to read "Steven Leuthold's Downshifting Into Neutral on Stocks "

advertisement

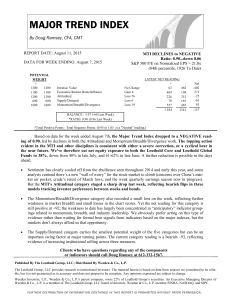

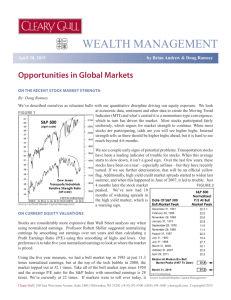

% THE DOW JONES BUSINESS AND FINANCIAL WEEKLY www.barrons.com JUNE 4, 2007 $4.00 Interview With Steven Leuthold Chief investment strategist, Leuthold Group Downshifting Into Neutral on Stocks by Sandra Ward ALL IT TOOK WAS AN E-MAIL ALERT FROM the folks at Leuthold Group informing us their major trend index, which takes the pulse of all sorts of market measures, had slipped to neutral after deteriorating from a peak in mid-March. That gave us a good excuse to check in with the grand poobah of the renowned Minneapolis research and money-management outfit to see which way the investment winds are blowing. Gas prices be damned, what better way to kick off Memorial Day weekend than by paying a visit to Leuthold at his summer home on the Maine coast and hearing what’s on his mind. Barron’s: A year ago, you and I were discussing how a new bear market might have just begun. It hadn’t. Now where do we stand? But your work on market trends is flashing a warning sign again. Our market work remained positive, on balance, until a few weeks ago, when it downshifted to neutral. We’ve got 180 components in the major trend index and what has caused it to shift has been an acceleration of inflation, in commodity prices, and the very recent increase in rates. That’s occurring against the back- “It looks like maybe the consumer, for the first time in my lifetime, might actually be tapped out. I’m not expecting a new secular bear market…But we certainly could see a 25% to 30% correction.” drop of an economic expansion that is long in the tooth by post-World War II standards of duration and magnitude. This cyclical bull market has now run about 14 months longer than the typical cyclical bull market. The S&P 500 is up 95% from trough to peak, versus an average of 80% [see chart on facing page]. As a result, we’ve moved to neutral. We are 50% in equities, compared with 70% at the first of the year. Steve Leuthold How do you balance this with the flood of liquidity that keeps coming into the market? Is that a factor in the major trend index? I went back through our Green Book and read what I wrote in 1987. Why ’87? Because we also turned negative in 1987 prematurely, about two or three months prematurely, and people thought we didn’t recognize a new era of valuations. The (over please) THE PUBLISHER ’ S SALE OF THIS REPRINT DOES NOT CONSTITUTE OR IMPLY ANY ENDORSEMENT OR SPONSORSHIP OF ANY PRODUCT, SERVICE, COMPANY OR ORGANIZATION. Custom Reprints (609)520-4331 P.O. Box 300 Princeton, N.J. 08543-0300. DO NOT EDIT OR ALTER REPRINTS ● REPRODUCTIONS NOT PERMITTED #32504 ! Kevin Brusie for Barron’s Leuthold: Our disciplines turned negative a year ago and we became defensive and moved our asset allocation down to 30% in equities and we stayed with that for about 3µ months. We got back into the market when our indexes improved. The original signal was a false alarm. It’s the price you pay sometimes for being defensive. Our whole credo is making it and keeping it, and we try to get out of the way if we think we’re headed for trouble. It was premature and, in retrospect, it was wrong. “Private equity isn’t going to sink the stock market. The negative stuff is going to come when, down the road, private capital attempts to regurgitate these companies and sell them back to the public after they have stripped all the assets out of them.” two things Wall Street was talking about to support the market before the terrible October decline was the huge amount of liquidity and the big shrink in equities. Then liquidity was coming from Japan because Japanese brokers had started selling U.S. stocks. The big equity shrink was partly the result of LBOs, but mostly from companies buying back their own stock. There were other parallels. Breadth was deteriorating and investors were gravitating to big-cap stocks from small-cap stocks. There was an acceleration of inflation, which we are seeing now. There was an acceleration of interest rates, and the market kept going up in the face of higher rates, although, back then, the rise in rates was greater. There were a lot of similarities. There was also a real-estate boom. Yes, there was. More to the point, though, this is an old market. It is mature by historical standards since World War II. We’ve had two economic expansions of 8 and 10 years under Reagan and Clinton, and people have come to believe that those are normal. But the average economic expansion has actually been about five years since World War II. Here we are at five years from 2002. In terms of magnitude, the cyclical bull market has overshot. the 81st percentile, so it’s modestly overvalued. We are starting to see a shift where large-caps are winning by a small margin over small- and mid-caps. That is also typical of what we saw in 1987. What about sentiment? What happened then philosophically was also very much like what might be happening today. At the end of 1986, institutions thought the market was overvalued and they became cautious. Then the market had a big move up in January 1987 and people were sitting there with defensive positions and thought, “Uh-oh, the market is going up.” And it kept going up. Finally, there was a point of capitulation as managers who were lagging behind the S&P 500 and their peers threw in the towel and bought stocks. We haven’t seen that happen yet this time around. We could see it happen pretty soon. We’ve already seen it happen with the hedge funds, which, if you look at the ISI Group’s numbers, are about as long as they could get. A Bigger, Stronger Bull This market’s rise has lasted much longer and gone much further than most since World War II, suggesting that it might lose steam before long. Bull Market Duration Bull Market Magnitude (Months) You mentioned all the similarities to ’87. What’s different today? The valuation level in the S&P 500 is not as extended as it was back then. Then it was selling at 20 times earnings, now it’s selling at 15µ-16 times current earnings. But if you normalize the earnings, we may be looking at peak earnings for the S&P or very close. Also, the S&P is much cheaper than almost any other aspect of the market. By our estimation, were the S&P to go back to median valuation levels, it would decline about 13% from current levels. But mid-caps and small-caps would decline about 25% or 30% because the universe of 3,000 stocks we cover in those categories are in the 97th percentile of valuations historically and at about 21µ times normalized earnings. In terms of normalized earnings, the S&P 500 is in 95% 55 80% 36 Post WWII Median From October 2002 Low Source: The Leuthold Group What about the public? The public isn’t participating. Net inflow into U.S.-focused equity funds this year is about $16 billion. That sounds like a lot of money, but a year ago, at this same time, it was $38 billion-$39 billion. We are seeing the market making new highs and yet there have been weeks of net redemptions. Are they still going overseas? They are. Net inflows into foreign funds, as of a few weeks ago, was about $69 bil- 2 lion, compared to the $16 billion into U.S. funds. It is performance-chasing. One thing you can bet on is that when we get to extremes, the public is going to be wrong. One of the few bullish sentiment factors in this U.S. market is that the public has not come in. The question is whether they will. We’re approaching the 10th anniversary of the big Asian financial crisis. Any thoughts about whether we are going to find ourselves in a similar situation? It is possible. We still have 8% in foreign markets, and it’s all in emerging markets. That had been as high as 15% a couple of years ago, then we moved it to about 6% and since the first of the year we’ve been slightly increasing it. Our biggest single position is 2% in China. I ask myself every day if this parabolic advance in the Chinese market is the end of the road. Right now, we don’t think so, but maybe as we get closer to the 2008 summer Olympics, the market will begin to discount a correction. We just did a study on stock multiples of companies with more than $1 billion in market value in China and the average is 32 or 33 times earnings, whereas in Japan they were 42 to 43 times earnings at the 1989 peak. But I don’t think there is any way that China is going to quit investing in dollar-denominated securities, though they could allocate more to euro- or even yen-denominated securities or maybe other currencies in the Middle East. But unless the U.S. is stupid enough to raise a major threat of restricting or taxing imports, which it looks like some politicians would like to do, there will be peace until after the Olympics, and we are not likely to see some type of a trade war. What’s the impact on U.S. companies? A trade war could really hurt when you consider that about 48% of the earnings in the S&P 500 come from foreign operations. The long-term average of up-todown earnings, from 1984 to date, is 1.68. Today, with 90% of our earnings, the current up-to-down ratio is 1.16. The only times we’ve seen it lower than that was in the past two recessions. That is kind of scary. It shows the breadth of earnings advances is being focused more and more in the large-cap stocks. They are the 3Ms (Ticker: MMM), the Intels (INTC) and the Dells (DELL) that have big foreign operations and are global. There seems to be quite a few instances of “only-in-a-recession” data coming out. We are going to see two quarters of negative GDP by the time we get to mid2008, which would be the official definition of a recession. Earnings may not reflect that because we have exported so much of the labor function. But it looks like maybe the consumer, for the first time in my lifetime, might actually be tapped out. I’m not expecting any huge decline or a new secular bear market or anything like that. But we certainly could see a 25% to 30% kind of a correction, which would be a normal cyclical bear market. That’s my opinion, but as I have often said, our numbers are more reliable than our opinion and right now our numbers are neutral. What influence are hedge funds and private equity exerting on the market? Our preliminary numbers show the price private-equity firms are paying to buy out companies is 33% to 40% higher than a year ago, based on cash flow. And everybody and his brother is running screens as to who the next likely leveraged-buyout candidate will be. It turns out everything is an LBO candidate. There has never been any kind of a technique, including any kind of portfolio management, that can’t be defeated as an effective strategy by too much money and that’s exactly what we are seeing happen. But the fallout in the stock market probably is going to be quite a long way away. I don’t think private equity is going to be the thing that sinks the stock market. The negative stuff is going to come when two years or three years or four years down the road, private capital attempts to regurgitate these companies and sell them back to the public after they have stripped all the assets out of them or taken their big dividends and so on and so forth. Let’s talk about interest rates. Recently, rates started rising to levels that made a lot of people sit up and take notice. The 30-year went up to 5.01%. The 10year went to 4.90%, temporarily. They are probably going to go higher. The reason they are going higher is that we have to be competitive in the rates we are paying, because rates are going up in Germany and the U.K. It is very weird because at the same time you are looking at T-bill rates going down and the spread between T-bills and the Fed funds is very wide now. But it has reversed the inversion of the yield curve, which a lot of people point to as being a positive thing, because they are scared of that inversion. The inversion itself isn’t negative but we are seeing higher longer-term rates building. I think we’ll get to 5.60% on the long bond. In how long? Within six months. What that does is put another strain on the whole housing industry because it has a direct impact on mortgage rates, especially since they have curtailed the interest-only mortgages and the “liar’s loans.” People’s mortgage payments are going to be higher, and that is going to hurt the sales of new houses, probably. Steve, where are you looking to make profits from this market? We should focus on foreign markets because there is intrinsically stronger growth there. The U.S. is a mature economy. The emerging countries are not. I am not sure China is the place to go. There are some other emerging markets like Korea, which is a lot cheaper, that may make a lot more sense. Thanks, Steve. n Leuthold Funds, Inc. The opinions expressed within this article are those of Steve Leuthold and The Leuthold Group, L.L.C., and are subject to change without notice. Investors should consider the investment objectives, risks, charges and expenses of the investment company carefully before investing. The Prospectus contains this and other information about the Funds. For current Prospectus, call toll-free, 1-800-273-6886, or download from our web site: www.LeutholdFunds.com. Please read the Prospectus carefully before you invest. Not FDIC Insured No Bank Guarantee May Lose Value Distributor: Rafferty Capital Markets, LLC Garden City, NY 11530 06-11-2007 3