Chapter 8- Receivables

advertisement

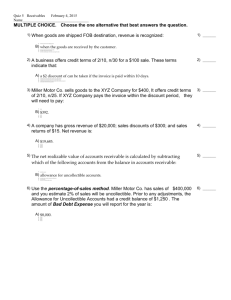

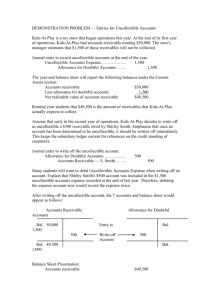

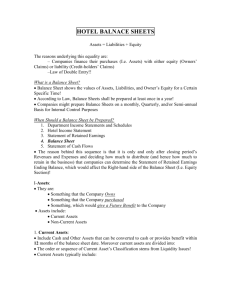

Chapter 8- Receivables UNCOLLECTIBLE ACCOUNTS - Because of errors in judgment by credit department or unexpected developments. - Each year uncollectible accounts expense is estimated and reflected in the year end balance sheet and income statement to fulfill the Matching Principle. ALLOWANCE FOR DOUBTFUL ACCOUNTS (P.361) - the account to be credited when estimating uncollectible accounts A Contra-Asset-Account Accountants try to be conservative in their estimation of assets (report assets at lower end range of reasonable values.) ~Principle of Conservatism~ 3 METHODS OF ACCOUNTING FOR UNCOLLECTIBLE ACCOUNTS 1. Balance sheet (p. 365- Aging A/R) 2. Income Statement (p.367- % of net sales) 3. Direct Write off (p.367) ADJUSTING ENTRY TO RECORD UNCOLLECTIBLE ASSETS (P.360) Uncollectible Accounts Expense 10,000 Allowance for doubtful Accounts 10,000 To record the portion of total A/R estimated to be uncollectible. “BALANCE SHEET” APPROACH This method emphasizes the proper B/S valuation Key factor in the B/S approach is an “aging” of A/R “Aging” means classifying each A/R according to its age. This analysis of A/R gives management a useful picture of the status of collections and probabilities of credit losses Longer past due, more likelihood of not being collected Credit manager uses this aging schedule to estimate the percentage of credit losses likely to occur in each age group of A/R, and the resulting uncollectible portions for all age groups. This determines the required balance in the allowance for doubtful accounts. This account is then adjusted to the required balance Ex. A/R - $100,000 at Dec. 31 -$5,680 estimated to be uncollectible -$4,000 balance (CR) in account Allowance for Doubtful Accounts -Month end adjusting entry should be $1680 Uncollectible Accounts Expense Allowance for Doubtful Accounts 1680 1680 To increase allowance for Doubtful Accounts to $5680 from $4000 WRITING OFF AN UNCOLLECTIBLE A/R - When an A/R from a specific customer is determined to be uncollectible. ENTRY: DR Allowance for Doubtful Accounts CR A/R – Jim Smith NB:* xx xx DR is to the Allowance for Doubtful Account NOT to uncollectible Account expense! The expense occurs at the end of each accounting period and is an estimate for the uncollectible accounts for the forthcoming year. When an A/R actually is determined to be worthless, this is just confirming our previous ESTIMATE of the EXPENSE – We must NOT expense the amount again! - If estimates > write-offs, Allowance for Doubtful Accounts will show a CR balance. If estimates < write-offs, Allowance for Doubtful Accounts will show a temporary DR balance until the end of the period. The net value of receivables is unchanged by write-offs, see p. 363. RECOVERY OF A/R PREVIOUSLY WRITTEN OFF 1. Reinstate Asset (A/R): DR A/R – Jim Smith CR Allowance for Doubtful A/Cs xx xx 2. Separate entry in cash receipts journal to record collection of A/R: DR Cash CR xx A/R – Jim Smith xx INCOME STATEMENT APPROACH - Ex. Focuses on estimating the uncollectible accounts EXPENSE for the period, rather than adjusting an asset account to a required balance. Uncollectable account expense is ESTIMATED at some % OF NET SALES. The adjusting entry is made in full amount of the estimated expense, without regard for current balance in the Allowance for Doubtful Accounts. Net Credit Sales = $150,000 % of credit sales uncollectible = 2% ENTRY AT MONTH END DR Uncollectable A/C expense 3,000 CR Allowance for Doubtful A/Cs 3,000 To record uncollectable Account Expense, estimated at 2% of CR sales (150,000 X 0.02)