Zacks Rank Strong Buy 50 Strategy Portfolio Series 6 Fact Card

Unit Investment Trust U.S. Equity Guggenheim Blueprints Strategy

Zacks Rank Strong Buy 50 Strategy Portfolio, Series 6

Investment Objective

The Zacks Rank Strong Buy 50 Strategy Portfolio,

Series 6 (“Trust”) seeks to provide aboveaverage total return primarily through capital appreciation.

“ Earnings estimate revisions are the most powerful force impacting stock prices.”

— Len Zacks, founder of Zacks Investment Research

The Zacks Rank Model was developed as an actionable ranking system which continuously monitors over

200,000 earnings estimates and revisions. With that in mind, Guggenheim created the Zacks Rank Strong Buy

50 Strategy Portfolio to provide exposure to 50 U.S.-listed securities with the largest “Last Earnings Per Share

Surprise Percentage*” that received a “Strong Buy” ranking.

Key Considerations

■ Defi ned: The Trust is defi ned with regard to strategy, holdings, and duration—providing a high level of transparency for investors.

■ Focused: The Trust seeks to provide investors access to insights of institutional investors and trends in earnings estimate revisions through the Zacks Rank Model, which seeks consistent stock selection regardless of market conditions.

■

Timely: Repeatedly constructing a portfolio of ‘Strong Buy’ stocks has enabled the Zacks

Rank Strong Buy 50 Strategy to outperform the overall markets in 11 of 15 years, as shown in the chart below.

GROWTH OF $10,000

Hypothetical Strategy vs. S&P 500 Index 12.31.1999–11.30.2015.

$50,000

$40,000

$30,000

$20,000

$10,000

$0

12.31.99

Hypothetical Strategy (Ending value $34,885)

12.31.03

12.31.07

S&P 500 Index (Ending value $19,302)

12.31.11

11.30.15

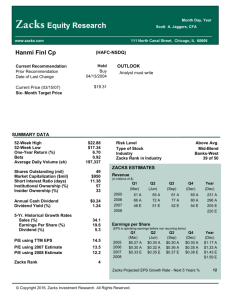

ANNUAL TOTAL RETURNS

Hypothetical Strategy vs. S&P 500 Index.

Year 1

2000

2001

2002

2003+

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Hypothetical

Strategy

-3.14%

-21.21%

-15.20%

68.98%

21.46%

24.38%

22.34%

17.41%

-44.56%

15.82%

26.87%

4.39%

17.10%

45.18%

2014 -3.15%

2015 (through 11.30.2015) 5.00%

+ These returns are the result of extraordinary market events and are not expected to be repeated.

S&P 500

Index

-9.10%

-11.89%

-22.10%

28.68%

10.88%

4.91%

15.79%

5.49%

-37.00%

26.47%

15.06%

2.63%

16.00%

32.39%

13.68%

3.01%

HISTORICAL RISK/RETURN

Hypothetical Strategy vs. S&P 500 Index

12.31.1999–11.30.2015.

25%

20%

15%

10%

5%

RISK ANALYSIS 2

Hypothetical Strategy vs. S&P 500 Index

12.31.1999–11.30.2015.

Standard Deviation

Sharpe Ratio

Alpha

Hypothetical

Strategy

23.23%

0.27

4.18%

S&P 500

Index

15.15%

0.15

0.00%

Beta

Up-market

Capture Ratio

Down-market

Capture Ratio

1.22

154.75%

122.97%

1.00

100.00%

100.00%

0%

0% 5% 10% 15%

Risk (Standard Deviation)**

20% 25%

Hypothetical Strategy – Risk (Standard Deviation): 23.23%, Return: 8.17%

S&P 500 Index – Risk (Standard Deviation): 15.15%, Return: 4.22%

** See last page for defi nition.

2 Index Return data and Risk Free Rates data are from Bloomberg.

Guggenheim calculates numerical data illustrated from raw data received from partners. Calculations are based on annualized fi gures.

See last page for defi nitions.

AVERAGE ANNUAL TOTAL RETURNS

Hypothetical Strategy vs. S&P 500 Index through 12.31.2014.

Time Period

10-Year

5-Year

3-Year

1-Year

Hypothetical Strategy

9.49%

16.63%

17.68%

-4.16%

S&P 500 Index

7.73%

15.57%

20.41%

13.68%

* See Security Selection for defi nition.

1 Annual total returns are calculated using closing prices beginning 12.31 the previous year and ending 12.31 the stated year, for the noted one year period except that for 2015. Total return measures change in the value of an investment assuming reinvestment of all dividends and capital gains. It is assumed that the investment is liquidated at the end of the time series shown here, resulting in application of relevant fees and charges.

All strategy performance is hypothetical (not any actual Trust) and refl ects Trust sales charges (full sales charge in fi rst year of 2.95% and reduced rollover charge thereafter of 1.95%) and estimated expenses but not brokerage commissions on stocks or taxes. Hypothetical performance is based on the assumption that the portfolio reconstitution would have occurred annually. Past performance is no guarantee of future results. Actual returns will vary from hypothetical strategy returns due to timing diff erences and because the Trust may not be invested equally in all stocks or be fully invested at all times. In any given year the strategy may lose money or underperform the Index. High returns are highly unusual and cannot be sustained. Investors should also be aware that these returns were primarily achieved during favorable market conditions. Growth of $10,000 chart is based on monthly net returns for both the strategy and index. Source for all data is Guggenheim Funds Distributors, LLC, unless otherwise stated.

The S&P 500 Index (the “Index”) is designed to measure performance of the broad domestic economy. The Index is unmanaged, it is not possible to invest directly in the Index, and its returns do not include payment of any sales charges or fees which would lower performance. The historical performance of the Index is shown for illustrative purposes only; it is not meant to forecast, imply or guarantee the future performance of any particular investment or the Trust, which will vary. Securities in which the Trust invests may diff er from those in the Index. The Trust will not try to replicate the performance of the Index and will not necessarily invest any substantial portion of its assets in securities in the Index. There is no guarantee that the perceived intrinsic value of a security will be realized.

Zacks Rank Strong Buy 50 Strategy Portfolio, Series 6

Security Selection

The screening process to determine the investment portfolio of the Trust was executed eight business days before the initial date of deposit of the Trust (the “Security

Selection Date”). The fi nal constituents are chosen based on the below criteria as of the

Security Selection Date.

Initial Universe

■ The security selection process begins by identifying an initial universe of all securities that trade on at least one public North American securities exchange.

■

■

First, eliminate all MLPs, closed-end funds, and exchange-traded funds.

Next, eliminate securities with a market capitalization less than $300,000,000.

■

Next, eliminate securities not designated by the Zacks Rank Model as “Strong Buy.”

■

Next, rank the remaining securities in descending order of their “Last EPS

Surprise %” as reported by Zacks Investment Research; where “Last EPS

Surprise %” is the diff erence (as a percentage) between the actual earnings per share (“EPS”) reported for the last quarter and the consensus estimate for the last quarter. A consensus estimate is the average of all the current earnings estimates made by a pool of brokerage analysts utilized by Zacks Investment

Management.

■

Then, select the 50 securities with the largest “Last EPS Surprise %” and equal weight them.

Final Trust Portfolio Construction Screen

Select only Zacks Strong Buy

Rank based on Last

EPS Surprise %

Final

Portfolio

Zacks Rank Strong Buy 50 Strategy Portfolio

The securities are combined to form the fi nal portfolio. A fi nal liquidity check is performed as follows: any security eligible for inclusion in the Trust portfolio with liquidity of less than the estimated total dollar value of the security as of the Security Selection Date will be removed from the Trust portfolio and replaced by the next highest ranked security. Liquidity is determined by taking the price of a security and multiplying it by its three month trading volume. The estimated total dollar value is the total dollar position that must be purchased for each security.

In the event that a security that has a pending cash or stock merger and acquisition or bankruptcy which will lead to delisting the security is chosen, that security will be removed and the next security in the list will be selected for inclusion in the portfolio. Such events will be determined by reviewing the announced merger and acquisition data from Bloomberg and if the announced date falls before the Security Selection Date, an announcement of an agreement to be acquired in whole for cash or stock from an acquiring company or bankruptcy fi ling will cause removal.

In the event that a security is selected which is not treated as a corporation for U.S. tax purposes, that security will be removed and the next security in the list will be selected for inclusion in the portfolio.

Please note that due to the fl uctuating nature of security prices, the weighting of an individual security in the Trust portfolio may change after the Security Selection Date.

Zacks Rank Model

The Zacks Rank Model is a proprietary quantitative model that uses trends in earnings estimate revisions and EPS surprises to classify stocks into fi ve groups: Strong Buy,

Buy, Hold, Sell and Strong Sell.

Strong Buy

Buy

Hold

Sell

Strong Sell

The top 5% of stocks get this coveted rating. A Strong Buy should outperform the market more than any other rank.

The next 15% of stocks are rated as “Buy.” These stocks should also outperform the market.

Most stocks (60%) fall into this category. These stocks should perform in-line with the market.

Stocks with this rating (15%) will most likely underperform compared to the market.

The bottom 5% of all stocks get this rating. These stocks should perform dramatically worse than the market.

The Zacks Rank

Strong Buy 50

Strategy Portfolio selects the 50 securities with the largest “Last

EPS Surprise %” within the Strong

Buy ranking, as of

Security Selection

Date.

Zacks Rank Strong Buy 50 Strategy Portfolio, Series 6

PORTFOLIO ALLOCATION

Breakdown and weightings are as of 12.31.2015 and subject to change.

CAPITALIZATION BREAKDOWN

■

Large-Cap 5.96%

■

Mid-Cap 13.95%

■

Small-Cap 80.09%

■

■

Growth

Value

PORTFOLIO HOLDINGS

Holdings, breakdown and weightings are as of 12.31.2015 and subject to change.

STYLE ALLOCATION BREAKDOWN

80.03%

19.97%

Consumer Discretionary (16.00%)

ANF

BYD

ELY

TAST

CPS

PLAY

RGS

SHAK

Consumer Staples (2.03%)

CENT

Energy (2.01%)

AR

Financials (13.94%)

BHBK

CINF

EIG

FBC

TREE

NBHC

UIHC

Abercrombie & Fitch Company

Boyd Gaming Corporation

Callaway Golf Company

Carrols Restaurant Group, Inc.

Cooper-Standard Holding, Inc.

Dave & Buster’s Entertainment, Inc.

Regis Corporation

Shake Shack, Inc.

Central Garden & Pet Company

Antero Resources Corporation

Blue Hills Bancorp, Inc.

Cincinnati Financial Corporation

Employers Holdings, Inc.

Flagstar Bancorp, Inc.

LendingTree, Inc.

National Bank Holdings Corporation

United Insurance Holdings Corporation

Health Care (11.98%)

ACHN Achillion Pharmaceuticals, Inc.

AMPH Amphastar Pharmaceuticals, Inc.

ANIK

CORT

CCRN

NXTM

Anika Therapeutics, Inc.

Corcept Therapeutics, Inc.

Cross Country Healthcare, Inc.

NxStage Medical, Inc.

Industrials (9.97%)

AMWD American Woodmark Corporation

VLRS

WIRE

PAC

DOOR

Controladora Vuela Cia de Aviacion SAB de CV

Encore Wire Corporation

Grupo Aeroportuario del Pacifi co SAB de CV

Masonite International Corporation

Information Technology (36.02%)

ADSK

CEVA

CMPR

CRAY

CVT

EA

EXTR

FORM

IDCC

MFLX

NPTN

NVDA

PCTY

RP

SALE

RUBI

SHOR

SSNI

Autodesk, Inc.

CEVA, Inc.

Cimpress NV

Cray, Inc.

Cvent, Inc.

Electronic Arts, Inc.

Extreme Networks, Inc.

FormFactor, Inc.

InterDigital, Inc.

Multi-Fineline Electronix, Inc.

NeoPhotonics Corporation

NVIDIA Corporation

Paylocity Holding Corporation

RealPage, Inc.

RetailMeNot, Inc.

Rubicon Project, Inc.

ShoreTel, Inc.

Silver Spring Networks, Inc.

Materials (6.04%)

BAK

RYAM

USCR

Braskem SA

Rayonier Advanced Materials, Inc.

US Concrete, Inc.

Telecommunication Services (2.01%)

FRP FairPoint Communications, Inc.

PORTFOLIO SUMMARY

Inception Date

Termination Date

Initial Off er Price

Number of Issues

Historical Annual Dividend

Distribution 3

Distributions

1.4.2016

4.3.2017

$10.00

50

$0.0000

25th day of each month commencing on 1.25.2016, if any

3 The Historical Annual Dividend Distribution is as of 12.31.2015 and subject to change. The amount of distributions paid by the

Trust’s securities may be lower or greater than the above-stated amount due to certain factors that may include, but are not limited to, a change in the dividends paid by issuers, a change in Trust expenses or the sale or maturity of securities in the portfolio. Fees and expenses of the Trust may vary as a result of a variety of factors including the Trust’s size, redemption activity, brokerage and other transaction costs and extraordinary expenses.

SALES CHARGES

Sales Charge (“S/C”) is based on a $10 per unit off ering price.

Amount

Per Unit

Percentage of Public

Off ering Price

Up-front S/C $0.100

1.00%

$0.145

1.45% Deferred S/C 4

Creation and Development

(“C&D”) Fee

Total S/C

$0.050

$0.295

0.50%

2.95%

4 The deferred sales charge (“DSC”) will be deducted in monthly installments on the last business day commencing May 2016 and ending July 2016. If units are redeemed prior to the DSC period, the entire DSC will be collected. For unit prices other than $10, percentages of initial sales charge, C&D fees, and DSCs will vary.

Early redemption of units will still cause payment of the DSC.

TICKETING INFORMATION

CUSIP (cash payment)

CUSIP (reinvestment accounts)

CUSIP (fee-cash)

CUSIP (fee-reinvest)

Ticker

VOLUME DISCOUNT BREAKPOINTS

Purchase Amount

Less than $50,000

$50,000 – $99,999

$100,000 – $249,999

$250,000 – $499,999

$500,000 – $999,999

$1,000,000 or more

40169Y835

40169Y843

40169Y850

40169Y868

CZRSFX

Sales Charge Reductions

5 As a % of the Public Off ering Price.

0.00%

0.25%

0.50%

0.75%

1.00%

1.50%

5

Zacks Rank Strong Buy 50 Strategy Portfolio, Series 6

Guggenheim Investments UITs—What Sets Us Apart?

Committed to Client Success —We are a responsive, reliable partner committed to developing the best investment path with innovative and eff ective solutions designed to produce results our clients seek.

Institutional-Level Research and Global Resources —Our UITs deliver Guggenheim’s investment management capabilities, formerly only available to institutional accounts. We have specialized teams managing all major asset classes—fi xed income, equities and alternatives.

Proven Expertise across the Fixed-Income Spectrum —Guggenheim’s fi xed-income teams bring expertise up and down the capital structure, ranging from government and corporate credit to preferreds and bank loans. More than 100 investment professionals are dedicated to research, evaluation and management of fi xed-income assets.

Innovative Off erings —Our UITs are distinctive against a backdrop of sameness within the industry. Our clients enjoy access to a wide array of innovative UITs including domestic and global equity, taxable and municipal income, as well as theme, sector and multi-asset portfolios.

Risk Management —Guggenheim brings a time-tested institutional heritage of seeking to deliver strong returns with eff ective downside protection over market cycles.

Understanding risk at the security, sector and portfolio-composition level is a consistent focus of our investment process.

PORTFOLIO CHARACTERISTIC DEFINITIONS: Standard

Deviation is a measure of historical volatility that indicates the degree to which an investment’s returns fl uctuate around its average return. Generally, a higher standard deviation indicates a more risky investment. Sharpe Ratio is a measure of reward per unit of risk.

A higher Sharpe ratio indicates outperformance on a historical riskadjusted performance basis, while a lower Sharpe ratio indicates underperformance on a historical risk-adjusted performance basis.

Alpha is a statistical measurement that depicts the performance difference between a portfolio’s return and an underlying performance benchmark, given the portfolio’s level of volatility, measured by beta. The benchmark index will always refl ect an alpha of 0.00%. A positive alpha indicates a portfolio has performed better than its beta would predict in the stated period. Beta is the measure of a portfolio’s sensitivity to the Index. By defi nition, the beta of the Index is 1.00. Any portfolio with a higher beta is more volatile than the Index. Likewise, any portfolio with a lower beta will be less volatile than the Index in the stated period. The Up-Market

Capture Ratio is a measure of a portfolio in up-markets relative to the Index during the same period. A ratio value of 115 indicates that the portfolio has outperformed the market index by 15% in periods when the Index has risen. The Down-Market Capture Ratio is the direct opposite of the up-market capture ratio, gauging performance of the portfolio relative to the Index in down-markets. A ratio value of 80 would indicate the portfolio has declined only 80% as much as the declining overall market, indicating relative outperformance.

RISK CONSIDERATIONS: As with all investments, you may lose some or all of your investment in the Trust. No assurance can be given that the Trust’s investment objective will be achieved.

The Trust also might not perform as well as you expect. This can happen for reasons such as these: • Securities prices can be volatile.

• Securities selected according to this strategy may not perform as intended. The Trust is exposed to additional risk due to its policy of investing in accordance with an investment strategy. Although the Trust’s investment strategy is designed to achieve the Trust’s investment objective, the strategy may not prove to be successful.

The investment decisions may not produce the intended results and there is no guarantee that the investment objective will be achieved.

• The Trust is concentrated in the information technology sector.

As a result, the factors that impact the information technology sector will likely have a greater eff ect on this Trust than on a more broadly diversifi ed trust. Companies involved in this sector must contend with rapid changes in technology, intense competition, government regulation and the rapid obsolescence of products and services. Furthermore, sector predictions may not materialize and the companies selected for the Trust may not represent the entire sector and may not participate in the overall sector growth.

• The Trust invests in securities issued by small-capitalization and mid-capitalization companies which involve more risk than largecapitalization companies, such as limited product lines, markets or fi nancial resources and may be more vulnerable to adverse general market or economic developments. • The Trust invests in U.S.-listed foreign securities and American Depositary Receipts (“ADRs”) which present additional risk due to such factors as adverse economic, currency, political, social or regulatory developments in a country.

• Share prices or dividend rates on the securities in the Trust may decline during the life of the Trust. There is no guarantee that share prices of the securities in the Trust will not decline and that the issuers of the securities will declare dividends in the future and, if declared, whether they will remain at current levels or increase over time. • Infl ation may lead to a decrease in the value of assets or income from investments. Please see the Trust prospectus for more complete risk information.

Unit Investment Trusts are fi xed, not actively managed and should be considered as part of a long-term strategy. Investors should consider their ability to invest in successive portfolios, if available, at the applicable sales charge. UITs are subject to annual fund operating expenses in addition to the sales charge. Investors should consult an attorney or tax advisor regarding tax consequences associated with an investment from one series to the next, if available, and with the purchase or sale of units. Guggenheim Funds Distributors, LLC does not off er tax advice.

Read the Trust’s prospectus carefully before investing. It contains the Trust’s investment objectives, risks, charges, expenses and other information, which should be considered carefully before investing. Obtain a prospectus at guggenheiminvestments.com.

Guggenheim Funds Distributors, LLC

Member FINRA/SIPC 1/2016 ZRSB-006 #20689

NOT FDIC INSURED | NOT BANK GUARANTEED | MAY LOSE VALUE guggenheiminvestments.com