Exercises on Final Accounts

advertisement

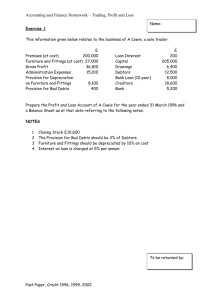

SPCS Form Four Principles of Accounts Exercises on Final Accounts FINAL_EX01 From the following trial balance and additional information, prepare a trading and profit and loss account for the year ended 31 March 2007 and a balance sheet as at the same date. Trial balance as at 31 March 2007: Dr ($) Tax payable Net sales Net purchases Stock Salaries & wages Rent & rates Water & electricity Trade creditors Trade debtors Insurance Cash in hand Cash at bank Plant & machinery Furniture & fittings Capital Drawings Fixed deposits with bank Bank loan Provision for depreciation – plant & machinery Provision for depreciation – furniture & fittings Cr ($) 90,000 930,000 320,000 30,000 180,000 140,000 21,000 119,600 321,000 51,000 20,000 134,000 420,000 97,600 700,000 15,000 300,000 2,049,600 170,000 30,000 10,000 2,049,600 Additional information: (a) Closing stock amounted to $70,000. (b) Provision for depreciation is to be made for the current year: Plant & machinery @ 10% on book value. Furniture & fittings @ 8% on book value (c) Accrued expenses: Wages $8,000. Water & electricity $3,000. (d) Prepaid expenses: Rent & rates $14,000 Insurance $25,000. (e) Accrued income: Accrued interest up to and including 31 March 2007: $13,000. (f) Provide for doubtful debts: 4% of total debtors. Required: Prepare a trading and profit and loss account for the year ended 31 March 2007 and a balance sheet as at that date. Page 1 D. Ko SPCS Form Four Principles of Accounts FINAL_EX02 The following trial balance was extracted from the book of William Watson, a sole trader, at the close of business on 31 October 2008: Debtors & creditors Discounts Capital as at 1 November 2007 Drawings Bank overdraft Bills receivable & payable Purchases & sales Sales & purchases returns Wages & salaries Office furniture Delivery van Van running expenses Rent & rates Cash Stock as at 1 November 2007 Bad debts written off Sundry expenses Provision for bad & doubtful debts Dr ($) 4,110,000 530,000 Cr ($) 2,070,000 290,000 5,200,000 2,760,000 550,000 9,840,000 720,000 3,250,000 800,000 960,000 420,000 710,000 90,000 1,970,000 270,000 260,000 1,090,000 380,000 17,630,000 360,000 220,000 27,240,000 27,240,000 Additional notes: (a) (b) (c) (d) (e) Stock as at 31 October 2008 - $3,040,000. The company decided to increase its provision for the year to $260,000 in total. $70,000 wages remained outstanding on 31 October 2008. $60,000 rates were paid in advance on 31 October 2008. Provision for depreciation: Office furniture – 20% on cost Delivery van – 30% on (net) book value Required: Prepare a trading and profit and loss account for the year ended 31 October 2008, together with a balance sheet as at that date. Page 2 D. Ko