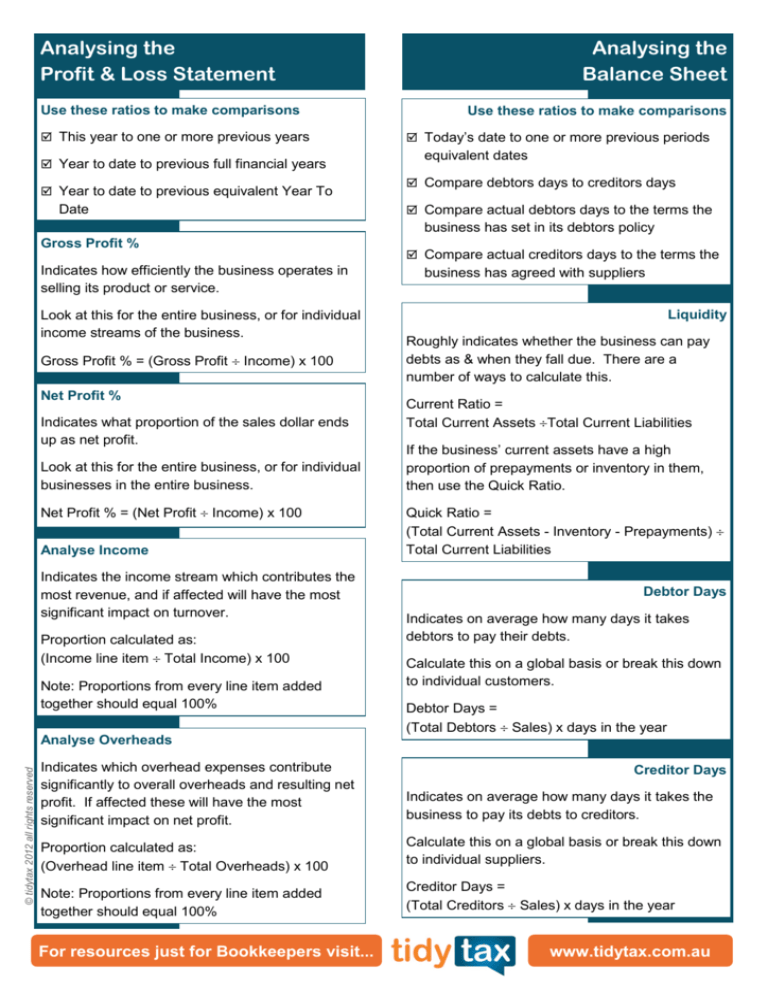

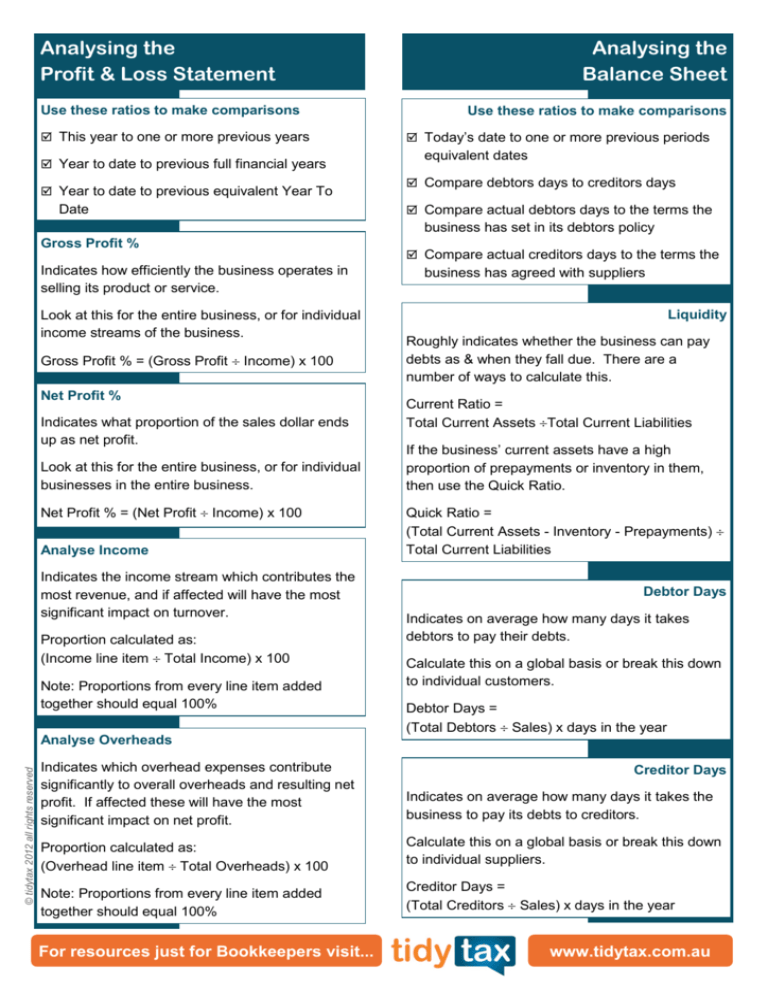

Analysing the

Profit & Loss Statement

Use these ratios to make comparisons

This year to one or more previous years

Year to date to previous full financial years

Year to date to previous equivalent Year To

Date

Analysing the

Balance Sheet

Use these ratios to make comparisons

Today’s date to one or more previous periods

equivalent dates

Compare debtors days to creditors days

Compare actual debtors days to the terms the

business has set in its debtors policy

Gross Profit %

Indicates how efficiently the business operates in

selling its product or service.

Look at this for the entire business, or for individual

income streams of the business.

Gross Profit % = (Gross Profit Income) x 100

Net Profit %

Indicates what proportion of the sales dollar ends

up as net profit.

Look at this for the entire business, or for individual

businesses in the entire business.

Net Profit % = (Net Profit Income) x 100

Analyse Income

Indicates the income stream which contributes the

most revenue, and if affected will have the most

significant impact on turnover.

Proportion calculated as:

(Income line item Total Income) x 100

Note: Proportions from every line item added

together should equal 100%

© tidytax 2012 all rights reserved

Analyse Overheads

Indicates which overhead expenses contribute

significantly to overall overheads and resulting net

profit. If affected these will have the most

significant impact on net profit.

Compare actual creditors days to the terms the

business has agreed with suppliers

Liquidity

Roughly indicates whether the business can pay

debts as & when they fall due. There are a

number of ways to calculate this.

Current Ratio =

Total Current Assets Total Current Liabilities

If the business’ current assets have a high

proportion of prepayments or inventory in them,

then use the Quick Ratio.

Quick Ratio =

(Total Current Assets - Inventory - Prepayments)

Total Current Liabilities

Debtor Days

Indicates on average how many days it takes

debtors to pay their debts.

Calculate this on a global basis or break this down

to individual customers.

Debtor Days =

(Total Debtors Sales) x days in the year

Creditor Days

Indicates on average how many days it takes the

business to pay its debts to creditors.

Proportion calculated as:

(Overhead line item Total Overheads) x 100

Calculate this on a global basis or break this down

to individual suppliers.

Note: Proportions from every line item added

together should equal 100%

Creditor Days =

(Total Creditors Sales) x days in the year

For resources just for Bookkeepers visit...

www.tidytax.com.au

Cashflow

Cashflow Statement

This historical report shows how cash has

moved through the business for a given period.

The Cash Flow Statement uses Net Profit as

the starting point. That is, Net Income should

equal Net Income per the Profit and Loss

Statement.

It then adds back or subtracts the non cash

items in the accounts to calculate cash

generated from business activities.

It then adds back or subtracts other non

business cash flows from investing and

financing to show how the closing balance of

the bank account has eventuated. The Cash at

the End of the Period should equal the total of

the bank account(s) in the Balance Sheet.

In this example, the business took out loans of $65,000. However, if it had received repayments from A. Person and

had a better debt collection policy, the bank account may not have been overdrawn.

Cashflow Forecast

Cash Flow Forecast

Opening Cash Balance

Week 1

$ Actual

Week 2

$

Week 3

$

Week 4

$

Incoming Cash

Sales

Debtors

Interest

Top Ups by owner

Total

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Outgoing Cash

Direct Debit

Auto Payments

Loan Repayments

Creditors

Wages

Super

PAYGW

BAS

PAYG Instalments

Drawings by owner

Total

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Closing Cash Balance

$

$

$

$

The Cashflow Forecast is a forward looking estimate

of what cashflows might look like so that the business

can plan.

This is an example, however, consider what’s most

appropriate for the business:

Has the cash effect of every account in the

Balance Sheet and Profit and Loss Statement

been included appropriately?

How long should the forward estimate be?

Should the estimate be daily, weekly or monthly?

How summarised should the statement be?

Budgeting - where to start

Understand what your normal operations will be next year and assign dollar amounts to that

Find out if the environment will force changes on you in the next year and assign dollar amounts to that

Decide what you would like to implement in the upcoming year and assign dollar amounts to that

Add these parts together to understand what your complete budget will look like

For resources just for Bookkeepers visit...

www.tidytax.com.au