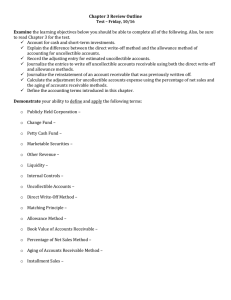

Chapter 7 Theory Quiz

advertisement

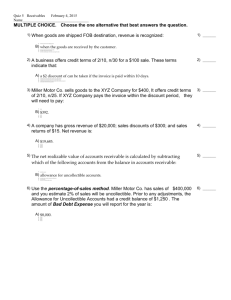

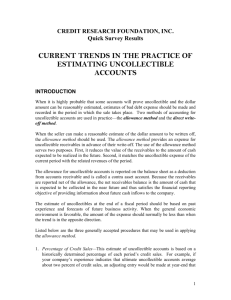

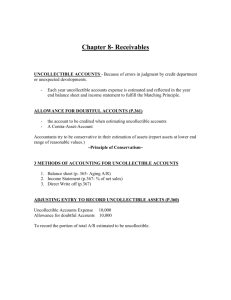

Accounting II – Chapter 7 Theory Quiz NAME: 1. What is the most common reason for writing off an account? a. Company forgot to pay b. Company went bankrupt c. Company paid the wrong amount d. Company encountered a natural disaster 2. When would the Allowance for Uncollectible Accounts account have a debit balance? a. Not enough sales on account b. You wrote off more accounts than you estimated for c. You wrote off less accounts that you estimated for d. Your accounts receivable has a negative balance 3. What is the entry for reinstating an account in the allowance method? a. Debit AR, Credit Allowance for Uncollectible Accts b. Debit Allowance for Uncollectible Accts, Credit AR c. Debit AR, Credit Collections of Uncollectible Accounts d. Debit Collections of Uncollectible Accounts, Credit Allowance for Uncollectible Accts 4. Companies want to get their Accounts Receivable Turnover Ratio as close to _____ as possible. a. 1 b. 6 c. 12 d. 365 5. How many times do you record Uncollectible Accounts Expense when using the Direct Write Off Method? a. Once a month b. Once a year c. As many times as an account needs to be written off d. Every time you need to re-estimate your balance in the Allowance for UA account 6. What is the normal balance of the Allowance for Uncollectible Accounts account? a. Debit b. Credit c. This account has no normal balance 7. What account is Allowance for Uncollectible Accounts contra to? a. Merchandise Inventory b. Cash c. Accounts Receivable d. It isn’t contra to any account 8. When using the Aging of Accounts Receivable method for determining Uncollectible Accounts Expense, you would expect the uncollectible percentage to ____________ as the amount of days past due becomes loonger. a. Decrease b. Increase c. Not enough information 9. Does the Allowance for Uncollectible Accounts method follow the Matching concept? Briefly explain. 10. When using the Direct-Write Off Method, what is the entry to record the writing off of an account that has become uncollectible? 11. Is an accounts receivable turnover ratio of 2.5 efficient? Explain. 12. What does the book value of accounts receivable represent? 13. What is the percentage in the Percentage of Net Sales based on? 14. What are 2 ways in which a company might increase their Accounts Receivable Turnover Ratio? Use the following data to answer questions 9 and 10. Date Due Within 30 days 30-60 days 60-90 days over 90 days Percentage 1% 3% 10% 50% Amount Due 20,000 10,000 8,000 4,000 Aging of AR Amount 15. What is the amount that this company expects their Allowance for Uncollectible Accounts to be? 16. Assuming that this company had a previous debit balance of $100 in the Allowance account, what should the Dec. 31 adjusting entry be? (make sure to include accounts and amount)