FIN - East West University

advertisement

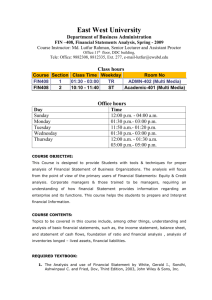

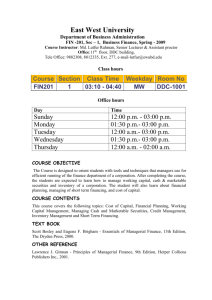

East West University Department of Business Administration FIN –335, Sec – 2, Financial Institutions & Markets, Spring - 2009 Course Instructor: Md. Lutfur Rahman, Senior Lecturer and Assistant Proctor Office: 11th floor, DDC building, Tele: Office: 9882308, 8812335, Ext. 277, e-mail-lutfur@ewubd.edu Class hour Course Section Class Time Weekday Room No FIN335 2 11:50 - 01:20 MW Academic-603 (Multi Media) FIN335 3 03:10 - 04:40 ST ADMN-602 (Multi Media) FIN335 4 10:10 - 11:40 TR Academic-401 (Multi Media) Office hour Day Sunday Monday Tuesday Wednesday Thursday Time 12:00 p.m. - 03:00 p.m. 01:30 p.m.- 03:00 p.m. 12:00 a.m.- 03:00 p.m. 01:30 p.m.- 03:00 p.m. 12:00 a.m. - 02:00 a.m. COURSE OBJECTIVE Financial markets facilitate the flow of funds in order to finance the investment by individual, corporations and governments. Financial institutions are the key players in financial markets. Hence, an understanding of money and capital markets and financial instruments traded in these markets and the discussions of major financial institutions are the major focus of the course. COURSE CONTENTS This course covers the following topics: The role of financial markets and institutions, the money markets, the bond markets, the stock markets, the mutual funds, the commercial banks, the insurance companies and the Bangladesh financial markets. TEXT BOOK: Jeff Madura – Financial markets and institutions, 7th Edition, South Western College publishing, 2001. OTHER REFERENCE Robert W. Kolb and Ricardo J. Rodruguez, Financial Institutions, Black Well Publishers, First Edition, 1996 ATTENDANCE Students are expected to attend all classes and prepare home assignments on due time. Students' participation will be strongly encouraged. If any student misses more than three classes, he/she is required to take course teacher's permission to attend the subsequent classes provided that the student had valid reason for missing the class. TENTATIVE CLASS SCHEDULE TOPICS Chapter No. of Class 1 2 (Topics to be covered: Loanable fund theory, 2 economic forces that affect interest rates) 2 1. Role of Financial markets and institutions (Topics to be covered: Types of markets, types of securities, valuation of securities in financial markets) 2. Determination of interest rates 3. Money market ((Topics to be covered: Money markets securities, Institutional use of money markets, valuation and risk 9 of money markets securities, Interaction among money markets yeilds) 2 4. Bond markets (Topics to be covered: Background on bond, 6 Different types of bonds, institutional use of bond markets) 3 5. Stock offering and investor monitoring (Topics to be covered: Background on stock, IPO, 10 Secondary stock offering, stock exchanges, investor participation in the secondary markets, monitoring by investors, corporate monitoring role0 4 6. Market strategies and microstructure (Topics to be covered: Stock market transactions, how trades are executed, regulation of stock trading) 12 1 7. Mutual fund operations (Topics to be covered: Background on mutual fund, different types of mutual fund, performance of mutual fund) 24 3 17 2 (Topics to be covered: Background, types of life insurance policies, sources of funds, uses of funds, exposure to risk, asset management, reinsurance, 26 valuation of an insurance company) 2 8. Commercial Banks (Topics to be covered: Banks sources of funds, uses of funds by banks) 9. Insurance operations 10. Pension fund operation (Topics to be covered: Background, different types of pension plan, pension fund management) 10. Bangladesh Capital markets 25 1 2 Exam Schedule: Term I Exam- 18 February 2009 Term II Exam – 18 March 2009 Final Exam – 29 April 2009 Home assignments Home assignments play a key role for quiz and exam preparation. Home assignments must be submitted at the beginning of the class on the day the assignments are due. There will be at least four assignments of which best three will be counted. Quiz There will be at least four quizzes of which the best three will be counted for the grading purpose. No makeup quiz will be entertained whatever the reason. Examinations There will be three examinations. Each exam is important and you must be serious about them. Makeup exam is especially discouraged. Most importantly you must remember that we practice ZERO TOLERANCE for any kind of academic misconduct in the exam hall. Penalty for cheating by students in examinations: As per East West University rules “There is zero tolerance for cheating at EWU. Students caught with cheat sheets in their possession, whether used or not used, & or copying from cheat sheets, writing on the palm of hand, back of calculators, chairs or nearby walls, etc. would be treated as cheating in the exam hall. The only penalty for cheating in the exam hall is expulsion from EWU.” COURSE EVALUATION: Grades are earned, not given. Grades will be based on home assignments, quizzes, and examinations. The distribution of total marks of 100 will be as follows: 1. Quizzes 10 percent 11. Assignments and term paper 10 percent 3. First Mid-term Examination 25 percent 4. Second Mid-term Examination 25 percent 5. Final Examination 30 percent Total 100 percent GRADING POLICY: Guideline for converting numerical scores to letter grades: A+ 73 - below 77 C+ 90 - below 97 A 70 - below 73 C 87 - below 90 A- 67 - below 70 C- 83 - below 87 B+ 63 - below 67 D+ 80 - below 83 B 60 - below 63 D 77 - below 80 B- - below 60 F 97 97- 100