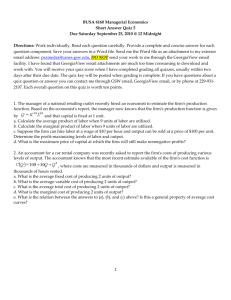

Quiz 9a

advertisement

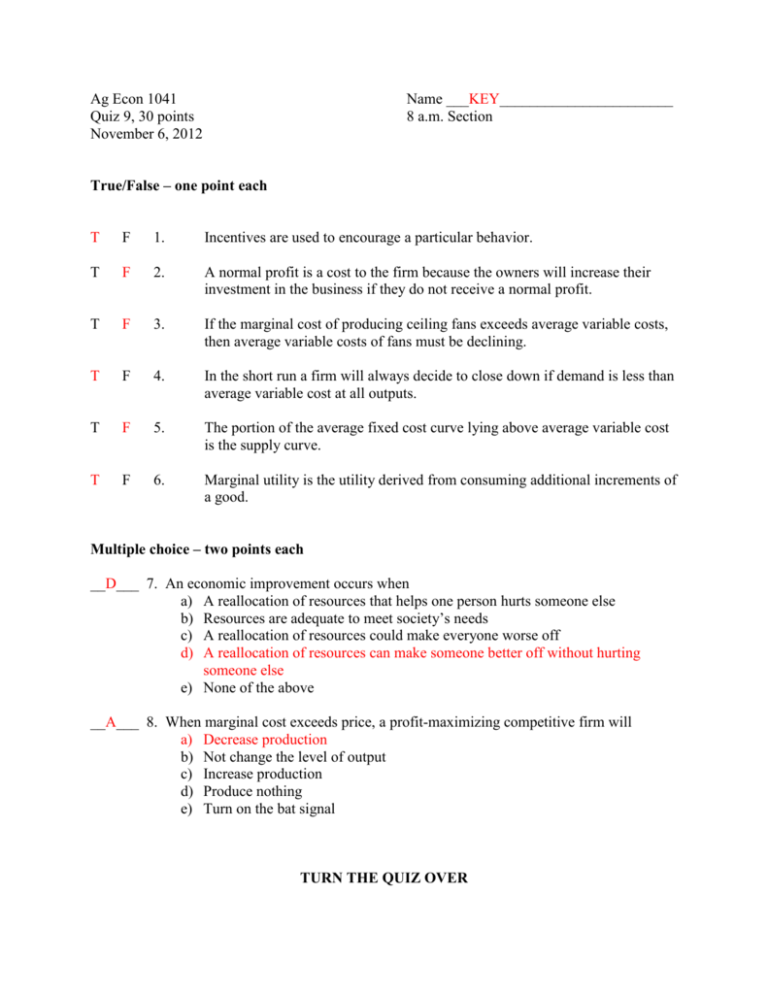

Ag Econ 1041 Quiz 9, 30 points November 6, 2012 Name ___KEY_______________________ 8 a.m. Section True/False – one point each T F 1. Incentives are used to encourage a particular behavior. T F 2. A normal profit is a cost to the firm because the owners will increase their investment in the business if they do not receive a normal profit. T F 3. If the marginal cost of producing ceiling fans exceeds average variable costs, then average variable costs of fans must be declining. T F 4. In the short run a firm will always decide to close down if demand is less than average variable cost at all outputs. T F 5. The portion of the average fixed cost curve lying above average variable cost is the supply curve. T F 6. Marginal utility is the utility derived from consuming additional increments of a good. Multiple choice – two points each __D___ 7. An economic improvement occurs when a) A reallocation of resources that helps one person hurts someone else b) Resources are adequate to meet society’s needs c) A reallocation of resources could make everyone worse off d) A reallocation of resources can make someone better off without hurting someone else e) None of the above __A___ 8. When marginal cost exceeds price, a profit-maximizing competitive firm will a) Decrease production b) Not change the level of output c) Increase production d) Produce nothing e) Turn on the bat signal TURN THE QUIZ OVER Short answers – five points each 9. Market solutions are efficient and the government should mimic their result is the premise of the ____Coase________ ___Theorem___________________. 10. Why do room rental rates increase in the Ozarks in the summer compared to winter? Demand is greater in summer or demand is less in winter Ten points 11. Diagram a per unit tax on gasoline. Be complete. Show deadweight loss and the amount of tax collected. a) What is the impact on consumer surplus? __it decreases_______________________ b) Why are consumers likely to eventually pay the majority of the tax assessed? __inelastic demand_________________________ S1 P S P1 TAX DWL P0 D 0 Q1 Q0 Q