Taxation - Varsityfield

advertisement

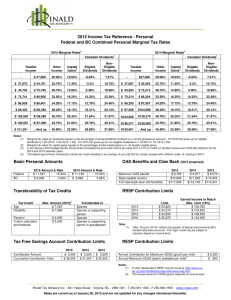

Chapter 3 • • • • • • Personal taxation Company taxation Capital gains tax Other taxes Double taxation South African taxation • What is tax? • Who pays tax? • Who is SARS? • Personal tax will be levied on all financial resources of individuals! • Principle sources: • • • • • Income (earned – wages/salaries or unearned – investment income/rent) Profit from operating as a sole trader or partner Inherited wealth Investment gains Value of assets held • Income tax is often main source of tax revenue for governments • Employed and self-employed pay income tax • Governments may also introduce: • Capital gains tax (section 3) • Wealth tax • Inheritance tax • 1.1 Considerations • Taxing cashflows: o Easier to tax income than wealth because income is an accessible cashflow • Taxing in arrears: o To ensure citizens have sufficient retained income and wealth to meet their essential needs o Also PAYE (pay as you earn) scheme – pay tax when salary is received weekly/monthly o Self employed pay income tax twice a year – estimate made on current year’s earnings and amendment is made when actual earnings are known • 1.1 Considerations (continue….) • Taxing once • In general revenue flows are taxed only once • However, double taxation will be likely if taxed on wealth • 1.2 Calculating taxable income • Tax-free income o Most profits from gambling o Most forms of social security benefit o Income from certain types of investments (example Individual Savings Account) • Tax-free expenditure o Contributions to an approved pension fund scheme o Charitable gifts • 1.2 Calculating taxable income • Income in kind (“fringe” benefits / byvoordeel) o Company cars available for private use o Medical insurance premiums o Free housing o Subsidised mortgages (reduced interest rate payable on mortgage finance) • Investment income deducted at source o Examples: Interest from a building society account is received net of tax – when personal tax calculated will offset the tax already paid o Also company dividends are paid net of tax (but attaching tax credit for recipient – called franked investment income) • 1.2 Calculating taxable income • Allowances o Personal allowance may be deducted from income before determining liability to tax o Also age allowances (pensioners) o Some countries allowance for married couples • 1.3 Tax rates (UK) o Consideration must be given to whether marginal tax rates should increase, remain constant or decrease as the individual’s taxable base varies. o UK tax year 2013/2014 – Marginal tax rates are: 20% (basic rate) 40% (higher rate) 45% (additional rate) o Tax rates are applied to bands of taxable income o Income increases and taken to higher band, the higher marginal rate applies to additional income earned • Question 3.2 Personal allowance is R5 000 Marginal rates 20% for first R40 000 And 40% for taxable income above this. Assuming no adjustments to total income, how much tax will a single person earning R50 000 pay? What proportion of total income is paid in tax? Companies are liable to corporate income tax on their taxable profits! 2.1 Calculating taxable profit • Taxable profits usually include both income (less expenses) and capital gains • Accounting profit: o Starting point Profit on ordinary activities before taxation Sales revenue Less: Expenses Operating profit Plus: Non-trading income (interest, dividends, capital gains) Profit before tax and interest Less: Interest paid Profit before tax • Taxable profit o Accounting profit before tax needs to be adjusted why?? o Since the rules for taxation is not the same as for accounting purposes!!! • The main adjustments are: o Add back any business expenses or potential expenditure which are not allowed for tax (i.e. entertainment of customers, fines for illegal acts) o Add back any charge for depreciation, and instead subtract the allowable “capital allowance” (tax authorities for consistency purposes use their own capital allowances) o Deduct any special reliefs, i.e. research and development costs • The rates of tax o UK tax rate for year 2013/2014 – standard rate for corporation tax is 23% and due to fall to 21% for the tax year 2014/2015 o Small companies pay a lower rate of 20% o Corporation tax rates around the world vary considerably o For simplicity the 30% rate may be used as a proxy for the true rate of corporation tax (both Core Reading and ActEd notes often use tax rate of 30%) • Uses of the corporation tax system o Some countries give relief to shareholders on dividends received – since dividends are paid from post-tax income, tax has already been paid on dividends, therefore dividend income is known as “franked income” meaning income that has already been taxed o Such an “imputed” tax system ensures that there is no disadvantage experienced by the shareholder when company distribute profits (otherwise company and shareholder would pay tax on dividend) o Government incentivise to retain and reinvest earnings with tax system… o How?? Levying higher taxes on dividends than on retained profits or allowing tax relief for new investments o Also pension provision – offering tax relief to encourage to save for retirement