Which of the following is included in *Other Receivables

advertisement

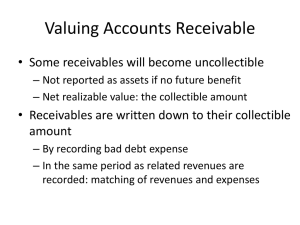

Which of the following is included in “Other Receivables”? Investments Notes receivables Accounts receivables Loans to employees Which of the following is included in “Other Receivables”? Investments Notes receivables Accounts receivables Loans to employees Which of the following duties should NOT be performed by a credit department? A. Evaluate customers who apply for credit b. Handle cash receipts c. Monitor customer payment records d. Review applicant’s income and credit history Which of the following duties should NOT be performed by a credit department? A. Evaluate customers who apply for credit b. Handle cash receipts c. Monitor customer payment records d. Review applicant’s income and credit history Which is a method of establishing control over collections of accounts receivable? A. Set up a petty cash fund b. Establish a bank lock box system c. Allow no one but the bookkeeper to handle cash d. Designate an authorized check signer. Which is a method of establishing control over collections of accounts receivable? A. Set up a petty cash fund b. Establish a bank lock box system c. Allow no one but the bookkeeper to handle cash d. Designate an authorized check signer. Which is a disadvantage of selling on credit? A. Sales can be made to more people b. Profits are increased c. Some customers do not pay, creating an expense d. Both A & B Which is a disadvantage of selling on credit? A. Sales can be made to more people b. Profits are increased c. Some customers do not pay, creating an expense d. Both A & B What are the two methods of accounting for uncollectible receivables? Allowance method Liability method Direct write-off method Asset method What are the two methods of accounting for uncollectible receivables? Allowance method Liability method Direct write-off method Asset method Which are the two methods of estimating uncollectible receivables? Aging of accounts receivable method Percent of Sales method Allowance method Direct write off method Which are the two methods of estimating uncollectible receivables? Aging of accounts receivable method Percent of Sales method Allowance method Direct write off method Which is the income statement approach to estimating bad debts? Aging of accounts receivable method Percent of Sales method Allowance method Direct write off method Which is the income statement approach to estimating bad debts? Aging of accounts receivable method Percent of Sales method Allowance method Direct write off method Which is the balance sheet approach to estimating bad debts? Aging of accounts receivable method Percent of Sales method Allowance method Direct write off method Which is the balance sheet approach to estimating bad debts? Aging of accounts receivable method Percent of Sales method Allowance method Direct write off method What is it called when the maker of a promissory note fails to pay the note on the due date? A discounted note A discarded note A dishonored note An uncollectible note What is it called when the maker of a promissory note fails to pay the note on the due date? A discounted note A discarded note A dishonored note An uncollectible note What is the maturity value of a note? What is the maturity value of a note? Principal amount plus interest Other things to know: calculating maturity date Maturity value Interest