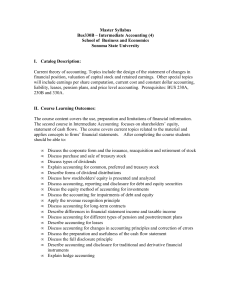

ACCT 401 Syllabus - Darla Moore School of Business

advertisement

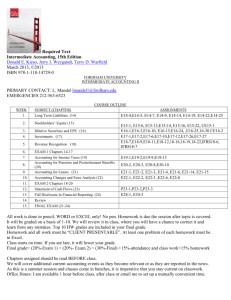

University of South Carolina Moore School of Business ACCT 405 Financial Accounting 2 Section 1 Spring 2011 PREREQUISITES: ACCT 401 (with earned grade of at least a C) INSTRUCTOR: Marcus Caylor OFFICE: 314 OFFICE HOURS: Tuesdays & Thursdays 1:30 pm – 4 pm (Hours also available by appointment) TELEPHONE / EMAIL: 777-6081 / marcus.caylor@moore.sc.edu I prefer to be contacted via this email as opposed to through Blackboard TEXTBOOK: Intermediate Accounting, 13th ed., Kieso, Weygandt and Warfield(REQUIRED) Course Description and Learning Outcomes: This course is a continuation of ACCT 401, the study of financial accounting theory and practice as it relates to the preparation and understanding of financial statements. You will be expected to apply concepts from previous accounting courses to the material of this course. The basic learning outcomes of this course include: 1.) Understanding owner’s equity. 2.) Understanding of the valuation and reporting of investments. 3.) Understanding of the reporting of income taxes. 4.) Understanding of the valuation and reporting of pensions and leases. 5.) Understanding of revenue recognition issues. 6.) Understanding of the reporting of cash flows. Attendance: Students are encouraged to attend every class. Students are responsible for everything that is covered in the class. Academic Dishonesty: You are expected to practice the highest possible standards of academic integrity. Any deviation from this expectation will result in a minimum academic penalty of your failing the assignment, and will result in additional disciplinary measures including referring you to the Office of Academic Integrity. Violations of the University's Honor Code include, but are not limited to improper citation of sources, using another student’s work, and any other form of academic misrepresentation. For more information, see the Carolina Community Student Handbook. 1 Homework: Students are expected to be prepared for every class. You are expected to have read and studied the chapter before we cover it in class. You will only get out of the class as much as you put into it. All assigned exercises and problems should be worked prior to the class meeting for which it is scheduled to be covered. Depending on time, I will work some problems in class and post solutions to other problems on Blackboard. Student Evaluation: Your grade for this course will be based on the number of points you earn from the following: Item Exam #1 Exam #2 Final Exam Total Point value 300 350 350 1,000 Percent of final grade 30% 35% 35% 100% Exams will be roughly 50% multiple choice type questions with the remaining 50% to be word problems. These word problems may require journal entries, financial statement preparation, computations, and/or written explanations. Graded exams will be reviewed in class. Exams may also be reviewed in my office for seven days after the date reviewed in class. After seven days, exam scores are final and exams are not available for review. Approval to be absent from an exam will be granted only in cases of extreme personal emergency, not for convenience. Written documentation must be provided. You must let me know by email as early as possible if you know you will be unable to take an exam on the assigned date. In lieu of makeup exams, the final exam will be given proportionately greater weight. Grading scale: Grades are assigned based on points earned as follows: Points Percent 900 and above 90% and above 870-899 87%-89.9% 800-869 80%-86.9% 770-799 77%-79.9% 700-769 70%-76.9% 600-699 60%-69.9% Below 600 Below 60% Grade A B+ B C+ C D F Withdrawal from course: It is your responsibility to be familiar with university policy governing withdrawal. 2 ACCT 405 Schedule of Events (Subject to Change) Date January 11 Chapter and Topic Chapter 15: Stockholders’ Equity January 13 Chapter 15: Stockholders’ Equity January 18 Chapter 15: Stockholders’ Equity---Problems January 20 Chapter 16: Dilutive Securities and Earnings Per Share January 25 Chapter 16: Dilutive Securities and Earnings Per Share January 27 Chapter 16: Dilutive Securities and Earnings Per Share--Problems February 1 Chapter 17: Investments February 3 Chapter 17: Investments February 8 Chapter 17: Investments---Problems February 10 Chapter 18: Revenue Recognition February 15 Exam 1: Chapters 15-17 February 17 Chapter 18: Revenue Recognition February 22 Go over Exam 1 in class February 24 Chapter 18: Revenue Recognition---Problems February 28 Last Day to Withdraw Without a Grade of “WF” March 1 Chapter 19: Accounting for Income Taxes March 3 Chapter 19: Accounting for Income Taxes March 8 Spring Break – No class March 10 Spring Break – No class 3 Homework Assignment HW Problems: E15-2; E15-5; E15-11; E15-12; E15-13; E15-14; E15-22; P152; P15-5 HW Problems: E16-9; E16-11; E16-14; E16-25; E16-28; P16-2 HW Problems: E17-3; E17-7; E17-9; E17-12; E17-19; P17-5; P17-8 HW Problems: E18-4; E18-7; E18-9; E18-11, E18-16; P18-3; P18-7; P18-8 March 15 Chapter 19: Accounting for Income Taxes---Problems March 17 Chapter 20: Accounting for Pensions and Postretirement Benefits March 22 Chapter 20: Accounting for Pensions and Postretirement Benefits March 24 Chapter 20: Accounting for Pensions and Postretirement Benefits---Problems March 29 Exam 2: Chapters 18-20 March 31 Chapter 21: Accounting for Leases HW Problems: E19-2; E19-5; E19-16; E19-22; E19-23; P19-1 HW Problems: E20-2; E20-4; E20-5; E20-8; E20-12; P20-3 April 5 Go over Exam 2 in class April 7 Chapter 21: Accounting for Leases April 12 Chapter 21: Accounting for Leases---Problems April 14 Chapter 23: Statement of Cash Flows April 19 Chapter 23: Statement of Cash Flows April 21 Chapter 23: Statement of Cash Flows---Problems / Final Exam Review May 2 2 PM - Final Exam with roughly 40% covering Chapters 21 and 23 and the other 60% covering Chapters 15-20. 4 HW Problems: E21-2; E21-4; E21-6; E21-8; E21-12; P21-1 HW Problems: E23-3; E23-4; E23-13; E23-14; P23-1; P23-2 Tips for success: 1. Attend every class. 2. Be prepared for class by reading the covered chapter and working assigned problems. 3. Never get behind because the material will move fast. If you do find that you do not understand a particular concept, please ask me for help immediately! Accountant’s mental toolbox: 1. Know the accounting equation. 2. Know the accounting cycle and journal entries. 3. Know how to use T-accounts. 4. As new concepts and new accounts are learned ask yourself the following questions: a. What type of account is this (i.e., asset, liability, owners’ equity, revenue, expense, gain, or loss)? b. How is this account measured? When can it be recognized/realized? c. On what statement is it to be found? What is its effect on that statement? d. What is the account’s effect on other accounts/statements? 5