CERTIFIED FINANCIAL PLANNER CERTIFICATION

PROFESSIONAL EDUCATION PROGRAM

Income Tax Planning

Module 3

Income Tax Aspects of

Property Acquisitions &

Introduction to Property

Dispositions

©2013, College for Financial Planning, all rights reserved.

Learning Objectives

3–1: Identify the type of property in a situation.

3–2: Analyze a situation to determine the correct

treatment for property-related expenditures.

3–3: Analyze a situation to calculate the adjusted basis of

property.

3–4: Analyze a situation to calculate the cost recovery

deductions over the recovery period.

3–5: Analyze a situation to calculate the election or

deduction amount under Section 179.

3–6: Analyze a situation to calculate the amount of cost

recovery recapture, or unrecaptured Section 1250

income.

3–7: Analyze a situation to determine the tax treatment of

Section 1231 property transactions.

3-2

Questions to Get Us Warmed Up

3-3

Learning Objectives

3–1: Identify the type of property in a situation.

3–2: Analyze a situation to determine the correct

treatment for property-related expenditures.

3–3: Analyze a situation to calculate the adjusted basis of

property.

3–4: Analyze a situation to calculate the cost recovery

deductions over the recovery period.

3–5: Analyze a situation to calculate the election or

deduction amount under Section 179.

3–6: Analyze a situation to calculate the amount of cost

recovery recapture, or unrecaptured Section 1250

income.

3–7: Analyze a situation to determine the tax treatment of

Section 1231 property transactions.

3-4

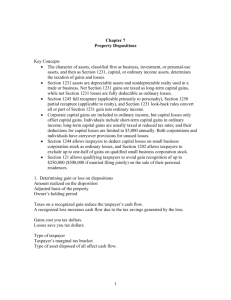

Types of Property

Realty

• Land, anything permanently affixed or

attached to the land, and certain items that

cannot easily be removed

Personalty

(sometimes known as “personal property”)

• Any type of property that is not realty,

including such items as automobiles, jewelry,

clothing, equipment, and furniture

3-5

Types of Property

Tangible Property

• Property that has physical existence and can be

touched and felt

Intangible Property

• Property, such as a leasehold interest in real estate

or a stock certificate, that has no physical

existence of its own, but represents the evidence

of ownership or value

3-6

Types of Property

Trade or Business

• Property used on a regular and continuous basis in

the taxpayer’s trade, business, or occupation to

produce income

Production of Income

• Property that does not require a significant amount

of the taxpayer’s time or attention

3-7

Types of Property

Inventory

• Property held for resale in the normal course of a

trade or business

Personal Use

(NOT the same as personal property)

• Property held for the taxpayer’s personal pleasure

or enjoyment

3-8

Property-Related Expenditures

Not Currently

Deductible

• Those incurred

purely for

personal

reasons by the

taxpayer

(generally)

• Exception:

Itemized

deductions

Currently

Deductible

• Ordinary and

necessary

expenses

incurred to carry

on a trade or

business—§162

expenses

Capitalized and

Amortized

or Depreciated

• The purchase of

property or

improvements

to property that

extend beyond

the taxable year

or that provide

a benefit for

more than one

tax year

3-9

Tax Basis

Purchased Property

Original costs plus acquisition costs and

cost of subsequent capital improvements,

less amount of cost recovery deduction

claimed

Inherited Property

Generally, equal to fair market value (FMV)

on decedent’s death, or

FMV on alternate valuation date (exactly six

months after decedent’s death) if so

elected

3-10

Tax Basis

Property Acquired by

Gift

Donor’s basis, unless fair market value

(FMV) of property on date gifted is lower

than donor’s basis:

- If eventually sold for less than FMV on

date received, basis becomes value on

date received

- If eventually sold for more than donor’s

basis, basis becomes donor’s cost

- If eventually sold for value between FMV

on date received and donor’s basis,

taxpayer reports neither gain nor loss

-Tacking of holding period if donor’s basis

used

3-11

Learning Objectives

3–1: Identify the type of property in a situation.

3–2: Analyze a situation to determine the correct

treatment for property-related expenditures.

3–3: Analyze a situation to calculate the adjusted basis of

property.

3–4: Analyze a situation to calculate the cost recovery

deductions over the recovery period.

3–5: Analyze a situation to calculate the election or

deduction amount under Section 179.

3–6: Analyze a situation to calculate the amount of cost

recovery recapture, or unrecaptured Section 1250

income.

3–7: Analyze a situation to determine the tax treatment of

Section 1231 property transactions.

3-12

Cost Recovery: MACRS

Defined

Recover cost of wasting asset over time period

approximating asset’s useful life

Personalty

• MACRS table (200% DB w/ ½ year convention)

• Straight-line option for personalty

• Section 179 expense election

• 50% bonus depreciation

o May elect out for entire class of property

Realty

• Straight-line mandatory for real estate

3-13

Section 179 Expense Election

• Election to immediately expense

• Up to $500,000 (for 2013) of qualifying property

Qualifying property

• Tangible

• Personalty

• For use in active conduct of a trade or business

Limitations

• Phaseout for property placed in service over

$2 million

• Taxable income limitation

3-14

Learning Objectives

3–1: Identify the type of property in a situation.

3–2: Analyze a situation to determine the correct

treatment for property-related expenditures.

3–3: Analyze a situation to calculate the adjusted basis of

property.

3–4: Analyze a situation to calculate the cost recovery

deductions over the recovery period.

3–5: Analyze a situation to calculate the election or

deduction amount under Section 179.

3–6: Analyze a situation to calculate the amount of cost

recovery recapture, or unrecaptured Section 1250

income.

3–7: Analyze a situation to determine the tax treatment of

Section 1231 property transactions.

3-15

Cost Recovery Recapture

Calculating Cost Recovery Recapture on

Section 1245 Property*

Calculate gain

realized and

recognized.

Calculate Section

1245 gain

Calculate Section

1231 gain

Lesser of: cost

recovery

deductions taken

or gain realized.

Gain recognized

less Section

1245 gain.

*Assumes no basis adjustments other than cost recovery deductions.

3-16

Section 1245 Recapture

Sale Price

$15

Cost Basis

$10

Depreciation

Adjusted Basis

Sale Price

$(7)

§1231

Potential LTCG

§1245 Income

Cost Recovery

Recapture

Ordinary Income

$3

$1

§1231

Ordinary Loss

3-17

Unrecaptured Section 1250 Income

Sale Price

$15

Cost Basis

$10

S/L Depreciation

Adjusted Basis

Sale Price

$(7)

§1231

LTCG

Unrecaptured §1250

Income

(Type of §1231 gain)

25% LTCG

$3

$1

§1231

Ordinary Loss

3-18

Section 1231 Lookback

• Lookback period—5 years

• If unrecaptured §1231 losses during lookback

•

period

Current year net §1231 gains

treated as ordinary income

3-19

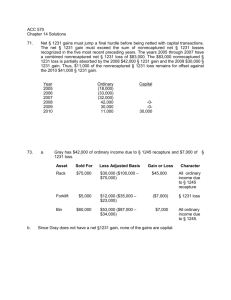

Review Question 1

A leasehold interest in an apartment building is

considered

a. tangible realty.

b. tangible personalty.

c. intangible realty.

d. intangible personalty.

3-20

Review Question 2

A taxpayer purchases a new computer for use in his

consulting business. He incurs sales taxes and shipping

charges in connection with the purchase.

Which one of the following correctly describes

treatment of the sales taxes and shipping charges?

a. Both are currently deductible.

b. Both are capitalized.

c. The sales taxes are capitalized, and the shipping

charges are currently deductible.

d. The sales taxes are currently deductible, and the

shipping charges are capitalized.

3-21

Review Question 3

Don Reeves purchased a small duplex for use as a

rental property. After the property was placed in

service, he made some improvements; and later in the

year, he made some repairs to the property.

Which one of the following statements is correct

regarding treatment of the expenditures?

a. The improvements and repairs must be capitalized.

b. The improvements must be capitalized; the repairs

are currently deductible.

c. The improvements are currently deductible; the

repairs must be capitalized.

d. The improvements and repairs are currently

deductible.

3-22

Review Question 4

The basis of an asset acquired by inheritance

generally is

a. the greater of the decedent’s adjusted basis

or the fair market value on the date of

death.

b. the lesser of the decedent’s adjusted basis

or the fair market value on the date of

death.

c. the decedent’s adjusted basis.

d. the fair market value on the date of death.

3-23

Review Question 5

This year, Jeff Walker purchased a parcel of raw

land on which he could construct a new building

for his hardware business. He paid $50,000 for

the land and incurred $500 in legal fees

associated with the title search. Property taxes

on the land have totaled $1,200 annually.

What is Jeff’s adjusted basis in the land?

a. $50,500

b. $51,200

c. $51,700

3-24

Review Question 6

Two years ago, Jeff Walker purchased new office

equipment for use in his hardware business. The

cost of the equipment was $15,000, and freight

and installation costs totaled $500. He received a

first-year cost recovery deduction of $2,215 and a

second-year cost recovery deduction of $3,796.

What is Jeff’s adjusted basis in the equipment?

a. $8,989

b. $9,489

c. $15,000

d. $15,500

3-25

Review Question 7

Two years ago, Sam Jones received a gift of

100 shares of common stock from his parents.

The fair market value of the stock on the date

of the gift was $10 per share. His parents had

purchased the stock four years earlier at $3 per

share. Sam sold this stock for $12 per share last

week.

What was Sam’s per share basis in the stock

when it was sold?

a. $3

b. $10

c. $12

3-26

Review Question 8

Jerry’s uncle gave him 100 shares of ABC, Inc.,

common stock. The fair market value of the

stock on the date of the gift was $20 per share.

Jerry’s uncle had purchased the stock 22

months earlier at $30 per share. Jerry sold his

holdings of the stock for $24 per share three

weeks ago.

What was Jerry’s gain or loss on the sale of the

stock?

a. ($600)

b. $0

c. $400

3-27

Review Question 9

Mary purchased a used pickup truck at a cost of

$4,200 with sales taxes of $300, to use in her

delivery business. She purchased the pickup

(5-year property) and placed it in service on

January 1 of the current year.

Using MACRS, what is the first-year cost

recovery deduction that Mary can claim?

a. $450

b. $900

c. $1,800

3-28

Review Question 10

Bill purchased an automobile at a cost of $7,500 to

use in his pizza delivery business. He also paid

$500 in sales taxes on the vehicle. He purchased

the automobile (5-year property) and placed it in

service on March 1 of the current tax year.

Using the straight-line method available as an

option under MACRS, what is the first-year cost

recovery deduction that Bill can claim?

a. $750

b. $800

c. $1,500

d. $1,600

3-29

Review Question 11

Frank Jones owns and operates a small

business as a sole proprietor. On August 7,

2013, he purchased equipment (7-year

property) at a cost of $625,000 to use in his

business. He qualifies for and elects the

maximum Section 179 expense deduction.

What is the total amount of deductions that

Frank can claim in 2013? Use the MACRS table.

a. $375,000

b. $500,000

c. $517,863

d. $625,000

3-30

Review Question 12

Mary Grey purchased office furniture several

years ago at a cost of $4,500 to use in her

business. She claimed $3,295 of cost recovery

deductions. She sold the furniture for $3,000.

What is the amount and character of the gain

or loss resulting from this disposition?

a. $1,500 ordinary loss

b. $1,500 capital loss

c. $1,795 of ordinary income, $0 long-term

capital gain

d. $1,795 long-term capital gain, $0 of ordinary

income

3-31

Review Question 13

Julio Gallardo owns and operates a manufacturing plant

as a sole proprietor. He purchased a machine used in

the manufacturing process at a cost of $12,000 several

years ago. Julio sold the machine for $16,000 after

claiming $3,184 of cost recovery deductions.

Calculate the amount and nature (character) of the gain

or loss resulting from this disposition.

a. $3,184 of ordinary income, $4,000 long-term capital

gain

b. $4,000 of ordinary income, $3,184 long-term capital

gain

c. $7,184 of ordinary income

d. $7,184 long-term capital gain

3-32

Review Question 14

Which one of the following statements is correct

regarding the tax treatment of Section 1231

and 1245?

a. Net Section 1231 gains are treated as

ordinary income.

b. Net Section 1231 gains are treated as longterm capital gains.

c. Section 1245 income is treated as capital

gain income.

d. Section 1245 losses are treated as ordinary

losses.

3-33

Review Question 15

During the current year, Peter Langley has Section 1231

gains totaling $8,000. He also has $1,000 of Section

1231 losses. Four years ago, Peter reported a net

Section 1231 loss of $2,000. These are the only two

years in which Peter has had Section 1231 gains or

losses.

What is the amount and character of the current year’s

Section 1231 gains and losses?

a. $2,000 of ordinary income, $5,000 long-term capital

gain

b. $5,000 of ordinary income, $2,000 long-term capital

gain

c. $7,000 of ordinary income

d. $7,000 long-term capital gain

3-34

Review Question 16

In 2013, Kevin Allen purchased various items of

depreciable tangible personal property with a total cost

of $528,000 for use in his business. Kevin has taxable

income (without regard to the Section 179 deduction)

of $116,000 from his business. He also has wages from

a part-time job of $14,000.

What is the maximum Section 179 expense deduction

that Kevin may claim in 2013?

a. $116,000

b. $130,000

c. $500,000

d. $528,000

3-35

CERTIFIED FINANCIAL PLANNER CERTIFICATION

PROFESSIONAL EDUCATION PROGRAM

Income Tax Planning

Module 3

End of Slides

©2013, College for Financial Planning, all rights reserved.