Homework 3 – FCS 3450 Spring 2013 1. Jenny Franklin estimates

advertisement

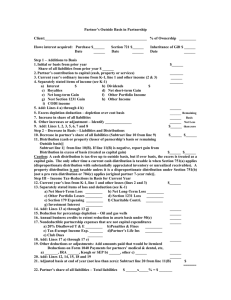

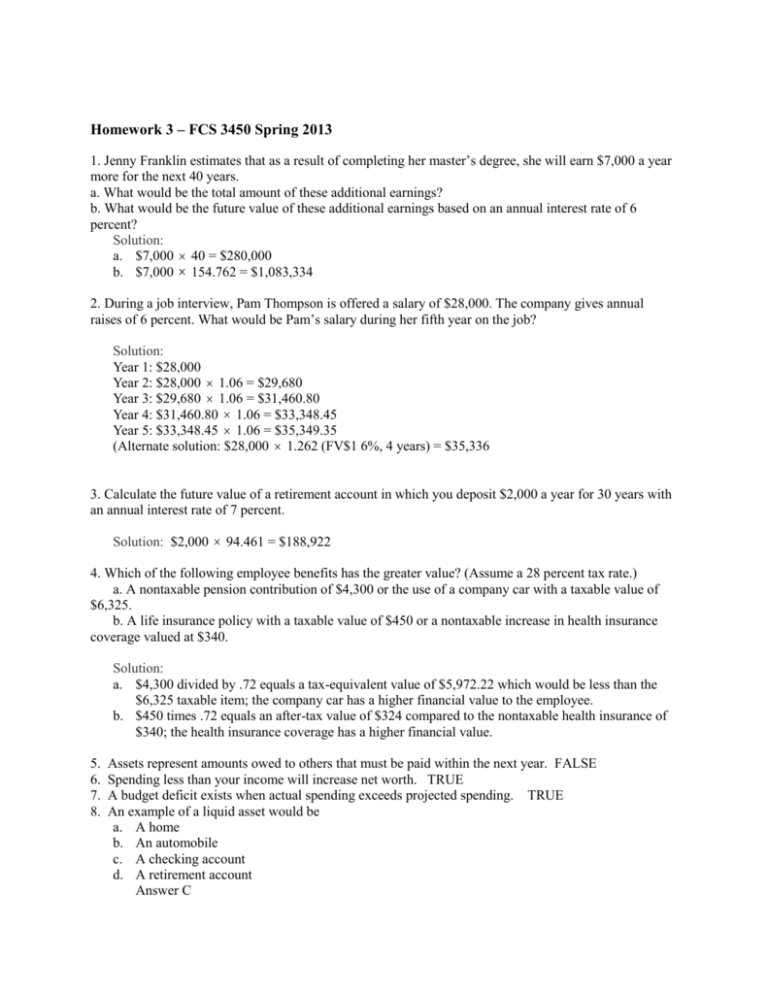

Homework 3 – FCS 3450 Spring 2013 1. Jenny Franklin estimates that as a result of completing her master’s degree, she will earn $7,000 a year more for the next 40 years. a. What would be the total amount of these additional earnings? b. What would be the future value of these additional earnings based on an annual interest rate of 6 percent? Solution: a. $7,000 40 = $280,000 b. $7,000 154.762 = $1,083,334 2. During a job interview, Pam Thompson is offered a salary of $28,000. The company gives annual raises of 6 percent. What would be Pam’s salary during her fifth year on the job? Solution: Year 1: $28,000 Year 2: $28,000 1.06 = $29,680 Year 3: $29,680 1.06 = $31,460.80 Year 4: $31,460.80 1.06 = $33,348.45 Year 5: $33,348.45 1.06 = $35,349.35 (Alternate solution: $28,000 1.262 (FV$1 6%, 4 years) = $35,336 3. Calculate the future value of a retirement account in which you deposit $2,000 a year for 30 years with an annual interest rate of 7 percent. Solution: $2,000 94.461 = $188,922 4. Which of the following employee benefits has the greater value? (Assume a 28 percent tax rate.) a. A nontaxable pension contribution of $4,300 or the use of a company car with a taxable value of $6,325. b. A life insurance policy with a taxable value of $450 or a nontaxable increase in health insurance coverage valued at $340. Solution: a. $4,300 divided by .72 equals a tax-equivalent value of $5,972.22 which would be less than the $6,325 taxable item; the company car has a higher financial value to the employee. b. $450 times .72 equals an after-tax value of $324 compared to the nontaxable health insurance of $340; the health insurance coverage has a higher financial value. 5. 6. 7. 8. Assets represent amounts owed to others that must be paid within the next year. FALSE Spending less than your income will increase net worth. TRUE A budget deficit exists when actual spending exceeds projected spending. TRUE An example of a liquid asset would be a. A home b. An automobile c. A checking account d. A retirement account Answer C 9. Based on the following data, compute the total assets, total liabilities, and net worth. Liquid assets, $4,670 Household assets, $93,780 Investment assets, $14,350 Long-term liabilities, $76,230 Current liabilities, $2,670 Solution: Total assets = $112,800 ($4,670 + 14,350 + 93,780) Total liabilities = $78,900 ($2,670 + $76,230) Net worth = $33,900 ($112,800 - $78,900) 10. Use the following items to prepare a balance sheet and a cash flow statement. Determine the total assets, total liabilities, net worth, total cash inflows, and total cash outflows. Rent for the month, $650 Cash in checking account, $450 Spending for food, $345 Current value of automobile, $7,800 Credit card balance, $235 Auto insurance, $230 Stereo equipment, $2,350 Lunches/parking at work, $180 Home computer, $1,500 Clothing purchase, $110 Monthly take-home salary, $1,950 Savings account balance, $1,890 Balance of educational loan, $2,160 Telephone bill paid for month, $65 Loan payment, $80 Household possessions, $3,400 Payment for electricity, $90 Donations to church, $70 Value of stock investment, $860 Restaurant spending, $130 Solution: Total assets = $18,250 ($450 + 1,890 + 7,800 + 2,350 + 1,500 + 3,400 + 860) Total liabilities = $2,395 ($235 + $2,160) Net worth = $15,855 ($18,250 - $2,395) Total cash inflows = $1,950 Total cash outflows = $1,950 ($650 + 345 + 230 + 180 + 110 + 65 + 80 + 90 + 70 + 130) 11. Carl Lester has liquid assets of $2,400, tangible assets of $3,200, investment assets of $1,000, current liabilities of $1,800, long term liabilities of $2,200, income of $3,500, total expenses of $2,800. a. What is his basic liquidity ratio? Solution: $2,400/$2,800 = .857 b. What is the liquidity ratio? Solution: $2,400/$1,800 = 1.33 c. What is the debt-to-asset ratio? Solution: $4,000/$6,600 = .606 12. Use future value and present value calculations (see tables in the Chapter 1 appendix) to determine the following. a. The future value of a $500 savings deposit after eight years at an annual interest rate of 3 percent. b. The future value of saving $1,500 a year for five years at an annual interest rate of 4 percent. c. The present value of a $2,000 savings account that will earn 3 percent interest for four years. Solution: a. $500 1.267 = $633.50 b. $1,500 5.416 = $8,124 c. $2,000 0.888 = $1,776 13. Kara George received a $6,000 gift for graduation from her uncle. If she deposits the entire amount in an account paying 3 percent, what will be the value of this gift in 15 years? Solution: $6,000 X 1.558 = $9,348 14. If the CPI for 1976 is 56.9 and the CPI for 2006 is 201.6, what is the rate of inflation between 1976 and 2006? Solution: (201.6-56.9)/56.9 x 100 = 254.30