rent or property tax - West Broadway Community Organization

advertisement

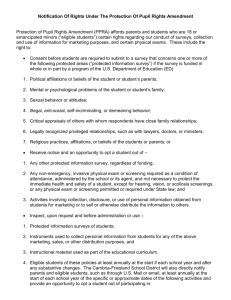

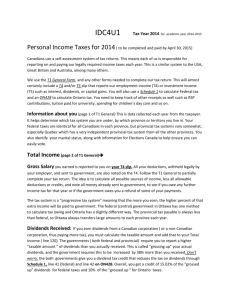

Community Volunteer Income Tax Program Volunteer Name: _______________ Number of Returns Completed:______ Drop Off Sheet 2013 T1S60 reviewed and signed? Yes No Efile confirmation number ____________________________________________ YEARS TO BE FILED 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Do you fit into any of the following situations? If YES, you are NOT eligible to participate in this program. __ Capital Gains __ Farming Income __ Professional/Business Income __ Commission Income __ Pre/Post Bankrupt Return __ Self-Employed __ Deceased Returns __ Rental Income __ Investment income over $1000 __ Employment Expenses __Other Complex Returns __ Single (over $30,000) ___Married/Single parent (over $35,000, plus $2,500 for each dependent) SOCIAL INSURANCE NUMBER_______________________ MR/MRS/MS________ MALE___FEMALE____ FIRST NAME_______________ LAST NAME_____________________ DATE OF BIRTH Year___________ ADDRESS _____________________________________________ Month __________ Do you fit into any of the following situations? If yes, you are NOT eligible to participate in this program. _________________________________ ____ Day ___________ __ Capital Gains __ Farming Income __ Professional/Business Income _________________ CODE_______________ __ Commission Income __ Pre/PostPOSTAL Bankrupt Return __ Self-Employed __ Deceased Returns __ Rental Income __ Investment income over $1000 TELEPHONE NUMBER HOME___________________________ WORK _____________________________ 1. What province did you live in on December 31, 2012? _________________ 2. If filing for prior years fill in province you lived in on December 31, 2010_______and 2011________ 3. Did you immigrate to Canada in 2012 and if so on what date? Y/M/D ________________ 4. Marital Status on December 31, 2012? Married Widowed Common Law (Please Circle One) Single Separated Divorced If Married or Common Law please complete Spouse’s name_______________________ Spouse’s SIN ______________________ Spouse’s date of birth__________________ Spouse’s income for 2012____________ Did marital status change at any time during 2011? What was the date of change? _________ 5. Authorization for Elections Canada? _____Yes ____ No 6. Are you applying for the GSTC? _____ Yes _____ No 7. Do you claim the Disability Tax Credit for yourself or a dependant? YES NO 8. Do you have tuition/education amount? Carry forward amounts? YES NO $____________ 9. Do you have childcare, children’s fitness, children’s art class expenses? YES NO $____________ 10. Do you have medical expenses? 11. Do you have charitable donations? Carry forward amounts? YES NO $____________ YES NO $__________CF $_______ 12. Do you have a safety deposit box? 13. Do you have monthly bus pass receipts to claim? Enter Amount. Please Complete Back pages YES NO $____________ $ ________________ T4 Slip Issuer's name Box 14 (24 & 26) Income Box 16 CPP/QPP Box 18 EI Box 22 Tax Deducted T5007 Slip Box 10 WCB Box 44 Dues Box 46 Donations Box 20 RPP Contributions Box 52 Pension Adjustment RC52 Slip Box 11 Social Assistance Box 14 Rate Box 10 Total Benefits Paid Box 19 Gross Pension Paid Box 20 Overpayment Recovered Box 21 Net Supplement Paid Box 22 Income Tax Deducted Box 21 # of Months Disability Box 23 # of Months - Retirement Box 22 Income Tax Deducted Box 13 Onset or Effective Date Box 18 Lumpsum Payments Box 24 Annuities Box 22 Income Tax Deducted T4A(OAS) Box 18 Taxable Pension Paid T4A(P) Box 20 Taxable CPP Benefits T4A Box 16 Pension or Superannuation T4E Box 14 Total Benefits Paid T4RRIF Box 22 Income Tax Deducted Box 16 Taxable Amounts Box 28 Income Tax Deducted T4RSP Box 16 Annuity Payments Box 28 Other Income or Deductions Box 30 Income Tax Deducted Box 26 Dividend Tax Credit for Eligible Dividends Box 11 Taxable Amount of Dividends Other Than Eligible Dividends Box 12 Interest From Canadian Sources Box 50 Taxable Amt of Eligible Dividends Box 51 Dividend Tax Credit for Eligible Dividends Box 21 Capital Gains Box 22 Withdrawal & Comm. Payments T5 Box 25 Taxable Amount of Eligible Dividends T3 Box 49 Actual Amt of Eligible Dividends Box 30 Capital Gains Eligible for Deduction Box 23 Québec Income Tax Deducted CHILDREN INFORMATION (CHILDREN IN YOUR CARE ONLY) First Name Last Name Date of Birth Relationship Net Income Relationship Net Income Y/M/D ELIGIBLE DEPENDANT INFORMATION First Name Last Name Date of Birth Y/M/D RENT OR PROPERTY TAX Address Number Total Rent or Name of individuals who Name of landlord or Municipality of Property tax shared accommodations to whom payment was Made Months paid in 2012 with you 2012 Proper Identification provided and verified for security purposes: YES NO __________________________________________________________________ _______________________________________________________________________________ Do you require a summary of your tax return? Yes No Unless requested one will not be provided as you should receive your official Notice of Assessment from CRA within 2 weeks, some instances where you may need Line 150 are for applications for different benefits such as Pharmacare, Daycare Subsidy, or Canada Student Loans. Please complete and then Sign the Form T1S60. Please note that if the Form is not completed we will not be able to complete or electronically file your return. Thank you.