Document - Oman College of Management & Technology

advertisement

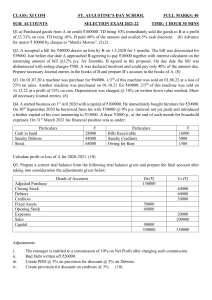

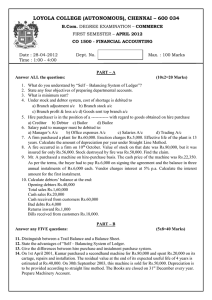

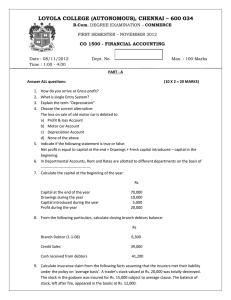

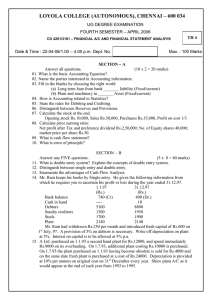

Oman College of Management and Technology, Department of Administrative and Financial Sciences: Specialized Financial Accounting (203301) Chapter- 3 Exercises: 1. Mr. Ahmed could not keep complete record. He furnishes you the following information for the year 2010: Details 1.1.2010 (RO) 31-12-2010 (RO) Stock in trade 37,400 46,800 Sundry debtors 24,000 28,000 Sundry creditors 18,000 3,000 Bills Receivable 8,000 10,000 Bills Payable 2,000 400 Furniture and Fixtures 1,200 1,200 24,000 24,000 8,700 1,600 (Cr.) Buildings Bank Balance Additional information: (a) Additional capital introduced : RO. 5,000; (b) Drawings amounted to RO. 15,000; (c) A provision @ 10% is required for doubtful debts and depreciation @ 5% p.a. is to be written-off for furniture and fixtures and buildings; (d) RO. 6,000 is outstanding for wages and RO. 2,400 for salaries, prepaid insurance amounted to RO.400 outstanding legal expenses are RO. 1,400. From the above particulars, find out the profit or loss of Mr. Ahmed by statement of affairs method. 2. A small trader does not maintain proper books of accounts. His assets and liabilities were as under: Details 31.1.2010 (RO) Cash 31-12-2011 (RO) 100 90 Sundry Debtors 3,900 4,500 Stock 3,400 3,200 Plant and Machinery 6,000 8,000 Sundry creditors 1,500 1,490 Bills Payable ------- 500 During the year, he introduced RO. 1,000 as new capital. He withdrew RO. 300 every month for his household expenses. Ascertain his profit. 3. A retailer had not kept proper books of accounts, but from the following details, you are required to ascertain the profit or loss for the year ended 30th June 2002 and also to prepare his statement of affairs as at that date: Details 1.7.2001 (RO) 30-6-2002 (RO) Stock-in-trade 16,700 18,100 Sundry creditors 15,400 19,200 Sundry debtors 11,200 10,600 250 1,400 Bank overdraft 19,200 Nil Bills receivable 16,000 5,000 Fixtures and Fittings 1,500 1,500 Motor Van 1,900 Nil Nil 2,900 Cash in hand Bank Balance The drawings during the year amounted to RO. 2,400. Depreciate fixtures and fittings by 10%. RO.600 is irrecoverable from debtors. Provide 5% provision for doubtful debts and a provision of RO. 200 in respect of bills receivable. 4. Hilal does not maintain proper books of account. From the following particulars, prepare trading and profit and loss account for the year ended 31st December, 2011 and the balance sheet as on that date: Details 31.12.2010 (RO) 31-12-2011 (RO) Debtors 9,000 12,500 Stock 4,900 6,600 Furniture 500 750 Creditors 3,000 2,250 Analysis of other transactions: Cash collected from the debtors 30,400 Cash paid to creditors 22,000 Salaries 6,000 Rent 750 Office expenses 900 Drawings 1,500 Additional capital introduced 1,000 Cash sales Cash purchases 750 2,500 Discount received 350 Discount allowed 150 Returns inward 500 Returns outward 400 Bad debts 100 He had RO. 2,500 as cash balance at the beginning of the year.