Management Accounting Tutorial: Multiple Choice Questions

advertisement

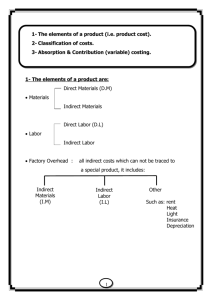

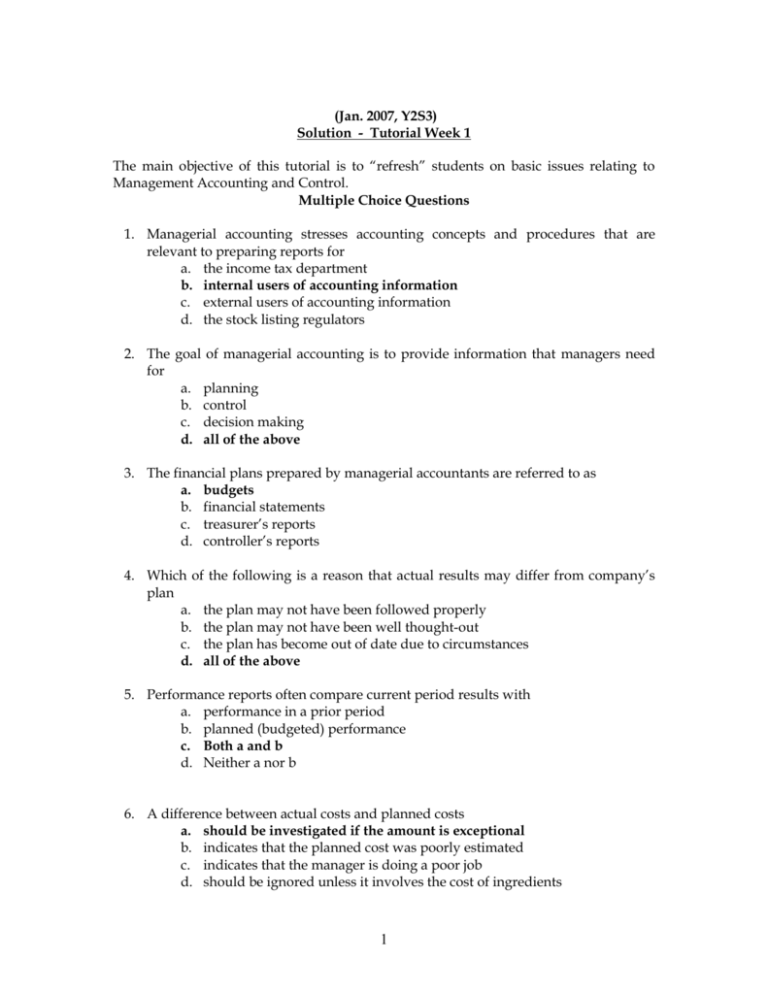

(Jan. 2007, Y2S3) Solution - Tutorial Week 1 The main objective of this tutorial is to “refresh” students on basic issues relating to Management Accounting and Control. Multiple Choice Questions 1. Managerial accounting stresses accounting concepts and procedures that are relevant to preparing reports for a. the income tax department b. internal users of accounting information c. external users of accounting information d. the stock listing regulators 2. The goal of managerial accounting is to provide information that managers need for a. planning b. control c. decision making d. all of the above 3. The financial plans prepared by managerial accountants are referred to as a. budgets b. financial statements c. treasurer’s reports d. controller’s reports 4. Which of the following is a reason that actual results may differ from company’s plan a. the plan may not have been followed properly b. the plan may not have been well thought-out c. the plan has become out of date due to circumstances d. all of the above 5. Performance reports often compare current period results with a. performance in a prior period b. planned (budgeted) performance c. Both a and b d. Neither a nor b 6. A difference between actual costs and planned costs a. should be investigated if the amount is exceptional b. indicates that the planned cost was poorly estimated c. indicates that the manager is doing a poor job d. should be ignored unless it involves the cost of ingredients 1 7. The principle that managers follow when they only investigate departures from the plan that appear to be significant is commonly known as a. small amounts don’t matter b. management by exception c. only labor and materials deserve attention d. exceptional costs yield exceptional results 8. Managerial accounting a. is primarily directed at external users of accounting information b. is required by the income tax department c. must follow GAAP d. is optional 9. The fundamental difference between managerial and financial accounting is that a. all financial accounting information is audited by qualified accountants whereas management accounting information does not required to be audited b. managerial accounting is concerned principally with determining the cost of inventory, whereas financial accounting information is concerned with a wider range of the organization’s activities c. managerial accounting provides information for decision-makers within the organization, whereas financial accounting provides information for external parties d. financial accounting information must follow GAAP, whereas managerial accounting generally follows rules set forth by the organization’s management 10. Which of the following costs does not change when the level of business activity changes? a. total fixed costs b. total variable costs c. total direct material costs d. fixed cost per unit 11. Variable cost per unit a. increases when the number of units produced increases b. does not change when the number of units produced increases c. decreases when the number of units produced increases d. decreases when the number of units produced decreases 12. Which of the following is not likely to be a fixed cost? a. direct materials b. rent c. depreciation d. salary of the human resource director 2 13. Which of the following statements regarding fixed cost is true? a. when production increases, fixed cost per unit increases b. when production decreases, total fixed costs decrease c. when production increases, fixed cost per unit decreases d. when production decreases, total fixed costs increase 14. Sunk costs a. are not relevant for decision making b. would include the cost of your tuition after the refund deadline has passed c. are costs that have been incurred in the past d. all of the above are correct 15. A cost which is directly traceable to a product, activity, or department is a a. fixed cost b. incremental cost c. opportunity cost d. direct cost 16. Which of the following statements regarding direct and indirect costs is true? a. the amount of direct costs in a department is always less than the amount of indirect costs in the department b. a department with no variable costs will also have no direct costs c. the distinction between a direct and indirect cost depends on the object of the cost tracing d. if a cost is indirect to a department within a plant, it will also be indirect for the plant as a whole 17. Which of the following is likely to be a non-controllable cost of a department supervisor? a. labor in the department b. materials used in the department c. insurance on the plant d. overtime pay earned by those working in the department 18. For each of the following, indicate whether the cost would typically be considered direct or indirect cost for the cost object given. a. b. c. d. e. The direct labor factory costs for the manufacturing division. (direct cost ) The factory supervisor’s salary for the product produced. (indirect cost) The factory supervisor’s salary for the manufacturing division. ( direct cost) The manufacturing overhead costs for the products produced. ( Indirect cost) The manufacturing overhead costs for the manufacturing division.( direct cost) 3 19. Property taxes on a manufacturing plant are an element of: A) B) C) D) Conversion cost Period cost Yes No Yes Yes No Yes No No 20. Which of the following would most likely be included as part of manufacturing overhead in the production of a wooden table? A) The amount paid to the individual whovarnish the table. B) The commission paid to the salesperson who sold the table. C) The cost of glue used in the table. D) The cost of the wood used in the table. 21.Which of the following combinations of costs make up conversion cost? A) Direct materials cost and manufacturing overhead cost. B) Direct labor cost and manufacturing overhead cost. C) Marketing cost and administrative cost. D) Direct materials costs and direct labor cost. 22. In decision making, managers use: A) financial accounting information exclusively since it is more objective and precise due to well-established principles and conventions. B) information regarding the organization as a whole rather than segments of the organization in order to capture a broader perspective of the company's operations. C) information that is as precise as humanly possible. D) whatever information is relevant to the decision even though the information may not conform to generally accepted accounting principles. 23 . During the month of April, direct labor cost totaled $19,000 and direct labor cost was 30% of prime cost. If total manufacturing costs during April were $79,000, the manufacturing overhead was: A) $63,333. B) $15,667. C) $60,000. D) $44,333. 24 .In April direct labor was 70% percent of conversion cost. If the manufacturing 4 overhead cost for the month was $42,000 and the direct materials cost was $28,000, the direct labor cost was: A) $98,000. B) $65,333. C) $18,000. D) $12,000. 25 .Among the costs Kunee Company incurred during the month of August were the following: 1) $15,000 for coolant used in the headquarters office air conditioning system. 2) $5,000 for property taxes on the factory building. 3) $10,000 for depreciation on trucks used to deliver products to customers. 4) $2,000 salary paid to a factory quality control inspector. The period costs from the above list total: A) $ 7,000. B) $25,000. C) $32,000. D) $30,000. 26 .Last month a manufacturing company had the following operating results: Beginning finished goods inventory ..... Ending finished goods inventory .......... Sales ...................................................... Gross margin ......................................... $84,000 $71,000 $505,000 $63,000 What was the cost of goods manufactured for the month? A) $429,000 B) $492,000 C) $442,000 D) $455,000 5