1- The elements of a product (i.e. product cost). 2

advertisement

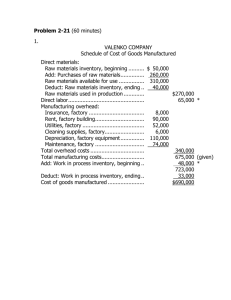

1- The elements of a product (i.e. product cost). 2- Classification of costs. 3- Absorption & Contribution (variable) costing. 1- The elements of a product are: Direct Materials (D.M) Materials Indirect Materials Direct Labor (D.L) Labor Indirect Labor Factory Overhead : all indirect costs which can not be traced to a special product, it includes: Indirect Materials (I.M) Indirect Labor (I.L) 1 Other Such as: rent Heat Light Insurance Depreciation 2- Classification of costs ▪In relation to income Costs are classified to Product costs All costs incurred in the Manufacturing of a product Period costs Selling & administrative costs 1- Product cost = Direct Materials + Direct Labor + Factory Overhead D.M ▪In relation to production Prime costs D.L Costs are classified as followed: costs which are directly related to production 2- Prime cost = Direct Material + Direct Labor D.M D.L Conversion Costs Costs concerned with transforming direct Material into finished products 3- Conversion cost = Direct Labor + Factory Overhead D.L 2 Ex. 1 The following cost information is available for the period ended 31/12/2003:- Material put into production L.E 41,000 (of which L.E 39,000 was considered direct Materials). - Labor costs for the period L.E 35,750 (of which L.E 6000 was for indirect labor). - Depreciation L.E 25,000. - Selling and administrative expenses L.E 31,350. Required: Compute the following: 1- Prime costs 2- Conversion costs 3- Product costs 4- Period costs ------------------------------------------------------------------------------------- Solution Direct materials Materials 41000 39000 Indirect materials Labor 35750 2000 (41000 – 39000) Direct labor 29750 (35750 – 6000) Indirect labor 6000 Factory overhead = indirect Materials + indirect labor + other manufacturing expenses (depreciation) = 2000 + 6000 + 25000 = 33000 1- Prime costs = Direct Materials + Direct Labor = 39000 + 29750 = 68750 2- Conversion costs = Direct Labor + Factory Overhead 3 = 3- Product costs 33000 = 62750 = Direct Materials + Direct Labor + Factory Overhead = 4- Period costs 29750 + 39000 + 29750 + 33000 =101750 = selling & administrative expenses = 31350 Ex. 2 A manufacturing company incurs the following costs in manufacturing wood tables: Item L.E Factory rent Glue Screws Wood cutters wages Depreciation of equipment Supervisors Wood (Lumber) Table assemblers wages Factory utilities 70,000 800 1000 100,000 21,000 20,000 10,000 180,000 20,000 Required 1- Classify the costs according to ability to trace the cost to the end product(direct materials, direct labor, and factory overhead) 2- Compute prime costs and conversion costs. 4 Solution Direct Direct Factory overhead Product Materials Labor (I.M +I.L +other) cost D.M D.L 70000 70000 Glue 800 800 Screws 1000 1000 Factory rent Wood cutters 100000 100000 depreciation 21000 21000 Supervisors 20000 20000 Wood(lumber) 10000 Table assemblers 10000 180000 Factory utilities 20000 20000 132800 422800 Total 10000 ▪ = D.M + D.L + Factory overhead Product cost 280000 180000 = 10,000 + 280,000 + 132,800 = 422800 [1] Prime costs = D.M + D.L = 10,000 + 280,000 = 290,000 [2] Conversion costs = D.L + Factory overhead = 280,000 + 132,800 = 412,800 ▪In relation to volume Variable costs Costs are classified to Fixed costs 5 Mixed costs Ex. 3 If the variable cost per unit was as follows: - Direct Materials 6 - Direct labor 4 - Other variable expenses 2 Total 12 L.E Fixed costs for the period - Rent 20,000 - Maintenance 30,000 - Insurance 10,000 Total 60,000 L.E Required: Calculate total cost for the following units 2000, 6000, 10000. Solution Total cost = total variable cost + total fixed cost = (variable cost / unit x units) + total fixed cost [1] Total cost = (12 x 2000) + 60000 = 84000 [2] Total cost = (12 x 6000) + 60000 = 132000 [3] Total cost = (12 x 1000) + 60000 = 180000 6