View Results - Credit Research Foundation

advertisement

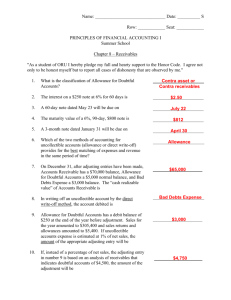

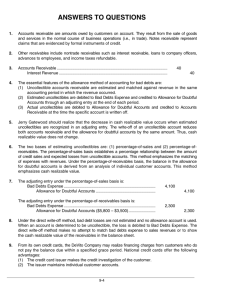

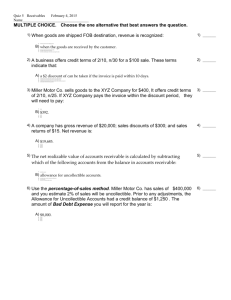

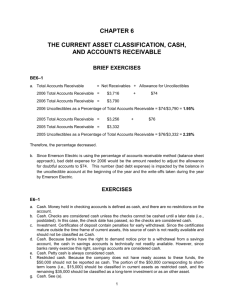

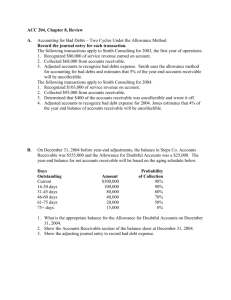

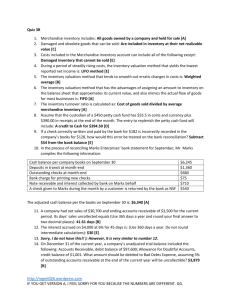

CREDIT RESEARCH FOUNDATION, INC. Quick Survey Results CURRENT TRENDS IN THE PRACTICE OF ESTIMATING UNCOLLECTIBLE ACCOUNTS INTRODUCTION When it is highly probable that some accounts will prove uncollectible and the dollar amount can be reasonably estimated, estimates of bad debt expense should be made and recorded in the period in which the sale takes place. Two methods of accounting for uncollectible accounts are used in practice—the allowance method and the direct writeoff method. When the seller can make a reasonable estimate of the dollar amount to be written off, the allowance method should be used. The allowance method provides an expense for uncollectible receivables in advance of their write-off. The use of the allowance method serves two purposes. First, it reduces the value of the receivables to the amount of cash expected to be realized in the future. Second, it matches the uncollectible expense of the current period with the related revenues of the period. The allowance for uncollectible accounts is reported on the balance sheet as a deduction from accounts receivable and is called a contra asset account. Because the receivables are reported net of the allowance, the net receivables balance is the amount of cash that is expected to be collected in the near future and thus satisfies the financial reporting objective of providing information about future cash inflows to the company. The estimate of uncollectibles at the end of a fiscal period should be based on past experience and forecasts of future business activity. When the general economic environment is favorable, the amount of the expense should normally be less than when the trend is in the opposite direction. Listed below are the three generally accepted procedures that may be used in applying the allowance method. 1. Percentage of Credit Sales—This estimate of uncollectible accounts is based on a historically determined percentage of each period’s credit sales. For example, if your company’s experience indicates that ultimate uncollectible accounts average about two percent of credit sales, an adjusting entry would be made at year-end that 1 expensed two percent of the receivables with an offsetting credit to the reserve for bad-debt. 2. Percentage of Ending Accounts Receivable—Under this method the percentage of the ending balance of accounts receivable not expected to be collected is determined. The allowance account is then adjusted to equal this percentage. The method emphasizes valuation of the receivables at net realizable value on the balance sheet. 3. Aging of Accounts Receivable—This method is similar to Percentage of Ending Accounts Receivable, but it is a more precise variation. Aging considers that the longer a receivable is outstanding, the less likely it is to be collected. A separate estimate of the percentage of uncollectibles is applied to each age classification group instead of applying an overall percentage. The allowance method emphasizes reporting uncollectible accounts expense in the period in which the sales occur. This emphasis on matching expenses with related revenue is the preferred method of accounting for uncollectible receivables. In situations in which it is impossible to estimate, with reasonable accuracy, the uncollectibles at the end of the period, the direct write-off method should be used. Under the direct write-off method, no entries are made until a customer actually defaults on payment, at which time the uncollectible account receivable is written off; therefore, no allowance account is required. The Statistics: All members of the Foundation representing a wide variety of industry sectors were invited to join in the “quick survey." Ø 160 questionnaires were returned. A 30.5% response rate. Of the respondents: Ø 26% use the direct write-off. Ø 74% use the reserve method. Of those using the reserve method: ◊ 30% use the Percentage of Credit Sales procedure ◊ 28% use the Aging of A/R procedure ◊ 15% use the Percentage of Aging A/R procedure Ø Even though there is a great disparity in which method the firms use to estimate their uncollectible accounts, most seem content with their choice as 89% of the firms have not altered their estimation method over the last five years. 2 Ø Only three factors were noted by a large percentage of the firms as a reason for altering their bad debt reserve. Reason for increasing or decreasing bad debt reserve: Percentage of firms saying bad debt reserve was altered for this reason: Accounts placed for collection 64% Evaluation of major accounts 66% Accounts in bankruptcy 71% All other factors, other than risk classification (38%) were noted by less than one quarter of the firms. Ø 65% of the respondents wait for factual evidence of an inability to pay while 35% state they write-off a bad debt when a reasonable estimate of a loss can be established. Ø 70% allow partial write-offs. Ø 72% of the respondents indicate that multiple titles (CFO, VP Finance, Treasurer, Chief Credit Executive) are responsible for establishing the bad debt reserve in their organizations. This could be somewhat misleading since some individuals may have multiple titles. The most frequent response was the CFO 78% of the time, sets the reserve. Ø Of the firms that use the percentage of credit sales approach to estimate uncollectible accounts, half use a history of more than three years. 27% use five years. Ø Almost all (87%) of the firms using the direct write off method, write off the receivable when it is clear the account is uncollectible as opposed to at the end of the year. Ø 36% of the respondents have had their external auditors or accountants suggest their company was over or under reserved for bad debt. Ø There are a few factors that seem to affect the occurrence of an external auditors’ suggestion. ◊ Firms are more likely to have their external auditors make this suggestion if they do not allow partial write-offs. 3 ♦ 45% of the firms that do not allow partial write-offs have this suggestion made to them, ♦ while it occurs 32% of the time with those who allow partial writeoffs. ◊ Size is another factor. ♦ 49% of the respondents with sales of less than $500 million have this suggestion made to them, ♦ while it occurs only 28% of the time of larger firms. CONCLUSION Setting a reserve for uncollectibles is a valuation reserve, since it in effect writes-down accounts receivable to a probable liquidation value. Whether the reserve is adequate, is a matter of judgment. Often, conservative management prefers to establish an allowance for uncollectibles on the high side, so that any portion of the allowance not needed at the end of the accounting period can be released into the profit column after a reasonable balance has been retained for the new accounting period. This approach has distinct advantages if a serious number of insolvency’s are encountered. On the other hand, it is sometimes criticized by auditors for being unrealistic and leading to understated profits in the course of the business year as the large allowance is accumulated. 4