Acc 204, Chapter 8, Review

advertisement

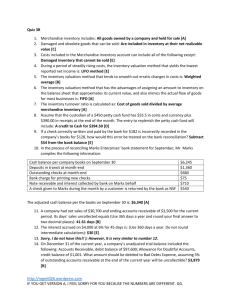

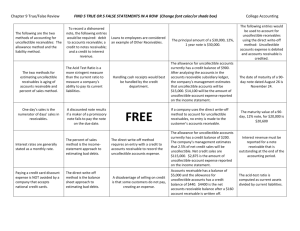

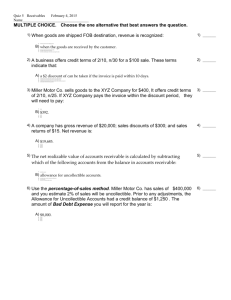

ACC 204, Chapter 8, Review A. Accounting for Bad Debts – Two Cycles Under the Allowance Method Record the journal entry for each transaction. The following transactions apply to Smith Consulting for 2003, the first year of operations: 1. Recognized $80,000 of service revenue earned on account. 2. Collected $68,000 from accounts receivable. 3. Adjusted accounts to recognize bad debts expense. Smith uses the allowance method for accounting for bad debts and estimates that 5% of the year-end accounts receivable will be uncollectible. The following transactions apply to Smith Consulting for 2004. 1. Recognized $103,000 of service revenue on account. 2. Collected $95,000 from accounts receivable. 3. Determined that $400 of the accounts receivable was uncollectible and wrote it off. 4. Adjusted accounts to recognize bad debt expense for 2004. Jones estimates that 4% of the year end balance of accounts receivable will be uncollectible. B. On December 31, 2004 before year-end adjustments, the balance in Steps Co. Accounts Receivable was $555,000 and the Allowance for Doubtful Accounts was a $25,000. The year-end balance for net accounts receivable will be based on the aging schedule below. Days Outstanding Current 16-30 days 31-45 days 46-60 days 61-75 days 75+ days Amount $300,000 100,000 80,000 40,000 20,000 15,000 Probability of Collection 98% 90% 80% 70% 50% 0% 1. What is the appropriate balance for the Allowance for Doubtful Accounts on December 31, 2004. 2. Show the Accounts Receivable section of the balance sheet at December 31, 2004. 3. Show the adjusting journal entry to record bad debt expense. C. The following information is available for the ECR Repair Company’s sales on account and accounts receivable: Accounts receivable balance, 1/1/2004 Allowance for doubtful accounts, 1/1/2004 Sales on account, 2004 Collections on account, 2004 $ 43,200 1,296 317,450 321,215 After several collection attempts, ECR wrote off accounts that could not be collected of $1,125. ECR estimates that 3% of the ending accounts receivable balance will be uncollectible. Record the journal entries 1. Sales on account for 2004. 2. Collections on account 2004. 3. Write-off the accounts that are not collective. 4. Record the estimated bad debt expense for 2004. Compute the following amounts: 1. Using the allowance method, the amount of bad debt expense for 2004. 2. Net realizable value of receivables at end of 2004. Explain why the bad debt expense amount is different from the amount that was written off as uncollectible. D. Crocket Corporation prepared the following aging schedule of its accounts receivable at December 31, 2004. Estimated Number of Days Uncollectible Outstanding Amount Percentage 0-20 $540,000 2 21-40 180,000 3 41-60 90,000 4 61-80 60,000 5 Over 80 70,000 7 Crocket reported sales on account of $2,600,000 during 2004 and wrote off $37,600 of accounts receivable as uncollectible for the year. Accounts receivable at January 1, 2004, was $895,000 and the allowance for uncollectible accounts was $41,200. Cash collected during 2000 was $2,517,400. 1. Compute the required balance in the allowance for uncollectible accounts at December 31, 2004. 2. Compute the amount that Crocket Corporation must record as bad debt expense for 2004 to bring the balance in the allowance for uncollectible accounts to the required level. 3. Compute the balance in accounts receivable at December 31, 2004.