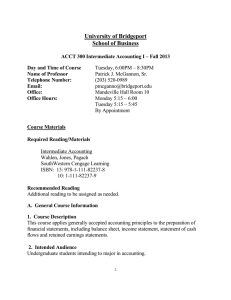

IONA - University of Bridgeport

advertisement

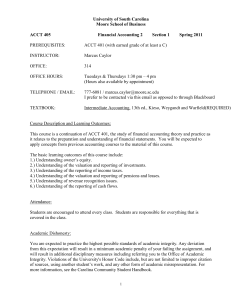

University of Bridgeport School of Business ACCT 301-Intermediate Accounting II Tuesday 6:00PM-8:30PM Accounting Department Spring 2014 Professor: Office: Office Hours: Phone: (203) 520-0989 Email: pmcganno@bridgeport.edu Patrick J. McGannon, Sr., MBA Mandeville Hall Room 10 Tuesday 5:15 – 5:45 & by appointment Required Reading/Materials Intermediate Accounting Wahlen, Jones, Pagach SouthWestern Cengage Learning ISBN: 13: 978-1-111-82237-8 10: 1-111-82237-9 Recommended Reading Additional reading to be assigned as needed. Students should familiarize themselves with business issues by reading some of the various business periodicals and journals. For accounting students the Wall Street Journal and Journal of Accountancy are excellent sources. A. General Course Information 1. Course Description The study of generally accepted accounting principles relating to accounting for leases, post-employment benefits, deferred taxes and other specialized topics. Emphasis on the pronouncement included in the Accounting Standards Codification (ASC) and reporting requirement of the Securities and Exchange Commission. 2. Intended Audience Undergraduate students intending to major in accounting. 3. Course Objectives Upon completion of this course, the students should be able to: Further develop the ability to utilize the Accounting Standards Codification (ASC) Explain property, plant and equipment (PP&E) valuation, acquisition, disposal, post-acquisition costs, and reporting issues Explain the accounting for research and development costs Explain the accounting issues connected with intangible assets Define and explain the accounting issues surrounding current liabilities Calculate the issue price of bonds, and account for premiums, discounts and interest expense Understand the issues related to common and preferred stock, additional paid-in capital and dividends Calculate basic and fully diluted earnings per share Understand the concepts and calculations surrounding deferred and current taxes and valuation allowances Explain the accounting for pensions, leases and investments Understand the issues surrounding accounting changes and income recognition Explain inventory reporting issues, gross profit methods, gross profit valuation, and retail inventory methods ACCT 301 – Prof. McGannon Spring 2014 Page 1 B. Prerequisites ACCT 101, ACCT 102 & ACCT 300 C. Mode of Instruction Classes will consist of discussion of previously assigned reading, topical lectures and problem solving both inside and outside of class. D. Student Responsibilities 1. Academic Honesty Standards Students should familiarize themselves with, and adhere to, the standards as set forth in the policies on cheating and plagiarism as defined in Chapters 2 and 5 of the “Key to UB” or the approved graduate handbook. These standards may be found at http://www.bridgeport.edu/pages/2623.asp. 2. Class Participation Class participation will be comprised of the following items: Assigned problems, attendance and contribution to the class discussion. In addition to the problems we will work in class, there will be problems assigned that the student will work on during discussion of a topic. Once the related topic or chapter is concluded, the student will turn in the assigned problem by the following class session. Problems must be submitted in a neat, orderly, and well thought out manner. Problems MUST be done in EXCEL or some other spreadsheet software. (See Communication below). Do not use WORD or other word processing software, unless assignments call for a written report. I will review submitted problems, and I will look for a reasonable attempt to complete the problem. Do not try to submit problems that were done 15 minutes before they are due. I will know, and I will penalize you accordingly. There is no requirement to get the answer correct. The only requirement is to turn in the problems according to the guidelines stated above. Problems not turned in timely will receive no credit. NO EXCUSES. Students are expected to be fully prepared for all classes, and are encouraged to contribute to the class discussion. Discussion among students usually facilitates the understanding of a topic. Moreover, some students may bring a different view on the subject matter that had not been previously considered. Regular and active class participation enhances the learning process. Attendance will be taken regularly. There are very few reasons for missing class. These are enumerated in the student handbook. Should you believe you have a valid reason, please contact me before class, not at 9:00PM the night of class. You may use your cell phone’s text message service for this purpose. My number is at the beginning of this syllabus. Please note that just coming to class does not guarantee you the full class participation grade. Lateness is also unacceptable, as is leaving during class, coming back late from breaks, or leaving before class is over. All of these will have a detrimental effect on your class participation grade. As with most accounting courses, the student should not expect a positive outcome by simply coming to class each week. You cannot learn this material in 2 ½ hours each week. Students should allocate time outside of class in order to master this material. It is suggested the student devote at least 15-20 hours each week outside class to study this material. 3. Communication The University e-mail system and Canvas will be used to communicate with students. You should check your UB email frequently, but no less than daily. E-mail has developed into the single most used form of communication in business today. As such it is to your advantage to develop the habit of looking at yours frequently. ACCT 301 – Prof. McGannon Spring 2014 Page 2 You must use your UB account to communicate with me, and I will use your account to communicate with you. I don’t need to know any other account you may use, nor do I accept the fact you may never check your UB account. You may use your devices to take notes, etc., but for no other purpose. There will be time during the class breaks to get your updates. As such your devices should be on “Vibrate”. I expect you to respect the learning environment by not sneaking a peek at your phones during class. I maintain neither a Facebook nor Twitter account. Requests to me via these media will go unanswered. E. Grading The course grade will be determined by the following components: Case studies Tests & Quizzes Class Participation Final Examination 20% 40% 10% 30% 100% There will be 5 case studies. Each case study will be worth 20 points. I will provide a rubric for the case evaluation. More on case studies as we progress throughout the term. Tests will be administered every 2-3 topics or chapters. Tentative test dates: February 11 March 11 April 15 All tests will be given in class. Tests will comprise a combination of multiple choice, short problems and short essays. You will be able to use your book and your notes. If you take notes on a laptop they must be printed out. You may not use your laptops during any test. You will be given 1 ½ hours to complete the test. Class will continue after the test. There will be a quiz each week. The quiz will only cover the discussion of the prior week and will last no more than 10 minutes. Questions may be multiple choice or short essays and will be theory-based. Each quiz will be worth 10 points. At the end of the semester I will aggregate the quiz scores and count that as an additional test score. No materials may be used during the quizzes. The final examination is May 6, and may be cumulative. Therefore it is important to constantly review material already covered. If you cram the night before the final you are only getting superficial knowledge of the material. As such this will translate into a superficial grade. Students will be evaluated based upon the categories set forth above. What a student needs, or requires is completely irrelevant. If you need to keep a scholarship, be reimbursed by an employer, get hired by an employer, etc. you must deal with that. It will not ever be a factor in computing your grade. If you keep track of your grades, prepare appropriately for classes and tests, you should know where you stand. It is incumbent upon the student to ask questions, to ask for clarification, or to contact me if he/she is struggling. Final grades will be calculated based upon the following scale: A AB+ B BC+ 94+ 90-93 87-89 84-86 80-83 77-79 4.00 3.67 3.33 3.00 2.67 2.33 ACCT 301 – Prof. McGannon Spring 2014 C CD+ D DF 74-76 70-73 67-69 64-66 60-63 < 60 2.00 1.67 1.33 1.00 0.67 0.00 Page 3 Make-Up Policy: If you miss any of the in-class tests you must take a make-up. The make-up will be the week following the regularly scheduled test. Please note that this is the only time you can make-up a test. In addition, there will be a penalty assessed on the make-up. The penalty will be determined by the point value of the test. There is no make-up for quizzes or the final examination. ACCT 301 – Prof. McGannon Spring 2014 Page 4 TENTATIVE COURSE SCHEDULE & ASSIGNMENTS Date 1/21/2014 1/27/2014 2/4/2014 2/11/2014 2/18/2014 2/25/2014 3/4/2014 3/11/2014 3/18/2014 3/25/2014 4/1/2014 4/8/2014 4/15/2014 4/22/2014 4/29/2014 5/6/2014 Coverage Course introduction Property, Plant & Equipment (Ch. 10) Property, Plant & Equipment (cont’d) Depreciation (Ch. 11) Depreciation (cont’d) Intangibles (Ch. 12) TEST #1 Current Liabilities (Ch. 9) Current Liabilities(cont’d) Bonds Payable (Ch. 14) Bonds Payable (cont’d) Contributed Capital (Ch. 15) Test #2 Retained Earnings/Earnings per Share (Ch. 16) No class – Spring Break Retained Earnings/Earnings per Share (cont’d) Accounting for Income Taxes (Ch. 18) Accounting for Income Taxes (cont’d) Test #3 Accounting for Pensions Accounting for Pensions (cont’d) Accounting for Leases Exercises E10-2, E10-6, E10-7, E10-9, E10-10, E1011, E10-12 Problems P10-4, P10-5 Due Date Completion of Ch. 10 E11-2, E11-10 P11-2 Completion of Ch. 11 E12-1, E12-3, E12-4, E12-9, E12-10, E12-18 E12-19 P12-10 Completion of Ch. 12 E9-2, E9-3, E9-4, E911, E9-13, E9-14, E917, E9-19 P9-18 Completion of Ch. 9 E14-1, E14-2, E14-3, E14-9, E14-14, E14-19 P14-13 Completion of Ch. 14 E15-1, E15-2, E15-7, E15-7, E15-10, E1516, E15-17 P15-9 Completion of Ch.15 E16-1, E16-6, E16-8, E16-10, E16-13, E1617, E16-19, E16-24 P16-7, P16-25 Completion of Ch. 16 E18-1, E18-2, E18-3, E18-5, E18-6, E18-9, E18-10, E18-13, E1814, E18-21 P18-3 Completion of Ch. 18 E19-1, E19-2, E19-5, E19-6, E19-8, E19-10, E19-11 P19-10 Completion of Ch. 19 E20-1, E20-3, E20-6, E20-7, E20-10, E20-11 P20-13 Completion of Ch. 20 Accounting for Leases (cont’d) Course Wrap-up Final Examination ACCT 301 – Prof. McGannon Spring 2014 Page 5