Immaculate Heart of Mary College (Team A) Cash is King (Improve

advertisement

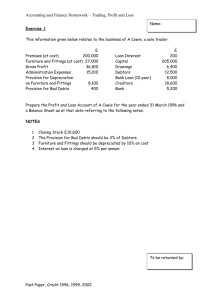

Immaculate Heart of Mary College (Team A) Cash is King (Improve the cash flow problem by better credit control) Content I. Background --------------------------------------------------------------------- P.2 II. Problem Analysis -------------------------------------------------------------- P.2 III. About Credit Control -------------------------------------------------------- P.2 IV. Increase Cash by a better credit control --------------------------------- P.2-3 V. Result and Conclusion -------------------------------------------------------- P.3-4 VI. Appendix ------------------------------------------------------------------------ P.4 Group member of Immaculate Heart of Mary College(Team A) Wong Pak Ho Lau Hong Man Ng Kwan Chak Lam Kwan Ching Kan Ho San Ho Chun Yin Lam Zhi Qian Chan Hei Yiu Chan Ho Shan 1 I. Background Lo Chi Kay Our company is called A. Better Choice Limited Company, which is a fashion wholesaler. In spite of we are making profit, we struggles with paying its due because we found that our cash is limited. After the internal and external analysis, we find that our receivable ratio is too high so we focus on better credit control to improve the limitation of cash. II. Problem Analysis We found out that we had a potential cash flow problem that is mainly due to the several reasons: 1. Repayment period of debtors The repayment period of our company is 120 days, which is too long. This makes the company only receive debt after along period of time and there are always insufficient cash. 2. Credit amount of debtors Sometimes, too many credit sales are made with no credit limit. This leads to the too large amount of accounts payable so we may not have enough cash for daily operations. 3. Without assessing the credit worthiness before making credit sales Financial conditions are not examined of the debtor before making transactions to the companies even with a new debtor. Also, the financial conditions of the debtors are not check constantly. This leads to the accumulation of bad debts, as they may not have the ability to repay debt. 4. Lack of late payment penalty There is no late payment penalty in our company. Many debtors then repay their debts late. As a result, we does not have sufficient cash flow. 5. No early cash discounts to raise debtor’s incentive to make early payment There is no cash discount for early payment so they have low incentives to settle the debts earlier and worsen the cash flow problem. III. About Credit Control Credit Control Policy is how a company should decide on their credit policy and then communication that to customers. The majority of business is conducted on credit basis and the terms of supply and payment of goods and services should be clearly stared in a set of trading terms the potential customer should sign and agree to before trading commences. The terms of trade should state clearly the effective date an invoice become payable, credit allowed and the interest that may be charged in the event of late payment. Business which have a lack of credit control over sales income suffer the most as other businesses take advantage to supplement their own cash deficiencies and liquidity problem. 2 IV. Increase Cash by a better credit control We can have a better credit control to improve our cash flow problem by the following measures. 1.Reduces repayment period of debtors The repayment period has been reduced from 120 days to 30days, which is similar to the fashion wholesaler in Hong Kong. This makes the liquidity become higher and have a better cash flow. Thus, our company is able to repay the credit on time. 2. Limits the credit amount of debtors The credit amount of debtors is being limited according to their financial conditions of their company and the relationship between they and us. This makes us to reduce the amount of accounts receivables and our company would have a better credit control. 3. Assessing the credit worthiness before making credit sales We would consider the financial conditions of the debtors thoroughly before making sales on credit especially with a new debtor. This can ensure that most of the money can be received so that there will be a better cash flow. 4. Grievous late payment penalty If they were unable to repay the debts on time, we would give them a grave penalty such as a 5% cash payment or stop supplying immediately to ensure that the debtors repay the debts on time and not to lead us into bankruptcy or a short-term liabilities problem. Moreover, this is only a short-term solution but not an extended way to solve the problem and may change to from punishing to encouraging the debtors to repay the debts on time afterward. 5. Cash discounts are provided for early payments A 2-3% cash discounts would be provided for early repayment such as settle the debts within 10 days (date of early repayment discounts will be set in each time of debts) to encourage the debtors to repay the debts early in order to have a higher liquidity. Although it is an effective method to receive money back on time, Cash discount is very expensive so it is used for a short period to improve the cash flow. V. Result and Conclusion After taking measures to solve the problem, there is a great improvement on the performance of our company. First, the accounts receivable ratio before taking measures is 48.02% and the one after is 19.87%. This shows that efficient credit control successfully solve the potential cash flow problem. Next, the amount of cash and bank has rapidly increased after the measures are taken as most of the debtors before has repaid their debts. Furthermore, most of the debtors repay their debt within the repayment period because we now have a good assessment on the financial condition of the customer. To conclude, the potential problem is solved by improving credit control by above measures. Now the debts can be repaid on time as we have a high liquidity of cash. Form the case, we now understand that although sometimes the profit of the company seems very high, it does not mean that the company has the ability to pay back the short-term liablities. If there is a poor credit control or even no credit control, the company may still have insufficient cash and even leads to bankruptcy. Therefore, credit control is very important to the management of all companies.