Chapter 3 Review Outline Test – Friday, 10/16 Examine the learning

advertisement

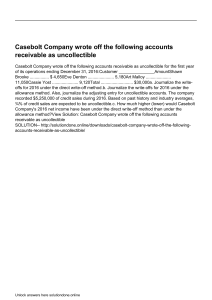

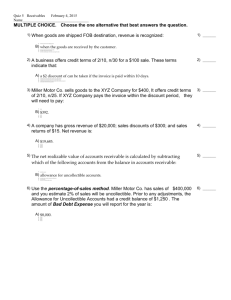

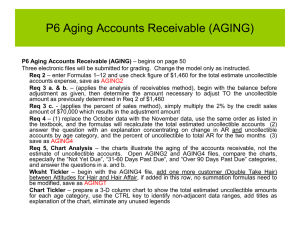

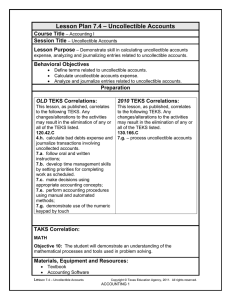

Chapter 3 Review Outline Test – Friday, 10/16 Examine the learning objectives below you should be able to complete all of the following. Also, be sure to read Chapter 3 for the test. Account for cash and short-term investments. Explain the difference between the direct write-off method and the allowance method of accounting for uncollectible accounts. Record the adjusting entry for estimated uncollectible accounts. Journalize the entries to write off uncollectible accounts receivable using both the direct write-off and allowance methods. Journalize the reinstatement of an account receivable that was previously written off. Calculate the adjustment for uncollectible accounts expense using the percentage of net sales and the aging of accounts receivable methods. Define the accounting terms introduced in this chapter. Demonstrate your ability to define and apply the following terms: o Publicly Held Corporation – o Change Fund – o Petty Cash Fund – o Marketable Securities – o Other Revenue – o Liquidity – o Internal Controls – o Uncollectible Accounts – o Direct Write-Off Method – o Matching Principle – o Allowance Method – o Book Value of Accounts Receivable – o Percentage of Net Sales Method – o Aging of Accounts Receivable Method – o Installment Sales – Apply your knowledge gained throughout this chapter by responding to the questions below. 1. Which accounts are debited and credited when a change fund is established? 2. In what circumstances is an entry made to the Cash Short and Over account? 3. How often is a debit made to the Petty Cash Fund account? 4. Why would a business invest in marketable securities? 5. Why are uncollectible accounts considered an expense for a business? 6. List two methods that are used to record uncollectible accounts. 7. For a business with many charge customers, why is the allowance method of handling uncollectible accounts preferred over the direct write-off method? 8. Under the allowance method, when the end-of-period adjustment for uncollectible accounts is made, why is there no entry to Accounts Receivable? 9. How is Allowance for Uncollectible Accounts classified? 10. When an account is written off using the allowance method, explain why the book value of accounts receivable does not decrease. 11. List two methods used to estimate uncollectible accounts. Note Be sure to thoroughly review your orange Ch. 3 Demonstration Packet.