Dear Unitholder: February 26, 2013

advertisement

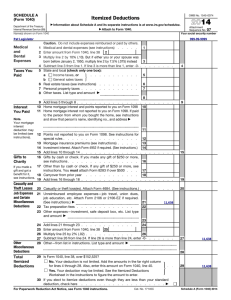

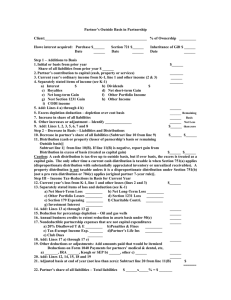

0.000000 (NYSE:EPB) February 26, 2013 JANUARY 2012 TEST K1 1001 LOUISIANA STREET SUITE 1000 HOUSTON, TX 77002 Dear Unitholder: Enclosed is your El Paso Pipeline Partners, L.P. (EPB or Partnership) tax package for 2012. The information contained in this package is being provided to you because the Partnership has been notified either by your broker or the Partnership’s transfer agent that you were an owner of Partnership units during the 2012 tax year. Accordingly, if the information provided by your broker or the transfer agent is incorrect, the information being reported to you and the Internal Revenue Service (IRS) will be incorrect. To that end, it is important that you carefully review the information included in this package and, in particular, the Transaction Schedule (explained below) to ensure it is consistent with the information sent to you by your broker or transfer agent for 2012. If you have not received a 2012 brokerage statement reflecting that you owned Partnership units, please contact EPB’s Tax Package Support (contact information below) so that the Partnership can update its records. The information contained in this package is more voluminous than what you may be use to receiving from your traditional equity investments in corporations. This is largely attributable to the more tax-favorable structure of EPB as a publicly-traded partnership (PTP) under the U.S. tax laws. As a PTP, the Partnership generally does not pay taxes like a corporation, thereby allowing for more cash to be distributed to its unitholders. Such favorable tax treatment creates some additional complexity compared with traditional investments in a corporation. For example, the Form 1099 issued by corporations merely reports interest and dividends. Partnerships, however, are required to separately report many different items of income, gain, loss, deduction and credit on a Schedule K-1. Careful attention to the information contained herein and, if needed, the assistance of a tax advisor, should allow you to report this information on your tax return with little difficulty. Also, please note that additional guidance is provided on the EPB Website, which may be accessed at www.eppipelinepartners.com and clicking K-1 Tax Information. Specifically, the following documents are being provided in this package: 1. Schedule K-1 and Instructions: The most important document in the Package, the Schedule K-1, provides your share of the Partnership’s 2012 income, deductions, credits, and related items. The K-1 information is to be included in your tax return to be filed for the 2012 tax year. Because of certain reporting limitations on the K-1, the Partnership also provides other important operating results needed in the preparation of your tax return in the Additional Information Statement described below. Also note, if applicable, that Box 1 of the Schedule K-1 includes Internal Revenue Code (Code) Section 743(b) adjustments. The Partnership has made a Code Section 754 election to adjust the basis of partnership property when property is distributed or when a partnership interest is transferred (under Code Section 743(b)). T.E9A021113a-1-1 DPSYS_NEWPAGE LANKNAME 02/11/2013 FOREIGN PARTNER GENERAL PARTNER TEST ALL BUCKETS LARGE NEGATIVES 6 LINES NAME ADDRESS 111222333 000000008131 DPBLANKNAME 2. Additional Information Statement: This Statement provides the K-1 box number, the code, the description, and the dollar amount for those items in box 20 marked in the Schedule K-1 with an asterisk and/or STMT. More specifically: • Box 20 items relate to the following: State bonus depreciation adjustment 3. State Information: Since the Partnership has operations in various states, you may be required to file an income tax return with those states. The Partnership is subject to and does pay the Texas Franchise (Margin) Tax, which is treated as a state income tax for federal income tax purposes. This State Information is not a tax return document. 4. Transactions Schedule and Sales Worksheet: These two important schedules contain your history of EPB units bought or sold by date and number of units, as reported to the Partnership by your broker or the Partnership’s transfer agent. In addition, if you sold EPB units during the 2012 tax year, the Sales Worksheet is provided to calculate your gain or loss from the disposition of Partnership units. The 2012 Sales Worksheet provides specific instructions to calculate your ordinary and capital gain or loss, as the case may be. In addition, if you reported ordinary income from the sale of your units, you will need to file a Code Section 751 Statement; an example is provided on the Sales Worksheet. Also included for your assistance in better understanding the tax reporting rules for taxpayers receiving K-1s are: FAQs and Graphic Guide. The FAQs address general tax-related issues associated with you receiving a Schedule K-1, rather than a Form 1099. The Graphic Guide links the information reflected on the Schedule K-1 to the specific tax forms that may be required in the filing of your 2012 federal income tax return. Finally, you should note that (1) your K-1 reflects certain nonrecourse liabilities of the Partnership being allocated to you likely resulting in an increase in your tax basis, and (2) the Partnership continues to claim bonus depreciation in 2012 resulting in an increased allocation of the related depreciation deduction. Any corrections to this information or any other information reflected in this package must be submitted to the Partnership by May 1, 2013 in any one of the following ways: 1. Mail to El Paso Pipeline Partners, L.P., Attention: Tax Package Support, P.O. Box 799060, Dallas, TX 75379-9060; 2. Call Tax Package Support at 1-866-709-8274; or 3. Submit corrections online through the Partnership’s website at www.eppipelinepartners.com. At this site, click K-1 Tax Information, which takes you to the Partnership’s Tax Reporting Package logon screen. There you will be able to view your 2012 tax schedules, request changes to incorrect information, print your tax package, transfer K-1 information to IRS forms, and print blank IRS forms. Also, please note that for the first time unitholders may elect to receive their K-1 Information exclusively through the Partnership’s website by clicking the link named "Go Paperless" located on the registered user’s home page. Failure to submit corrections by May 1st may require you to include in your federal income tax return Treasury Form 8082 - "Notice of Inconsistent Treatment or Administrative Adjustment". Thank you for your investment in EPB. El Paso Pipeline Partners, L.P. While EPB invests hundreds of millions of dollars each year to grow the company and operate our assets safely, we have always taken pride in being prudent with how we spend your money. To that point, we will not print and mail hard copies of our annual report. Instead, we will publish Chairman and CEO Richard D. Kinder’s unitholder letter on our web site at www.eppipelinepartners.com. Both the letter and EPB’s Form 10-K will be available online by early March. We hope that the resulting cost savings, along with the benefit of reducing our impact on the environment, outweighs any inconvenience. Please direct any inquiries to Investor Relations at (800) 324-2900 or (713) 369-9490. T.E9A021113a-1-2 651112 Final K-1 2012 Schedule K-1 (Form 1065) Department of the Treasury Internal Revenue Service Part III Partner’s Share of Current Year Income, Deductions, Credits, and Other Items For calendar year 2012, or tax year beginning , 20 Partner’s Share of Income, Deductions, a See back of form and separate instructions. Credits, etc. Part I A Information About the Partnership Ordinary business income (loss) 2 Net rental real estate income (loss) 3 Other net rental income (loss) 4 Guaranteed payments 5 Interest income 6a Ordinary dividends 6b Qualified dividends 15 Credits 16 Foreign transactions 17 Alternative minimum tax (AMT) items -526 Partnership’s employer identification number 26-0789784 B 1 , 2012 ending OMB No. 1545-0099 Amended K-1 5 Partnership’s name, address, city, state, and ZIP code EL PASO PIPELINE PARTNERS LP 1001 LOUISIANA ST HOUSTON, TX 77002 C IRS Center where partnership filed return D X 0 7 Royalties 8 Net short-term capital gain (loss) 9a Net long-term capital gain (loss) 9b Collectibles (28%) gain (loss) 9c Unrecaptured section 1250 gain 10 Net section 1231 gain (loss) 11 Other income (loss) OGDEN Check if this is a publicly traded partnership (PTP) Part II E Information About the Partner Partner’s identifying number 260-78-9784 F Partner’s name, address, city, state, and ZIP code JANUARY 2012 TEST K1 1001 LOUISIANA STREET SUITE 1000 HOUSTON, TX 77002 A 72 B -1 18 32 G X General partner or LLC member-manager Limited partner or other LLC member H X I1 What type of entity is this partner? (see instructions) I2 If this partner is a retirement plan (IRA/SEP/Keogh/etc.), check here (see instructions) . . . . . . . . . . . . . J Domestic partner Foreign partner 0.000000 0.000000 0.000000 Loss Capital K % % 12 Section 179 deduction 13 Other deductions . . . . . . . $ Recourse . $ . . . . . . 2 Distributions A 2,140 Other information % % 18,736 $ Qualified nonrecourse financing C 20 % Partner’s share of liabilities at year end: Nonrecourse 1 19 . 0.000454 0.000454 0.000454 % A Individual Partner’s share of profit, loss, and capital (see instructions): Beginning Ending Profit Tax-exempt income and nondeductible expenses 14 A 5 N 1,112 V -526 Self-employment earnings (loss) Y* Beginning capital account . . . Capital contributed during the year $ Current year increase (decrease) . $ . . $ ( . . $ . X GAAP Tax basis 0 34,900 -490 2,140 32,270 $ Withdrawals & distributions Ending capital account . Section 704(b) book Other (explain) M STMT *See attached statement for additional information. Partner’s capital account analysis: ) For IRS Use Only L Did the partner contribute property with a built-in gain or loss? X No Yes If “Yes,” attach statement (see instructions) For Paperwork Reduction Act Notice, see Instructions for Form 1065. IRS.gov/form1065 Cat. No. 11394R Schedule K-1 (Form 1065) 2012 Schedule K-1 (Form 1065) 2012 Page This list identifies the codes used on Schedule K-1 for all partners and provides summarized reporting information for partners who file Form 1040. For detailed reporting and filing information, see the separate Partner’s Instructions for Schedule K-1 and the instructions for your income tax return. 1. Ordinary business income (loss). Determine whether the income (loss) is passive or nonpassive and enter on your return as follows. Report on See the Partner’s Instructions Passive loss Passive income Schedule E, line 28, column (g) Nonpassive loss Schedule E, line 28, column (h) Nonpassive income Schedule E, line 28, column (j) 2. Net rental real estate income (loss) See the Partner’s Instructions 3. Other net rental income (loss) Net income Schedule E, line 28, column (g) Net loss See the Partner’s Instructions 4. Guaranteed payments Schedule E, line 28, column (j) 5. Interest income Form 1040, line 8a 6a. Ordinary dividends Form 1040, line 9a 6b. Qualified dividends Form 1040, line 9b Schedule E, line 4 7. Royalties 8. Net short-term capital gain (loss) Schedule D, line 5 Schedule D, line 12 9a. Net long-term capital gain (loss) 9b. Collectibles (28%) gain (loss) 28% Rate Gain Worksheet, line 4 (Schedule D instructions) 9c. Unrecaptured section 1250 gain See the Partner’s Instructions 10. Net section 1231 gain (loss) See the Partner’s Instructions 11. Other income (loss) Code A Other portfolio income (loss) See the Partner’s Instructions B Involuntary conversions See the Partner’s Instructions C Sec. 1256 contracts & straddles Form 6781, line 1 D Mining exploration costs recapture See Pub. 535 E Cancellation of debt Form 1040, line 21 or Form 982 F Other income (loss) See the Partner’s Instructions 12. Section 179 deduction See the Partner’s Instructions 13. Other deductions A Cash contributions (50%) B Cash contributions (30%) C Noncash contributions (50%) D Noncash contributions (30%) See the Partner’s E Capital gain property to a 50% Instructions organization (30%) F Capital gain property (20%) G Contributions (100%) H Investment interest expense Form 4952, line 1 I Deductions—royalty income Schedule E, line 19 J Section 59(e)(2) expenditures See the Partner’s Instructions K Deductions—portfolio (2% floor) Schedule A, line 23 L Deductions—portfolio (other) Schedule A, line 28 M Amounts paid for medical insurance Schedule A, line 1 or Form 1040, line 29 N Educational assistance benefits See the Partner’s Instructions O Dependent care benefits Form 2441, line 12 P Preproductive period expenses See the Partner’s Instructions Q Commercial revitalization deduction See Form 8582 instructions from rental real estate activities R Pensions and IRAs See the Partner’s Instructions S Reforestation expense deduction See the Partner’s Instructions T Domestic production activities See Form 8903 instructions information U Qualified production activities income Form 8903, line 7b V Employer’s Form W-2 wages Form 8903, line 17 W Other deductions See the Partner’s Instructions 14. Self-employment earnings (loss) Note. If you have a section 179 deduction or any partner-level deductions, see the Partner’s Instructions before completing Schedule SE. A Net earnings (loss) from Schedule SE, Section A or B self-employment B Gross farming or fishing income See the Partner’s Instructions C Gross non-farm income See the Partner’s Instructions 15. Credits A Low-income housing credit (section 42(j)(5)) from pre-2008 buildings B Low-income housing credit (other) from pre-2008 buildings C Low-income housing credit (section 42(j)(5)) from See the Partner’s Instructions post-2007 buildings D Low-income housing credit (other) from post-2007 buildings E Qualified rehabilitation expenditures (rental real estate) F Other rental real estate credits G Other rental credits H Undistributed capital gains credit Form 1040, line 71; check box a I Alcohol and cellulosic biofuel fuels See the Partner's Instructions credit } } 16. } Report on Code J Work opportunity credit K Disabled access credit L Empowerment zone and renewal community employment credit M Credit for increasing research See the Partner’s Instructions activities N Credit for employer social security and Medicare taxes O Backup withholding P Other credits Foreign transactions A Name of country or U.S. possession B Gross income from all sources Form 1116, Part I C Gross income sourced at partner level Foreign gross income sourced at partnership level D Passive category E General category Form 1116, Part I F Other Deductions allocated and apportioned at partner level Form 1116, Part I G Interest expense H Other Form 1116, Part I Deductions allocated and apportioned at partnership level to foreign source income I Passive category J General category Form 1116, Part I K Other Other information L Total foreign taxes paid Form 1116, Part II M Total foreign taxes accrued Form 1116, Part II N Reduction in taxes available for credit Form 1116, line 12 Form 8873 O Foreign trading gross receipts P Extraterritorial income exclusion Form 8873 Q Other foreign transactions See the Partner’s Instructions Alternative minimum tax (AMT) items A Post-1986 depreciation adjustment See the Partner’s B Adjusted gain or loss C Depletion (other than oil & gas) Instructions and D Oil, gas, & geothermal—gross income the Instructions for E Oil, gas, & geothermal—deductions Form 6251 F Other AMT items Tax-exempt income and nondeductible expenses A Tax-exempt interest income Form 1040, line 8b B Other tax-exempt income See the Partner’s Instructions C Nondeductible expenses See the Partner’s Instructions Distributions A Cash and marketable securities B Distribution subject to section 737 See the Partner’s Instructions C Other property Other information A Investment income Form 4952, line 4a B Investment expenses Form 4952, line 5 Form 4136 C Fuel tax credit information D Qualified rehabilitation expenditures See the Partner’s Instructions (other than rental real estate) E Basis of energy property See the Partner’s Instructions F Recapture of low-income housing Form 8611, line 8 credit (section 42(j)(5)) G Recapture of low-income housing Form 8611, line 8 credit (other) H Recapture of investment credit See Form 4255 I Recapture of other credits See the Partner’s Instructions J Look-back interest—completed See Form 8697 long-term contracts K Look-back interest—income forecast See Form 8866 } } } 17. 18. 19. 20. } } method L Dispositions of property with section 179 deductions M Recapture of section 179 deduction N Interest expense for corporate partners O Section 453(l)(3) information P Section 453A(c) information Q Section 1260(b) information R Interest allocable to production expenditures S CCF nonqualified withdrawals T Depletion information—oil and gas U Amortization of reforestation costs V Unrelated business taxable income W Precontribution gain (loss) X Section 108(i) information Y Other information } See the Partner’s Instructions 2 2012 SCHEDULE K-1 ADDITIONAL INFORMATION STATEMENT PARTNER NAME: JANUARY 2012 TEST K1 PARTNER ACCOUNT NUMBER: MAN 5232013115043 PARTNER FEDERAL ID/ENTITY: 260-78-9784 / Individual CUSTODIAN FEDERAL ID: PARTNERSHIP FEDERAL ID: K-1 CODES 20Y1 20Y2 26-0789784 DESCRIPTION AMOUNT/SOURCE Federal Bonus Depreciation Adjustment for Box 1 Gross Receipts 333 5,692 For tax year 2012, the Partnership has elected to take bonus depreciation for qualifying assets placed into service for federal income tax purposes. However there are certain states (non-conforming states) that do not allow the federal bonus depreciation adjustment. If you reside in one of the non-conforming states, when preparing your resident state income tax return you must adjust the amount reported on Box 1 of your Schedule K-1 by the bonus depreciation adjustment provided in the Schedule K-1 Supplemental Information Box 20. See the FAQs for a listing of the non-conforming states. T.E9A021113a-1-5 TRANSACTIONS SCHEDULE NOTE: THIS TRANSACTIONS SCHEDULE IS NOT PROOF OF OWNERSHIP NOR SHOULD IT BE CONSTRUED AS PROOF OF OWNERSHIP IN EL PASO PIPELINE PARTNERS, L.P. JANUARY 2012 TEST K1 MAN 5232013115043 260-78-9784 / Individual PARTNER FEDERAL ID/ENTITY: PARTNER NAME: PARTNER ACCOUNT NUMBER: CUSTODIAN FEDERAL ID: 26-0789784 PARTNERSHIP FEDERAL ID: TRANSACTION DESCRIPTION AC BUY DATE 1/1/2012 BROKER OR CERTIFICATE NUMBER BROKER-MAN UNITS 1,000.0000 1,000.0000 END OF YEAR UNITS T.E9A021113a-1-7 2012 STATE INFORMATION JANUARY 2012 TEST K1 MAN 5232013115043 PARTNER FEDERAL ID/ENTITY: 260-78-9784 / Individual PARTNER NAME: PARTNER ACCOUNT NUMBER: CUSTODIAN FEDERAL ID: PARTNERSHIP FEDERAL ID: 26-0789784 State Information State AL CO FL GA KS LA MS MT OK SC TN UT WY (1) NET ORDINARY INCOME OR LOSS (-) -79 -58 -2 -35 -10 -37 -11 0 -5 0 0 -9 -83 (2) PORTFOLIO DIVIDEND INCOME (3) PORTFOLIO INTEREST INCOME 0 0 0 0 0 0 0 0 0 0 0 0 0 (4) INVESTMENT INTEREST EXPENSE 1 1 0 1 0 0 0 0 0 0 0 0 1 T.E9A021113a-1-6 (5) FOREIGN TAXES ACCRUED 0 0 0 0 0 0 0 0 0 0 0 0 0 (6) GROSS RECEIPTS 0 0 0 0 0 0 0 0 0 0 0 0 0 905 674 60 1,245 119 432 395 2 53 4 2 103 954 (7) STATE INCOME TAX 0 0 0 0 0 0 0 0 0 0 0 0 0 Supplemental Income and Loss 2012 GRAPHIC GUIDE 2012 Attach to Form 1040, 1040NR, or Form 1041. ▶ Information about Schedule E and its separate instructions is at www.irs.gov/form1040. ▶ Department of the Treasury Internal Revenue Service (99) Name(s) shown on return Part I OMB No. 1545-0074 (From rental real estate, royalties, partnerships, S corporations, estates, trusts, REMICs, etc.) Attachment Sequence No. 13 Your social security number Income or Loss From Rental Real Estate and Royalties Note. If you are in the business of renting personal property, use Schedule C or C-EZ (see instructions). If you are an individual, report farm rental income or loss from Form 4835 on page 2, line 40. A Did you make any payments in 2012 that would require you to file Form(s) 1099? (see instructions) Yes No Schedule E (Form 2012 Attachment SequenceYes No. 13 No Page 2 or will you 1040) file required Forms 1099? B If “Yes,” did you Your social security number shown on return. Do not (street, enter name andstate, social security number if shown on other side. 1a Physical Name(s) address of each property city, ZIP code) A Caution. The IRS compares amounts reported on your tax return with amounts shown on Schedule(s) K-1. B Income or Loss From Partnerships and S Corporations Note. If you report a loss from an at-risk activity for which C Part II is not at risk, mustproperty check the box in column (e) on line 28 and attach Form 6198. Personal Use See instructions. 2 amount 1b Type of Property any For each rental realyou estate listed Fair Rental Days QJV above, report the number of fair rental and Days (from list27below)Are you reporting any days. loss not allowed in abox prior year due to the at-risk or basis limitations, a prior year personal use Check the QJV A A not reported on Form 8582), or unreimbursed unallowed loss from a passive activity (iftothat only if you meet the requirements file loss as was a qualified joint venture. See instructions. Yes No B partnership expenses? If you answered “Yes,” see instructions before completing this section. B (c) Check if (d) Employer (e) Check if C C (b) Enter P for (a) Name 28 partnership; S foreign identification any amount is Type of Property: for S corporation partnership number not at risk A 1 Single Family Residence 3 Vacation/Short-Term Rental 5 Land 7 Self-Rental B 2 Multi-Family Residence 4 Commercial 6 Royalties 8 Other (describe) El Paso Pipeline Partners, L.P. Income: Properties: A B C C D 3 Rents received . . . . . . . . . . . . . 3 Nonpassive Income and Loss 4 Royalties received . . . Passive 4 . . . Income . . . and . Loss . . (f) Passive loss allowed (g) Passive income (h) Nonpassive loss (i) Section 179 expense (j) Nonpassive income Expenses: from Schedule K–1 deduction from Form 4562 from Schedule K–1 5 Advertising . . (attach . . Form . 8582 . . if required) . . . . . .from . Schedule 5 K–1 A 6 Auto and travel (see instructions) . . . . . . . 6 B maintenance . . . . . . . . . 7 Cleaning and 7 8 Commissions. . . . . . . . . . . . . . 8 C 9 Insurance D . . . . . . . . . . . . . . . 9 29a professional Totals 10 Legal and other fees . . . . . . . 10 Totals 11 Managementbfees . . . . . . . . . . . . 11 30 Add columns (g) and of line 29a . . . 12. . . . . . . . . . . . . . . . . . 30 12 Mortgage interest paid to banks, etc. (j) (see instructions) ) 31 Add . 13. . . . . . . . . . . . . . . . . . 31 ( 13 Other interest. . . columns . . . (f), . (h), . and . . (i) .of line . . 29b . 14 Repairs. 32 . . Total . . .partnership . . . . and . .S .corporation . . . 14 income or (loss). Combine lines 30 and 31. Enter the 32 15 Supplies . . result . . .here . and . .include . . in . the . total . . on . line 41 15 below . . . . . . . . . . . . . . . and 16 Taxes . Part . . III . . Income . . . or . .Loss . .From . . Estates . . 16 Trusts (b) Employer 17 Utilities . 33 . . . . . . . . . . . . . . . 17(a) Name identification number 18 Depreciation expense or depletion . . . . . . . 18 Other (list) A▶ 19 19 B 20 Total expenses. Add lines 5 through 19 . . . . . 20 Income and Nonpassive Income and Loss Subtract line 20 from line 3 (rents) Passive and/or 4 (royalties). If Loss 21 A Passive deduction or loss (d) Passive income (e) Deduction or loss (f) Other income from result is a (loss), see(c)instructions to find outallowed if you must from Schedule K–1 Schedule K–1 file Form 6198 . . (attach . . .Form . 8582 . . if required) . . . . . 21 from Schedule K–1 OMB No. 1545-0074 BArental real estate loss after limitation, if any, Deductible 22SCHEDULE Interest and Ordinary Dividends )( )( ) (Formon 1040A or8582 1040) B (see instructions) . . . . . . . Form 22 ( Totals ▶ Attach 23a Total of all 34a amounts reported on line 3 for all rental properties . or . 1040. . . 23a to Form 1040A Department of the Treasury Attachment ▶ Information about Schedule B (Form 1040A or 1040) and its instructions is at www.irs.gov/form1040. Internal Revenue (99) b Totals b Total ofService all amounts reported on line 4 for all royalty properties . . . . 23b Sequence No. 08 Name(s) shown 35 Addreported columnson (d)line and12 (f)for of line 34a . . . . . . . . . . . . . . . . 23c . . . . . . Your . . social . .security . number 35 c Total ofon allreturn amounts all properties Addreported columnson (c)line and18 (e)for of all lineproperties 34b . . . . . . . . . . . . . . . 23d . . . . . . . . . . . 36 ( d Total of all 36 amounts e Total amounts linetrust 20If for allinterest properties . Combine . . lines . . 35 mortgage 23e 36. Enter 1 Total Listreported name payer. any from a. seller-financed and the Part I of all 37 estateofon and income or is (loss). and the result here Amount and buyeramounts used property a personal include in thethe total on line 41 below .residence, . include . . see . .instructions . . . . on . . back . . . . and . . .list . . . . 37 24 Income. Add positive shown onasline 21. Do not any losses . . . . 24 ▶ interest first. show thatReal buyer’s social security number and total address ) Part IVthislosses Income or Loss From Estate Mortgage Investment Conduits Holder 25Interest Losses. Add royalty from lineAlso, 21 and rental real estate losses from line 22. Enter losses here (REMICs)—Residual 25 ( The amounts reported on your 2012 Federal Schedule K-1 are represented by letters. Follow the arrows for each letter to locate the line on the appropriate federal form in which to report your federal amounts. *If the sum of boxes 1, 2, 3, 4, 8, 9a, 10, 11, 12, and 13J on your Schedule K-1 result in a negative number (a passive activity loss) do not report any of the amounts from boxes 1, 2, 3, 4, 8, 9a, 9b, 9c, 10, 11, 12, 13J, 15, and 17 on your 2012 federal tax return unless you sold all of your partnership units prior to January 1, 2013. If the sum of boxes 1, 2, 3, 4, 8, 9a, 10, 11, 12, and 13J on your Schedule K-1 result in a positive number, or if you sold units in the current year, see page 4 of the enclosed partner’s instructions for Schedule K-1 for instructions regarding Publicly Traded Partnerships. You may also want to consult your Tax Advisor. B (c) Excess inclusion from Employer (d)here. Taxable income (net loss) (e) Income from Total rental38real estate(a) and royalty income(b)or (loss). identification Combine lines 24 and 25. Enter Name Schedules Q, linethe 2c result from number Schedules Q, line 1b Schedules Q, line 3b instructions) If Parts II, III, IV, and line 40 on page 2 do not apply to you, also enter this (see amount on Form 1040, line (See instructions 17,and or Form 26 on back the 1040NR, line 18. Otherwise, include this amount in the total on line 41 on page 2 . . . . 39 Combine columns (d)tax and (e) only. Enter the result here and in the total on line 41 belowE (Form 391040) 2012 Forinstructions PaperworkforReduction Act Notice, see your return instructions. Schedule Cat.include No. 11344L Department of the Treasury Internal Revenue Service 1 . . . . . Total income or (loss). Combine lines 26, 32, 37, 39, and 40. Enter the result here and on Form 1040, line 17, or Form 1040NR, line 18 ▶ 41 Note. If you received a Form 42 1099-INT, Form 1099-OID, or substitute statement from a brokerage firm, 43 list the firm’s name as the 2 payer and enter 3 the total interest shown on that form. 4 Part I Partnership’s employer identification number B Partnership’s name, address, city, state, and ZIP code C D 42 G 2 H 3 Schedule E (Form 1040) 2012 4 Amount Note. If you received a Form 1099-DIV or substitute statement from a brokerage firm, (99) list the firm’s Department of the Treasury—Internal Revenue Service name as the U.S. Individual Income Tax Return OMB No. 1545-0074 IRS Use Only—Do not write or staple in this space. payer and enter See separate instructions. For the year Jan. 1–Dec. 31, 2012, or other tax year beginning , 2012, ending , 20 the ordinary Add the amounts Last on name line 5. Enter the total here and on Form 1040A, or Form Your social security number Your dividends first name and initial 6 shown 6 1040, line 9a . . . . . . . . . . . . . . . . . . . . . . ▶ on that form. K (See instructions on Filing Status back.) Check only one box. Apt. no. L c Spouse . Dependents: (1) First name . . . . . . . . . . . (2) Dependent’s social security number Last name . . . . . . . . } . . Boxes checked B (Form 1040A or 1040) 2012 . Schedule . . . . . (4) ✓ if child under age 17 qualifying for child tax credit (see instructions) (3) Dependent’s relationship to you If you did not get a W-2, see instructions. Enclose, but do not attach, any payment. Also, please use Form 1040-V. Adjusted Gross Income Other net rental income (loss) 4 Guaranteed payments 5 Interest income 6a Ordinary dividends 6b Qualified dividends 15 16 Part I Foreign transactions B D Royalties 8 Net short-term capital gain (loss) 9a Net long-term capital gain (loss) 9b Collectibles (28%) gain (loss) 9c Unrecaptured section 1250 gain 17 A B Alternative Minimum Taxable Income (See instructions for how to complete each line.) 1 If filing Schedule A (Form 1040), enter the amount from Form 1040, line 41, and go to line 2. Otherwise, enter the amount from Form 1040, line 38, and go to line 7. (If less than zero, enter as a negative amount.) Credits C 7 2012 Attachment Sequence No. 32 Your social security number Name(s) shown on Form 1040 or Form 1040NR Alternative minimum tax (AMT) items G H 1 2 Medical and dental. Enter the smaller of Schedule A (Form 1040), line 4, or 2.5% (.025) of Form 1040, line 38. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . 3 Taxes from Schedule A (Form 1040), line 9 . . . . . . . . . . . . . . . . . . . . 4 Enter the home mortgage interest adjustment, if any, from line 6 of the worksheet in the instructions for this line 5 Miscellaneous deductions from Schedule A (Form 1040), line 27. . . . . . . . . . . . . . 6 Skip this line. It is reserved for future use . . . . . . . . . . . . . . . . . . . . . 7 Tax refund from Form 1040, line 10 or line 21 . . . . . . . . . . . . . . . . . . . 8 Investment interest expense (difference between regular tax and AMT). . . . . . . . . . . . 9 Depletion (difference between regular tax and AMT) . . . . . . . . . . . . . . . . . 10 Net operating loss deduction from Form 1040, line 21. Enter as a positive amount . . . . . . . . 11 Alternative tax net operating loss deduction . . . . . . . . . . . . . . . . . . . . 12 Interest from specified private activity bonds exempt from the regular tax . . . . . . . . . . 13 Qualified small business stock (7% of gain excluded under section 1202) . . . . . . . . . . . 14 Exercise of incentive stock options (excess of AMT income over regular tax income) . . . . . . . . 15 Estates and trusts (amount from Schedule K-1 (Form 1041), box 12, code A) . . . . . . . . . 16 Electing large partnerships (amount from Schedule K-1 (Form 1065-B), box 6) . . . . . . . . . 17 Disposition of property (difference between AMT and regular tax gain or loss) . . . . . . . . . 18 Depreciation on assets placed in service after 1986 (difference between regular tax and AMT) . . . . 19 Passive activities (difference between AMT and regular tax income or loss) . . . . . . . . . . 20 Loss limitations (difference between AMT and regular tax income or loss) . . . . . . . . . . . 21 Circulation costs (difference between regular tax and AMT) . . . . . . . . . . . . . . . 22 Long-term contracts (difference between AMT and regular tax income) . . . . . . . . . . . 23 Mining costs (difference between regular tax and AMT) . . . . . . . . . . . . . . . . 24 Research and experimental costs (difference between regular tax and AMT) . . . . . . . . . . 25 Income from certain installment sales before January 1, 1987 . . . . . . . . . . . . . . 26 Intangible drilling costs preference . . . . . . . . . . . . . . . . . . . . . . . 27 Other adjustments, including income-based related adjustments . . . . . . . . . . . . . 2 3 4 5 6 7 ( 8 9 10 11 ( 12 13 14 15 16 17 18 19 20 21 22 23 24 25 ( 26 27 28 Alternative minimum taxable income. Combine lines 1 through 27. (If married filing separately, see instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28 ) A E ) J M G H ) Limited partner or other LLC member Domestic partner Foreign partner E 18 12 29 Exemption. See instructions . Tax-exempt income and nondeductible expenses 13 20 % Capital % % A . . . . . $ $ . . 14 $ . . . Distributions Other information I $ . $ . . $ ( . . $ Current year increase (decrease) Withdrawals & distributions Ending capital account . . Tax basis GAAP . . . . . . . . . . . . 4952 ) Section 704(b) book . 29 . 30 } . Total Investment Interest Expense 35 AMT. Subtract line 34 from line 33. If zero or less, enter -0-. Enter here and on Form 1040, line 45 . Self-employment earnings (loss) Part II . . . . . . 31 OMB No. 1545-0191 32 . 2012 . . . . . . Cat. No. 11394R 1 2 3 . . . 4c Form 6251 (2012) I . 4f . . . . income (see . . . . . . . . . . . . . . . . 4g 4h 5 6 Investment Interest Expense Deduction For Paperwork Reduction Act Notice, see page 4. IRS.gov/form1065 35 . . . Disallowed investment interest expense to be carried forward to 2013. Subtract line 6 from line 3. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . Investment interest expense deduction. Enter the smaller of line 3 or 6. See instructions . . 8 Yes No If “Yes,” attach statement (see instructions) . . . Net Investment Income Part III 7 . . . Cat. . .No. .13600G . . Gross income from property held for investment (excluding any net gain from the disposition of property held for investment) . . . 4a b Qualified dividends included on line 4a . . . . . . . . . 4b c Subtract line 4b from line 4a . . . . . . . . . . . . . . . . . . d Net gain from the disposition of property held for investment . . 4d e Enter the smaller of line 4d or your net capital gain from the disposition of property held for investment (see instructions) . 4e f Subtract line 4e from line 4d . . . . . . . . . . . . . . . . . . g Enter the amount from lines 4b and 4e that you elect to include in investment instructions) . . . . . . . . . . . . . . . . . . . . . . . . h Investment income. Add lines 4c, 4f, and 4g . . . . . . . . . . . . . 5 Investment expenses (see instructions) . . . . . . . . . . . . . . . Net investment income. Subtract line 5 from line 4h. If zero or less, enter -0- . . 6 Did the partner contribute property with a built-in gain or loss? For Paperwork Reduction Act Notice, see Instructions for Form 1065. . . . . . . . . . . . . Investment Interest. Expense Deduction Act Notice, seeor your tax return instructions. 1For Paperwork InvestmentReduction interest expense paid accrued in 2012 (see instructions) 2 Disallowed investment interest expense from 2011 Form 4952, line 7 . 3 Total investment interest expense. Add lines 1 and 2 . . . . . . $ Other (explain) . 32 Alternative minimum tax foreign tax credit (see instructions) . Part I *See attached statement for additional information. . . 4a Partner’s capital account analysis: . . • All others: If line 30 is $175,000 or less ($87,500 or less if married filing separately), multiply line 30 by 26% (.26). Otherwise, multiply line 30 by 28% (.28) and subtract $3,500 ($1,750 if married filing separately) from the result. Partner’s share of liabilities at year end: . . Other deductions % . . ▶ % . . Information about 4952 33 Tentative minimum tax. Subtract line 32 fromForm line 31 . and . its . instructions . . . . .is at . www.irs.gov/form4952. . . . . . . . . 33 Attachment Department of the Treasury ▶ Attach to your tax return. Sequence No. 51 Internal Revenue Service (99) 34 Tax from Form 1040, line 44 (minus any tax from Form 4972 and any foreign tax credit from Form Name(s) shown return 1040,online 47). If you used Schedule J to figure your tax, the amount from line 44 of Form 1040 must be Identifying number refigured without using Schedule J (see instructions) . . . . . . . . . . . . . . . . . 34 % . . Form Loss Recourse . Section 179 deduction Profit Qualified nonrecourse financing . 30 Subtract line 29 from line 28. If more than zero, go to line 31. If zero or less, enter -0- here and on lines 31, 33, and 35, and go to line 34 . . . . . . . . . . . . . . . . . . . . . . . . . 31 • If you are filing Form 2555 or 2555-EZ, see instructions for the amount to enter. • If you reported capital gain distributions directly on Form 1040, line 13; you reported qualified dividends on Form 1040, line 9b; or you had a gain on both lines 15 and 16 of Schedule D (Form 1040) (as refigured for the AMT, if necessary), complete Part III on the back and enter the amount from line 54 here. . . . Other income (loss) 19 . Partner’s share of profit, loss, and capital (see instructions): Beginning Ending Capital contributed during the year M 11 Net section 1231 gain (loss) 7 8 Form 4952 (2012) Cat. No. 13177Y Schedule K-1 (Form 1065) 2012 Dependents on 6c not entered above d Attach Form(s) W-2 here. Also attach Forms W-2G and 1099-R if tax was withheld. on 6a and 6b No. of children on 6c who: • lived with you • did not live with you due to divorce or separation (see instructions) If more than four dependents, see instructions and check here ▶ Income General partner or LLC member-manager Check here if you, or your spouse if filing b 3 Partner’s name, address, city, state, and ZIP code Beginning capital account . Make sure the SSN(s) above If “Yes,” are you required to file Form TD F 90-22.1 to report that financial interestjointly, or signature want $3 to go to this fund. Checking Foreign postal code Foreign province/state/county a box below will not authority? See Form TD F 90-22.1 and its instructions for filing requirements and exceptions to change your tax or refund. Spouse those requirements . . . . . . . . . . . . . . . . . . . . . . . . . You . 1 b Single 4 name Head household (with qualifying person). If you are required to file Form TD F 90-22.1, enter the ofofthe foreign country where the(See instructions.) If the qualifying person is a child but not your dependent, enter this Married filing jointly (even if only ▶ one had income) 2 financial account is located ▶ child’s here. of, 3 8 Married separately. Enter spouse’s SSN above During filing 2012, did you receive a distribution from, or were you thename grantor or transferor to, a ▶ and full name here. 5 Qualifying widow(er) with dependent foreign trust? If “Yes,” you may have to file Form 3520. See instructions on back . . . child . . . Cat. No.box 17146N 6a Yourself. If someone as a dependent, do not check 6a . For Paperwork Reduction Act Notice, see your can tax claim returnyou instructions. Exemptions Net rental real estate income (loss) A Partner’s identifying number Nonrecourse ▲ a financial At any time during 2012, did you have a financial interest in or signature authority over and on line 6c are correct. Part III account (such as a bank account, securities account, or brokerage account) located in a foreign City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions). Presidential Election Campaign Foreign country? See instructions . . . . . . . . . . . . . . . . . . . . . . . . Accounts and Trusts Information About the Partner If this partner is a retirement plan (IRA/SEP/Keogh/etc.), check here (see instructions) . . . . . . . . . . . . . Note. If line 6 is over $1,500, you must complete Part III. Last name If a joint return, spouse’s first name and initial Spouse’s social security number You must complete this part if you (a) had over $1,500 of taxable interest or ordinary dividends; (b) had a Yes No foreign account; or (c) received a distribution from, or were a grantor of, or a transferor to, a foreign trust. Foreign country name Check if this is a publicly traded partnership (PTP) I2 2012 7a IRS Center where partnership filed return What type of entity is this partner? (see instructions) 5 Home address (number and street). If you have a P.O. box, see instructions. EL PASO PIPELINE PARTNERS, L.P. 1001 Louisiana St Houston, TX 77002 I1 J C (See instructions on back and the instructions for Form 1040A, or Form 1040, line 9a.) Form E 2 10 Ordinary Dividends 1040 26-0789784 Part II Ordinary business income (loss) OMB No. 1545-0074 about Form 6251 and its separate instructions is at www.irs.gov/form6251. ▶ Attach to Form 1040 or Form 1040NR. Part II Alternative Minimum Tax (AMT) Reconciliation of farming and fishing income. Enter your gross farming and fishing income reported on Form 4835, line 7; Schedule K-1 (Form 1065), box 14, code B; Schedule K-1 (Form 1120S), box 17, code U; and Schedule K-1 (Form 1041), box 14, code F (see instructions) . . Reconciliation for real estate professionals. If you were a real estate professional (see instructions), enter the net income or (loss) you reported Add the amounts on line 1 . 1040NR . . . from . . all.rental . .real. estate . . activities . . . . . . anywhere on Form 1040 or Form inExcludable which you materially under passive activitybonds loss rules . . after 43 1989. interest participated on series EE andthe I U.S. savings issued Attach Form 8815 . . . . . . . . . . . . . . . . . . . . . Subtract line 3 from line 2. Enter the result here and on Form 1040A, or Form 1040, line 8a . . . . . . . . . . . . . . . . . . . . . . ▶ Note. If line 4 is over $1,500, you must complete Part III. List name of payer ▶ 5 Part II Information About the Partnership A 1 , 2012 , 20 Partner’s Share of Income, Deductions, ▶ See back of form and separate instructions. Credits, etc. F 40 41 year beginning OMB No. 1545-0099 Amended K-1 Alternative Minimum Tax—Individuals ▶ Information Department of the Treasury Internal Revenue Service (99) Part III Partner’s Share of Current Year Income, Deductions, Credits, and Other Items For calendar year 2012, or tax ending 26 Form 1040A, or Part V Summary Form 1040, 40 Net farm rental income or (loss) from Form 4835. Also, complete line 42 below . line 8a.) Final K-1 2012 Schedule K-1 (Form 1065) 2012 ) 6251 Form 651112 For IRS Use Only SCHEDULE E (Form 1040) 7 8a b 9a b Total number of exemptions claimed . . . . . . . . . . . . . . . Wages, salaries, tips, etc. Attach Form(s) W-2 . Taxable interest. Attach Schedule B if required . Tax-exempt interest. Do not include on line 8a . Ordinary dividends. Attach Schedule B if required . . . . . . . . . . . . . . 8b . . . . . . . . . . . . . . . . 8a . . D . . . . . 9a . . . . 10 11 Qualified dividends . . . . . . . . . . . 9b Taxable refunds, credits, or offsets of state and local income taxes Alimony received . . . . . . . . . . . . . . . . . . . 10 11 12 13 14 Business income or (loss). Attach Schedule C or C-EZ . . . . . . . . . Capital gain or (loss). Attach Schedule D if required. If not required, check here ▶ Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . . . 12 13 14 15a 16a 17 IRA distributions . 15a b Taxable amount . . . Pensions and annuities 16a b Taxable amount . . . Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 15b 16b 17 18 19 20a Farm income or (loss). Attach Schedule F . Unemployment compensation . . . . Social security benefits 20a 18 19 20b 21 22 Other income. List type and amount Combine the amounts in the far right column for lines 7 through 21. This is your total income . . . . . . . . 23 Reserved 24 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 or 2106-EZ 25 26 27 Health savings account deduction. Attach Form 8889 Moving expenses. Attach Form 3903 . . . . . . . . . . . . . . . . . 28 Deductible part of self-employment tax. Attach Schedule SE . Self-employed SEP, SIMPLE, and qualified plans . . 27 28 29 30 31a 32 33 Self-employed health insurance deduction Penalty on early withdrawal of savings . . . . . . . . . . Alimony paid b Recipient’s SSN IRA deduction . . . . . . Student loan interest deduction . 36 37 . . . . . . . . . . . . . . . . . ▶ Form 4797 Department of the Treasury Internal Revenue Service Sales of Business Property OMB No. 1545-0184 2012 (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) ▶ ▶ Attach to your tax return. Information about Form 4797 and its separate instructions is at www.irs.gov/form4797. 1 Enter the gross proceeds from sales or exchanges reported to you for 2012 on Form(s) 1099-B or 1099-S (or substitute statement) that you are including on line 2, 10, or 20 (see instructions) . . . . . . . . 1 Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft—Most Property Held More Than 1 Year (see instructions) (a) Description of property 2 27 Identifying number Name(s) shown on return Part I Attachment Sequence No. (b) Date acquired (mo., day, yr.) (c) Date sold (mo., day, yr.) (e) Depreciation allowed or allowable since acquisition (d) Gross sales price (f) Cost or other basis, plus improvements and expense of sale El Paso Pipeline Partners, L.P. (26-0789784) (g) Gain or (loss) Subtract (f) from the sum of (d) and (e) E 21 22 23 . 24 25 26 Reserved . . . . . . . . . . . . . . b Taxable amount . . 34 35 . . Add numbers on lines above ▶ 7 . . . . . . . . . . . . . . 29 30 31a 32 33 . . . . . . . 34 ▶ Domestic production activities deduction. Attach Form 8903 35 Add lines 23 through 35 . . . . . . . . . . . . . Subtract line 36 from line 22. This is your adjusted gross income . . TX-48981 El Paso Pipeline.indd 1 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. . . . . . . . . . ▶ 36 37 Cat. No. 11320B Form 1040 (2012) 3 4 5 Gain, if any, from Form 4684, line 39 . . . . . . . . . . . Section 1231 gain from installment sales from Form 6252, line 26 or 37 . Section 1231 gain or (loss) from like-kind exchanges from Form 8824 . 6 7 Gain, if any, from line 32, from other than casualty or theft. . . . . . . . . . . . . . . . . . Combine lines 2 through 6. Enter the gain or (loss) here and on the appropriate line as follows: . . . . . . . Partnerships (except electing large partnerships) and S corporations. Report the gain or (loss) following the instructions for Form 1065, Schedule K, line 10, or Form 1120S, Schedule K, line 9. Skip lines 8, 9, 11, and 12 below. Individuals, partners, S corporation shareholders, and all others. If line 7 is zero or a loss, enter the amount from line 7 on line 11 below and skip lines 8 and 9. If line 7 is a gain and you did not have any prior year section 1231 losses, or they were recaptured in an earlier year, enter the gain from line 7 as a long-term capital gain on the Schedule D filed with your return and skip lines 8, 9, 11, and 12 below. 6 7 8 Nonrecaptured net section 1231 losses from prior years (see instructions) . 8 9 Subtract line 8 from line 7. If zero or less, enter -0-. If line 9 is zero, enter the gain from line 7 on line 12 below. If line 9 is more than zero, enter the amount from line 8 on line 12 below and enter the gain from line 9 as a long-term capital gain on the Schedule D filed with your return (see instructions) . . . . . . . . . . . . . . Part II 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Ordinary Gains and Losses (see instructions) Ordinary gains and losses not included on lines 11 through 16 (include property held 1 year or less): . . . . . . . . . . . . . . . . . . . . 3 4 5 9 2/5/13 8:33 AM TX-48981 FREQUENTLY ASKED QUESTIONS Q: Are the cash distributions I received from the Partnership taxable? A: In general, cash distributions received from the Partnership are not taxable. You are required to report in your tax return only those items of income, gain, loss, deduction or tax credit as reflected on your Schedule K-1. Q: Why is the amount of cash I received different than my allocable share of Partnership income, gain, loss, deduction or credit? A: The Partnership distributes available cash determined by the Partnership agreement. The calculation of cash available for distribution differs from the calculation of taxable income to be reported to the partners. For example, depreciation is an expense that reduces taxable income reported to the partners but does not reduce cash available for distribution. Q: If I sell my Partnership units, how is my tax basis determined for computing gain or loss? A: Your tax basis is the original amount paid for the Partnership units, adjusted as follows: • Increased by the cumulative amounts of income and gain reported to you on Schedule K-1; • Reduced by the cumulative amounts of loss, deduction and credit reported to you on Schedule K-1; • Increased by the non recourse debt allocated to you on the Schedule K-1; • Reduced, but not below zero, by the cumulative amounts of cash distributions received from the Partnership. Q: Does the Schedule K-1 show my tax basis in Partnership units? A: No. However, the Schedule K-1 Box L – Partner’s Capital Account Analysis, may provide an approximation of your ending tax basis for all units owned at December 31. The amount reflected in the Ending Capital Account includes your original cost of units, as reported to the Partnership by your broker, and other adjustments affecting tax basis. However, brokers do not always report original cost to the Partnership, or the original cost reported may be incorrect. When brokers do not report original cost to the Partnership, the low closing price for the month in which you purchased units is assumed to be the cost. This assumption, or incorrect reporting by the broker, can cause this year end amount to be different than your actual tax basis at December 31. The current year increase(decrease) amount for Box L is computed as follows: sum of boxes 1, 2, 3, 4, 5, 6a, 7, 8, 9, 10, 11, 12, and 18C. Q: If I sell my Partnership units at a gain, why is part of the gain treated as ordinary income rather than capital gain? A: A sale of Partnership units is treated as if there was a sale of the partner’s allocable share of each of the Partnership’s assets. Gain on the sale of assets from which depreciation deduction has been taken is treated as ordinary income rather than capital gain. The ordinary income on sale of units represents the depreciation deduction previously allocated to you. Q: If my Schedule K-1 reports a passive activity loss from Partnership operations, does this mean the Partnership was not profitable? A: No. The net income of the Partnership for 2012 before certain items was $608 million and $589 million, including certain items. Any operating loss reported to partners for tax purposes is due principally to tax depreciation expense in excess of GAAP depreciation expense. Q: What is bonus depreciation? A: Favorable federal tax legislation passed in 2010 allows the Partnership to accelerate depreciation for certain qualifying property placed in service prior to January 1, 2012 resulting in larger tax deductions for the 2012 tax year. Such benefit, however, has not been adopted by all states; accordingly, this tax package may include information for both conforming and non-conforming states. Q: Which states are non-conforming? A: The following states are non-conforming: Arizona, Arkansas, California, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, New Hampshire, New Jersey, New York, North Carolina, Ohio, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Vermont, Virginia, Wisconsin. Q: What additional forms may be required for filing of my tax return? Form 1040 US Individual Income Tax Return Form 1040 Schedule B - Interest and Ordinary Dividends Form 1040 Schedule E - Supplemental Income and Loss Form 4797 Sales of Business Property Form 4952 Investment Interest Expense Deduction Form 6251 Alternative Minimum Tax – Individuals Form 8082 Notice of Inconsistent Treatment or Administrative Adjustment Request Q: What is a nonrecourse liability and how does it affect my tax basis in the Partnership? A: A partnership liability is treated as a nonrecourse liability to the extent that no partner or related person bears the economic risk of loss for such liability. A partner’s tax basis in the partnership includes its share of the partnership’s nonrecourse liabilities. A: TX-48981 El Paso Pipeline.indd 2 2/5/13 8:33 AM