MULTIPLE CHOICE. Choose the one alternative that best answers

advertisement

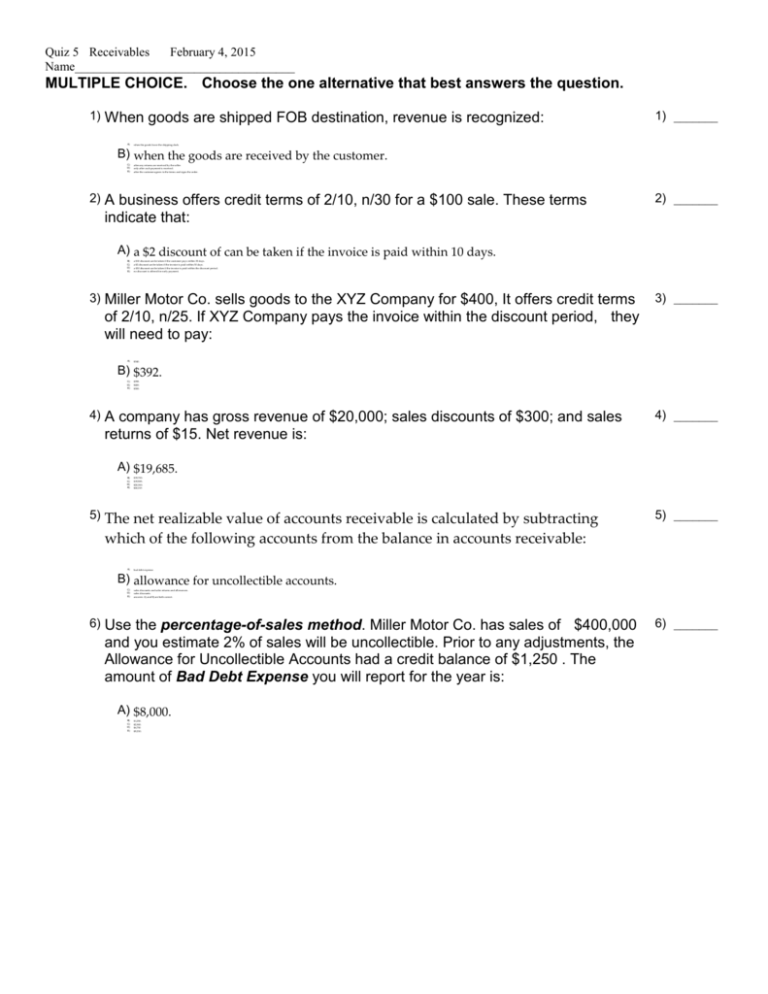

Quiz 5 Receivables February 4, 2015 Name___________________________________ MULTIPLE CHOICE. Choose the one alternative that best answers the question. 1) When goods are shipped FOB destination, revenue is recognized: A) 1) _______ when the goods leave the shipping dock. B) when the goods are received by the customer. C) D) E) 2) after any returns are received by the seller. only after cash payment is received. after the customer agrees to the terms and signs the order. A business offers credit terms of 2/10, n/30 for a $100 sale. These terms indicate that: 2) _______ A) a $2 discount of can be taken if the invoice is paid within 10 days. B) C) D) E) 3) a $10 discount can be taken if the customer pays within 30 days. a $2 discount can be taken if the invoice is paid within 30 days. a $30 discount can be taken if the invoice is paid within the discount period. no discount is offered for early payment. Miller Motor Co. sells goods to the XYZ Company for $400, It offers credit terms of 2/10, n/25. If XYZ Company pays the invoice within the discount period, they will need to pay: A) 3) _______ $340. B) $392. C) D) E) 4) $398. $400. $300. A company has gross revenue of $20,000; sales discounts of $300; and sales returns of $15. Net revenue is: 4) _______ A) $19,685. B) C) D) E) 5) $19,700. $19,985. $20,300. $20,315 The net realizable value of accounts receivable is calculated by subtracting which of the following accounts from the balance in accounts receivable: A) 5) _______ bad debt expense. B) allowance for uncollectible accounts. C) D) E) 6) sales discounts and sales returns and allowances. sales discounts. answers A) and B) are both correct. Use the percentage-of-sales method. Miller Motor Co. has sales of $400,000 and you estimate 2% of sales will be uncollectible. Prior to any adjustments, the Allowance for Uncollectible Accounts had a credit balance of $1,250 . The amount of Bad Debt Expense you will report for the year is: A) $8,000. B) C) D) E) $1,250. $2,500. $6,750 $9,250. 6) _______ 7) A year-end review of Accounts Receivable and estimated uncollectible percentages revealed the following: 1-60 days over 61 days $350,000 $50,000 1% 3,500 30% 15,000 Sales $400,000 18,500 Prior to any adjustment, the credit balance in Allowance for Uncollectible Accounts was $1,500. Under the aging-of-receivables method, what amount of Bad Debt Expense will you report for the year: d $1,500 B) $21,500. C) $17,000. D) E) 8) $18,500. $20,000 A year-end review of Accounts Receivable and estimated uncollectible percentages revealed the following: 1-60 days over 61 days $350,000 $50,000 Sales $400,000 8) _______ 1% 30% Prior to any adjustment, the credit balance in Allowance for Uncollectible Accounts was $1,500. Under the aging-of-receivables, method, what amount will you report in the Allowance for Uncollectible Accounts at year end: A) B) C) $5,500 $9,500 $1,500 D) $18,500. E) 9) $20,000. Miller Motor Co accepted a 9-month, $50,000, 6% note receivable from a customer on June 1, 2014. The amount of interest revenue to be accrued on December 31, 2014, is (round to nearest dollar): A) 9) _______ $1,500 B) $1,750. C) D) E) 10) $2,000. $2,333 $2,722 Miller Motor Co. accepted a 9-month, $50,000, 6% note on June 1, 2014. What is the amount of cash Miller Motor Co. will received on Feb. 28, 2015? A) B) $50,500 $51,750 C) $52,250 D) E) $53,000. $53,500 10) ______