MAJOR TREND INDEX - The Leuthold Group

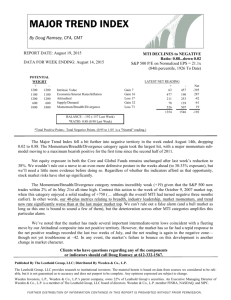

MAJOR TREND INDEX

By Doug Ramsey, CFA, CMT

REPORT DATE: August 11, 2015

DATA FOR WEEK ENDING: August 7, 2015

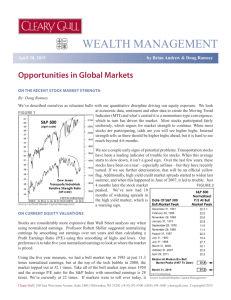

MTI DECLINES to NEGATIVE

Ratio: 0.90...down 0.06

S&P 500 P/E on Normalized EPS = 21.0x

(84th percentile, 1926 To Date)

POTENTIAL

WEIGHT

+ -

1200

1100

1200

600

1800

1200

1100

1200

600

1800

Intrinsic Value

Economic/Interest Rates/Inflation

Attitudinal

Supply/Demand

Momentum/Breadth/Divergence

No Change

Gain 4

Loss 76

Loss 6

Loss 19

LATEST NET READING

+

62

-

464

469

226

70

557

1384

198

251

163

465

1541

BALANCE : -157 (-60 Last Week)

*RATIO: 0.90 (0.96 Last Week)

*Total Positive Points : Total Negative Points. (0.95 to 1.05 is a "Neutral" reading.)

Net

-402

271

-25

-93

92

-157

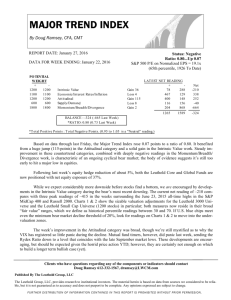

Based on data for the week ended August 7th, the Major Trend Index dropped to a NEGATIVE reading of 0.90

, led by declines in both the Attitudinal and Momentum/Breadth/Divergence work. The topping action evident in the MTI and other disciplines is consistent with either a severe correction, or a cyclical bear in the near future. We’ve therefore cut net equity exposure in both the Leuthold Core and Leuthold Global

Funds to 38%, down from 48% in late July, and 61-62% in late June. A further reduction is possible in the days ahead.

Sentiment has clearly cooled off from the ebullience seen throughout 2014 and early this year, and some analysts contend there’s a new “wall of worry” for the stock market to climb (concerns over China’s market air pocket, crude’s retest of March lows, and the weak quarterly earnings season now in progress).

But the MTI’s Attitudinal category staged a sharp drop last week, reflecting bearish flips in three models tracking investor preferences between stocks and bonds.

The Momentum/Breadth/Divergence category also recorded a small loss on the week, reflecting further weakness in market breadth and small losses in the chart scores. Yet the net reading for this category is still positive at +92; the weakness to date has largely been concentrated in “anticipatory” indicator groupings related to momentum, breadth, and industry leadership. We obviously prefer acting on this type of evidence rather than waiting for formal bear signals from indicators based on the major indexes, but the markets don’t always afford us that opportunity.

The Supply/Demand category carries the smallest potential weight of the five categories but can be an important swing factor at major turning points. The current category reading is a bearish –93, reflecting evidence of increasing institutional selling across three measures.

Clients who have questions regarding any of the components or indicators should call Doug Ramsey at 612-332-1567.

Published By The Leuthold Group, LLC; Distributed By Weeden & Co., L.P.

The Leuthold Group, LLC provides research to institutional investors. The material herein is based on data from sources we considered to be reliable, but it is not guaranteed as to accuracy and does not purport to be complete. Any opinions expressed are subject to change.

Weeden Investors, L.P., Weeden & Co., L.P.'s parent company, owns 22% of Leuthold Group’s securities. An Executive Managing Director of

Weeden & Co., L.P. is a member of The Leuthold Group, LLC board of directors. Weeden & Co., L.P. member FINRA, NASDAQ, and SIPC.

FURTHER DISTRIBUTION OF INFORMATION CONTAINED IN THIS REPORT IS PROHIBITED WITHOUT PRIOR PERMISSION.