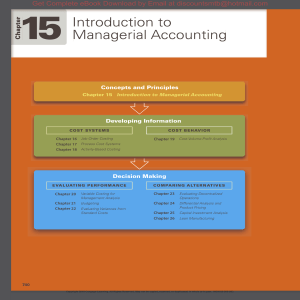

Introduction to Managerial Accounting Module 4

advertisement

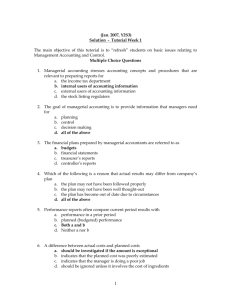

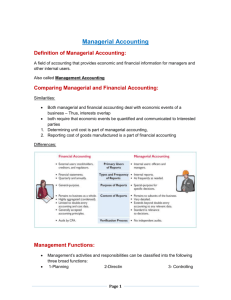

Introduction to Managerial Accounting Module 4 Managerial Accounting Concepts Created by M. Mari Fall 2007-1 Purpose of Managerial Accounting Providing useful information to decision makers They do this by collecting, managing, and reporting information in demand by their users. Much of managerial accounting involves gathering information about costs for planning and control decisions Managerial Characteristics Provides estimates of future operations Used by mgmt in conducting daily operations, planning, and developing strategies Differences with Financial Accounting Financial Managerial Users and decision makers Investors, creditors, and other users external to the organization Managers, employees, and decision makers internal to the organization Purpose of information Assist external users in making investment, credit decisions Assist managers in making planning and control decision Flexibility of practice Structured and often controlled by GAAP Relatively flexible Timeliness of information Often available only after an audit is complete Available quickly without the need to wait for an audit Focus on information Emphasis on whole organization Emphasis on an organization’s project, processes, and subdivisions Management Accountant in the Organization Individual reporting units in an organization can be viewed as having either – Line responsibilities One directly involved in the basic objectives of the organization Such as production and distribution – Staff responsibilities Is one that provides services, assistance, and advice to the departments with line or other staff responsibilities Has no direct authority over a line department Controller is such an example Organizational Chart CEO Chief Exexcutive Officer VP of Production VP of Sales VP of Distribution Director of Advertising Director of Marketing Controller Payroll Accts Rec Chief Financial Officer Director of Budgeting Director of Taxation Accts Payable Cost Budgeting Purpose of Managerial Accounting – Planning Is the process of setting goals and making plans to achieve them – Strategic planning – developing long range courses of action to achieve goals – Operational planning – develop short-term courses of action to manage the day to day operations of a business Purpose of Managerial Accounting – Directing Is the process by which managers, given their assigned level of responsibilities, run day-to-day operations. Purpose of Managerial Accounting – Controlling Is the process of monitoring planning decisions and evaluating an organization’s activities and employees. It includes the measurement and evaluation of actions, processes, and outcomes. Purpose of Managerial Accounting – Improving Feedback is used by managers to support continuous process improvement. CPI is the philosophy of continually improving employees, business processes, and products. Purpose of Managerial Accounting – Decision making is inherent in each of the four management processes described. Types of Cost Classification Cost object – is a product, process, department, or customer to which costs are assigned. Types of Cost Classification Direct cost – traceable to a cost object • Material • Labor cost – are incurred for the benefit of more than one cost object Indirect • Maintenance • Utilities Materials Direct – – cost of materials that are an integral part of the product Indirect – – Cost of materials that are not a significant portion of the total product cost Labor Direct – Cost of wages of employees who are directly involved in the converting materials into the manufactured product Indirect – Labor that do not enter directly into the manufacture of a product Factory Overhead Costs other than direct materials cost and direct labor costs – Manufacturing overhead – Factory burden – Depreciation – utilities Manufacturing Formulas: Prime Costs = Direct Material + Direct Labor Conversion Costs = Direct Labor + Factory Overhead Example Example: Suppose that direct materials are $5,000, direct labor is $4,000 and factory overhead is $3,000, what are prime costs and conversion costs? Prime costs = direct material + direct labor = $5,000 + 4,000 = $9,000 Conversion costs = direct labor + factory overhead = $4,000 + $3,000 = $7,000 Example Example: Suppose the direct materials are $3,000, prime costs are $5,000, conversion costs are $9,000, and factory overhead is $7,000. What are direct labor costs? Prime costs = Direct materials + Direct Labor $5,000 = $3,000 + DL $2,000 = DL Conversion costs = Direct labor + Factory overhead $9,000 = $2,000 + FO $7,000 = FO Costs Product costs – Direct materials, direct labor, and factory overhead – Associated with the production of the product Period costs – Refer to expenditures identified more with a time period than with finished products. – Selling and administrative expenses Inventory Accounts Materials inventory Work in process inventory Refers to the goods a company acquires to use in making products Direct and indirect material costs Asset account Consists of products in the process of being manufactured but not yet complete. Consists of direct materials, direct labor and factory overhead costs Finished goods inventory – Consists of completed products ready for sale. – Contains all of the costs incurred to manufacture the completed product. Cost of Goods Sold Beginning finished goods inventory + cost of goods manufactured Goods available for sale Less Ending finished goods inventory Cost of goods sold