Partner's Outside Basis in Partnership

advertisement

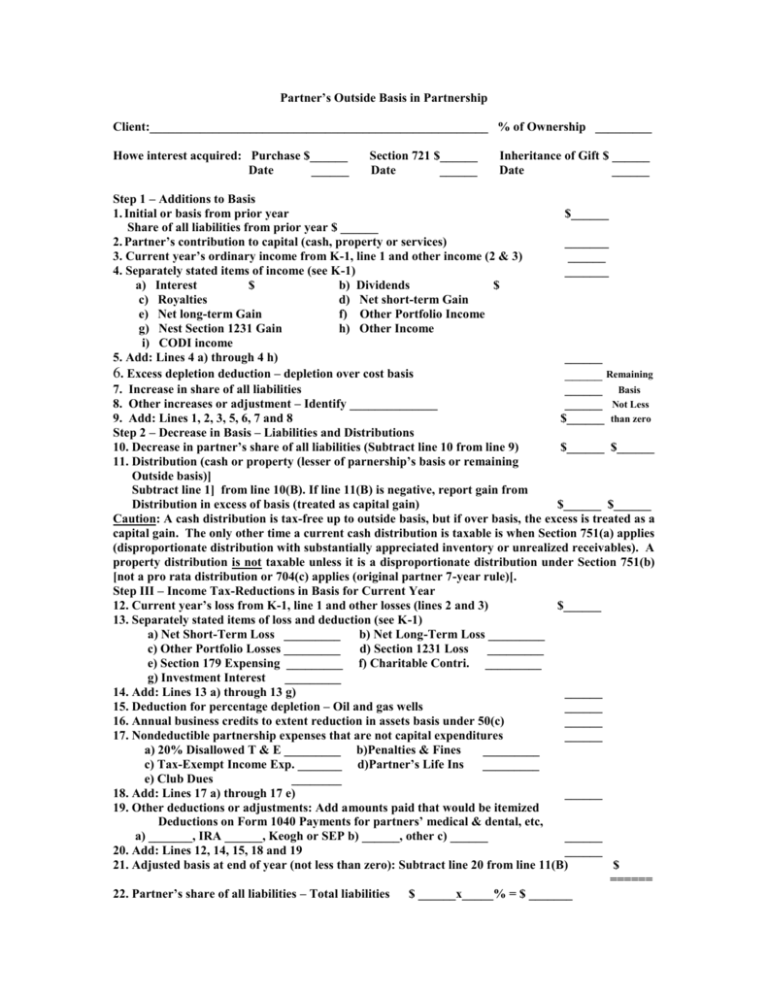

Partner’s Outside Basis in Partnership Client:______________________________________________________ % of Ownership _________ Howe interest acquired: Purchase $______ Date ______ Section 721 $______ Date ______ Inheritance of Gift $ ______ Date ______ Step 1 – Additions to Basis 1. Initial or basis from prior year $______ Share of all liabilities from prior year $ ______ 2. Partner’s contribution to capital (cash, property or services) _______ 3. Current year’s ordinary income from K-1, line 1 and other income (2 & 3) ______ 4. Separately stated items of income (see K-1) _______ a) Interest $ b) Dividends $ c) Royalties d) Net short-term Gain e) Net long-term Gain f) Other Portfolio Income g) Nest Section 1231 Gain h) Other Income i) CODI income 5. Add: Lines 4 a) through 4 h) ______ 6. Excess depletion deduction – depletion over cost basis _____ Remaining 7. Increase in share of all liabilities ______ Basis 8. Other increases or adjustment – Identify ______________ ______ Not Less 9. Add: Lines 1, 2, 3, 5, 6, 7 and 8 $______ than zero Step 2 – Decrease in Basis – Liabilities and Distributions 10. Decrease in partner’s share of all liabilities (Subtract line 10 from line 9) $______ $______ 11. Distribution (cash or property (lesser of parnership’s basis or remaining Outside basis)] Subtract line 1] from line 10(B). If line 11(B) is negative, report gain from Distribution in excess of basis (treated as capital gain) $______ $______ Caution: A cash distribution is tax-free up to outside basis, but if over basis, the excess is treated as a capital gain. The only other time a current cash distribution is taxable is when Section 751(a) applies (disproportionate distribution with substantially appreciated inventory or unrealized receivables). A property distribution is not taxable unless it is a disproportionate distribution under Section 751(b) [not a pro rata distribution or 704(c) applies (original partner 7-year rule)[. Step III – Income Tax-Reductions in Basis for Current Year 12. Current year’s loss from K-1, line 1 and other losses (lines 2 and 3) $______ 13. Separately stated items of loss and deduction (see K-1) a) Net Short-Term Loss _________ b) Net Long-Term Loss _________ c) Other Portfolio Losses _________ d) Section 1231 Loss _________ e) Section 179 Expensing _________ f) Charitable Contri. _________ g) Investment Interest _________ 14. Add: Lines 13 a) through 13 g) ______ 15. Deduction for percentage depletion – Oil and gas wells ______ 16. Annual business credits to extent reduction in assets basis under 50(c) ______ 17. Nondeductible partnership expenses that are not capital expenditures ______ a) 20% Disallowed T & E _________ b)Penalties & Fines _________ c) Tax-Exempt Income Exp. _______ d)Partner’s Life Ins _________ e) Club Dues ________ 18. Add: Lines 17 a) through 17 e) ______ 19. Other deductions or adjustments: Add amounts paid that would be itemized Deductions on Form 1040 Payments for partners’ medical & dental, etc, a) _______, IRA ______, Keogh or SEP b) ______, other c) ______ ______ 20. Add: Lines 12, 14, 15, 18 and 19 ______ 21. Adjusted basis at end of year (not less than zero): Subtract line 20 from line 11(B) $ ====== 22. Partner’s share of all liabilities – Total liabilities $ ______x_____% = $ _______