FIN - East West University

advertisement

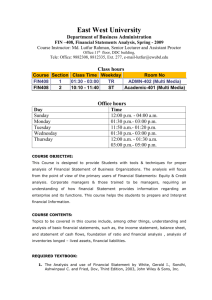

East West University Department of Business Administration FIN -201, Sec – 1, Business Finance, Spring - 2009 Course Instructor: Md. Lutfur Rahman, Senior Lecturer & Assistant proctor Office:11th floor, DDC building, Tele Office: 9882308, 8812335, Ext. 277, e-mail-lutfur@ewubd.edu Class hours Course Section Class Time Weekday Room No FIN201 1 03:10 - 04:40 MW DDC-1001 Office hours Day Time Sunday Monday Tuesday Wednesday Thursday 12:00 p.m. - 03:00 p.m. 01:30 p.m.- 03:00 p.m. 12:00 a.m.- 03:00 p.m. 01:30 p.m.- 03:00 p.m. 12:00 a.m. - 02:00 a.m. COURSE OBJECTIVE The Course is designed to orient students with tools and techniques that managers use for efficient running of the finance department of a corporation. After completing the course, the students are expected to learn how to manage working capital, cash & marketable securities and inventory of a corporation. The student will also learn about financial planning, managing of short term financing, and cost of capital. COURSE CONTENTS This course covers the following topics: Cost of Capital, Financial Planning, Working Capital Management, Managing Cash and Marketable Securities, Credit Management, Inventory Management and Short Term Financing. TEXT BOOK Scott Besley and Eugene F. Brigham - Essentials of Managerial Finance, 13th Edition, The Dryden Press, 2000. OTHER REFERENCE Lawrence J. Gitman - Principles of Managerial Finance, 9th Edition, Herper Collions Publishers Inc., 2001. ATTENDANCE Students are expected to attend all classes and prepare home assignments on due time. Students' participation will be strongly encouraged. If any student misses more than three classes, he/she is required to take course teacher's permission to attend the subsequent classes provided that the student had valid reason for missing the classes. TENTATIVE CLASS SCHEDULE: TOPICS Chapter No. of Class Lawrence J. Gitman - Principles of Managerial Finance 1 1. An Overview of Finance 1 (Topics to be covered: Definition of finance, finance managers responsibility, different forms of business) 2. The Cost of Capital (Topics to be covered: Definition, assumptions of cost of capital, basic concept of cost of capital, cost of long term debt, cost of preferred stock, cost of common stock, weighted average cost of capital, weighting schemes, weighted marginal cost of capital, investment opportunity schedule). 10 3 Scott Besley and Eugene F. Brigham Essentials of Managerial Finance 3. Financial Planning & Control 4 4 (Topics to be covered: Financial planning and control, sales forecast, projected financial statements, operating financial analysis, operating leverage, financial breakeven analysis, and financial leverage). 4. Working Capital Policy (Topics to be covered: Working capital terminology, relationship of working capital accounts, cash conversion cycle, working capital investment and financing policies) 13 2 14 3 Managing Short Term Assets 5. Cash Management (Topics to be covered: Cash management, cash budget, cash management techniques) 6. Credit Management 14 3 14 3 15 3 (Topics to be covered: Credit management, credit policy, receivable monitoring, changes in credit policy) 7. Inventory Management (Topics to be covered: Inventory management, types of inventory, optimal inventory level, inventory control system) 8. Managing Short Term Liabilities (Topics to be covered: Sources of short-term financing, accrual, accounts payable, short term bank loan, cost of bank loan, choosing a bank, use of security in short-term financing) Exam Schedule: Term I Exam- 18 February 2009 Term II Exam – 18 March 2009 Final Exam – 29 April 2009 Home assignments: Home assignments play a key role for quiz and exam preparation. Home assignments must be submitted at the beginning of the class on the day the assignments are due. There will be at least four assignments of which best three will be counted. Quiz: There will be at least four quizzes of which the best three will be counted for the grading purpose. No makeup quiz will be entertained whatever the reason. Examinations: There will be three examinations. Each exam is important and you must be serious about them. Makeup exam is especially discouraged. Penalty for cheating by students in examinations: As per East West University rules “There is zero tolerance for cheating at EWU. Students caught with cheat sheets in their possession, whether used or not used, & or copying from cheat sheets, writing on the palm of hand, back of calculators, chairs or nearby walls, etc. would be treated as cheating in the exam hall. The only penalty for cheating in the exam hall is expulsion from EWU.” COURSE EVALUATION: Grades are earned, not given. Grades will be based on home assignments, quizzes, and examinations. The distribution of total marks of 100 will be as follows: Quizzes 10 percent Assignments and Class performance 10 percent First Mid-term Examination 25 percent Second Mid-term Examination 25 percent Final Examination 30 percent Total 100 percent GRADING POLICY: Guideline for converting numerical scores into letter grades: A+ 73 - below 77 C+ 90 - below 97 A 70 - below 73 C 87 - below 90 A- 67 - below 70 C- 83 - below 87 B+ 63 - below 67 D+ 80 - below 83 B 60 - below 63 D 77 - below 80 B- - below 60 F 97 97- 100