influences. We asked John to share that with you below. ON TOP OF THE WORLD Why am I so pleased to introduce our new Zacks International Trader? Because a non-U.S. investment service is designed to significantly enhance and protect your portfolio. I will give you everything you need to make that happen. As Chief Equity Strategist at Zacks, it’s my responsibility to monitor global developments, and maintain personal connections with many of the world’s most successful investors. Every working day, I comb through ADR stocks, ETFs, bonds, precious metals, currency moves, and other opportunities, eliminating most of them. I also stay on top of the motion and meaning of published indicators. My mission is to find exceptional trades that add balance and substantial upside to your portfolio mix. But you won’t receive a barrage of potential investments. The International Trader is selective. At any time, only about 7 to 10 buys will be on our recommendation board. And while the opportunities will be time-sensitive, you won’t have to turn into a day trader to benefit from them. Our typical hold period is 3 to 6 months. Also, I’ll alert you via email on new trades. You’ll receive plain-spoken daily briefings from me on our recommendations, and on the major economic and political developments that may affect them. REASONS FOR GLOBAL EXPOSURE VALUATION As you well know, the U.S. economy has downs as well as ups. Think about the dotcom and housing busts; plus all of the plain vanilla pullbacks, corrections, and recessions. Yet, even when the U.S. market turns bearish, there are bull markets somewhere in the world where you can build substantial wealth. 4 That’s a key component to the Asset Allocation Theory of 1990 Nobel Prize winner, Harry Markowitz. He recommended 30% of an investor’s portfolio be devoted to non-U.S. stocks. And today is an especially good time to give your portfolio that needed international diversity. Here’s why… U.S. stocks trade at a valuation premium. They’ve gone up much faster than real earnings growth. Meanwhile, stocks in certain regions are considerably undervalued. In other words, many international companies are trading at substantial discounts compared to their U.S. counterparts. In fact, stocks from Europe, which is beginning an economic recovery, looked to be undervalued by around +20% to +30% in recent times. This offers significantly greater profit potential for your investments. STRONG TOP-LINE GROWTH Another powerful incentive for looking abroad is that we can find strong companies that are similar to American counterparts and trade on U.S. exchanges. The singular difference is that they happen to be located in economies booming several times faster than that of the United States. For example, the economies of Israel, Russia, Mexico, India, and China can be growing up to three times faster than the United States domestic real GDP. In turn, selected ADR stocks from countries like these can significantly boost your profit potential. Especially when our buys and sells are further enhanced with the timing power of the Zacks Rank. In addition to expansion trends, there has been a recent explosion of contrarian and relative-value opportunities in the world. Currency woes affecting India, Brazil, Indonesia, and Turkey have brought even more attractive valuations into certain international markets. So have events like the Syrian crisis. Yes, there is certainly an abundance of opportunity today. But you have to know exactly where to look for it. And exactly when to make your moves! I should add that none of these recommendations are “exotic” or complicated to buy. Each can be easily traded through any brokerage account. Each also has exceptional profit potential. 5 I AM WHO I AM I’m a macro economist by trade. My Ph.D. is from M.I.T. I’ve studied, taught, and practiced global economics for 25 years. Like most people, I am a product of my environment. My background as a highly trained MIT economist taught me to be a value investor too. Hanging out with the likes of Paul Samuelson, Franco Modigliani, Robert Merton, and Bob Shiller will do that to you. I have also worked under Jeff Sachs, advisor to the United Nations, and Olivier Blanchard, Chief Economist of the IMF. They have shown me the way on the global economy, policy, and interconnected financial markets. Len and Ben Zacks and their team at Zacks, in particular EVP Steve Reitmeister, have shown me how to be a timely trader by using the Zacks Rank. Add that into the 25 years of experience in top-down advice giving. This potent and unique mix has endowed me with the insights needed to understand bull and bear markets in the non-U.S context. I promise to give you my best efforts. In fact, you should expect that I have some my own personal money in some of these picks I share with you. We are in this together. I will be wrong plenty. But you will never see me run and hide. Instead, we will learn from every experience and together we will enjoy great success. Sincerely, John J. Blank, PhD. Editor of the International Trader Chief Equity Strategist, Zacks Investment Research, Inc. 6 3 Getting the Most Out of International Trader It is our job to provide you with timely and profitable stock picks, but there are steps that you can take to ensure your success with The International Trader Alert. Here are a few things you can do to get the most out of the product. 1. Read this guide carefully This guide is your friend. It has valuable information on how to use the product and succeed with the assistance of International Trader. It gives you step-by-step instructions on how to receive alerts and what to do when you receive them. It has important money management tips. 2. Have a working email address This is necessary to receive trading alerts. Make sure you can access your email in a timely fashion because acting on trades is essential to success. The Daily Summary email will be sent at 8:00 p.m. EST, which summarizes the positions as well as what happened on Wall Street during that trading day. Intra-day trading alerts, while rare, will usually be sent out by 12:00 p.m. EST Unfortunately, many Internet service providers have software programs that filter out emails you want to receive, like Zacks Profit from the Pros. To get optimal delivery of our emails follow this link for quick and easy instructions. 3. Have an online trading account We are not advocating any particular company for this, but ideally lower commissions will help you achieve a higher overall return. You will make several trades a month, and high commissions can really eat into your profit margin, especially if you have limited capital. 4. Access the site To access the site, go to www.zacks.com/internationaltrader and enter your username and password. This will take you to the main page where you can view the portfolio, any pending trades, and the commentary. 7 4 Follow the Leader With International Trader, it is better to follow than to lead. It is recommended that you follow each and every one of the picks to achieve overall success. The process to receive trades is very simple, yet we feel it is so important that we are going to spell it out for you. Here are the four steps: Receive the email with the daily summary or intra-day signal. Read the email to determine appropriate action. Place trades through your broker with the appropriate % allotted. Follow the daily summaries to determine when to sell. Subscribers who realize the highest returns follow the recommendations, and those who do the worst try and cherry pick which buy signals to act on and which to pass on. Follow the signals and you’ll maximize your opportunity for success. ACT PROMPTLY = MOST SUCCESS And if you don’t beat the market, you can take advantage of our 100% Money Back Guarantee. SPEAKING OF THE GUARANTEE.......... We feel that if we are not able to live up to our word and help you beat the market then we shouldn’t be deemed worthy enough to take your money. So in addition to the 90-day, no hassle guarantee, there is a 100% Money Back Performance Guarantee. There are a few conditions that have to be met first, but the bottom line is that we have to perform. Click here for details. 8 5 How to Read International Trader Alerts From time to time, this strategy will have a trading alert during the trading day. When a Buy Alert is sent out, you will typically receive the alert before 12:00 p.m. EST detailing what stock is being added and the rationale behind the move. It is important that you act as soon as you can and buy the stock yourself. Here is an example: Signal = The type of alert. It will be a green ball for a “buy” alert or red for a “sell”. Company Name = The name of the company that is being added to the International Trader portfolio. Symbol = Ticker symbol of stock being added to or deleted from the portfolio. Date = The date on which the stock was added to the portfolio. Portfolio Commentary = As part of the alert, John will explain his rationale for the addition or deletion. You will learn his reasoning for adding the stock and the current price at which the stock is trading. 9 6 How to Read the International Trader Daily Summary The Daily Summary provides a wide array of details for the International Trader every Monday to Friday. This summary has the new signals (if any) as well as the current open portfolio with daily commentary. This is valuable information. It conveys what our game plan is, why we are in each stock, when to get out and why, as well as any relevant news. This is emailed to you around 8:00 p.m. EST. In regards to the price added for the portfolio, Zacks typically uses the average of the price at the open and the closing price on the day the stock is added. 10 7 Virtues of Money Management Money management can be the difference between realizing large gains and going broke, even if the winning percentage is the same. How can this be? The key point is that winning investors know to ride their winners and cut their losses quickly, and stick with a plan that has proven to work in the past. Here are a few rules that you can follow to further improve your returns: First of all, don’t dump your entire portfolio into these International Trader picks. Only allocate that portion of your capital that can be comfortably devoted to speculation. While The International Trader portfolio is among the least speculative of the trading services, it is still a speculative portfolio. In other words, diversify your portfolio. Do not allocate your entire portfolio to The International Trader. This particular portfolio might hold 7 to 10 positions depending on market conditions. You should be able to sleep soundly and act rationally if you are only trading with your speculative money. Keep in mind that reinvesting profits and the power of compounding are your friends in this portfolio. Those frequent singles add up to be a home-run in the end when the phenomenon of compound interest works its magic. EVER-PRESENT CLICHÉ RINGS TRUE While the International Trader has a longer holding period relative to many trading services portfolios at Zacks Investment Research, it is still a trading service with many ideas coming at you per quarter. It has been said millions of times before, but it is so important it needs to be said again: Don’t put all your eggs in one basket. Even if you are the most brilliant investor in the world, there will be losing trades. The key is to stay in the game and build your equity over time in a systematic way. This can only be done when diversification is put to use. Not that we have to remind you, but the main point is that your capital was earned through years and years of hard work. Capital conservation sounds boring, but without it, you are fighting a losing battle. We don’t want to see the money you have put your blood, sweat, and tears into evaporate due to lack of discipline. 11 8 Tying it All Together It is our goal at Zacks to enhance your trading results via The International Trader service. This booklet touches upon the details of the service and provides several useful tips to realize the vast potential that The International Trader holds. We feel it is our job to let you know that we are here to help you get the most out of International Trader Alerts. Again, let’s go over some of the important points made in this booklet. Follow Every Single Trade Small Gains Add Up To Big Results Not Every Trade Will Be A Winner Timeliness Is Of The Essence Money Management Matters Greatly Have A Working Email Address We Are Here To Help The last point is important as we have free customer support that should be taken advantage of. Additional questions that you may have can be answered by just picking up the phone and giving us a call or emailing us: 1.888.775.8348 (outside the US, 1.312.265.9309) internationaltrader@zacks.com 12