1065 prep_10_book.indb

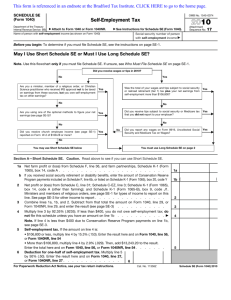

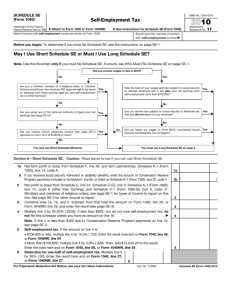

advertisement