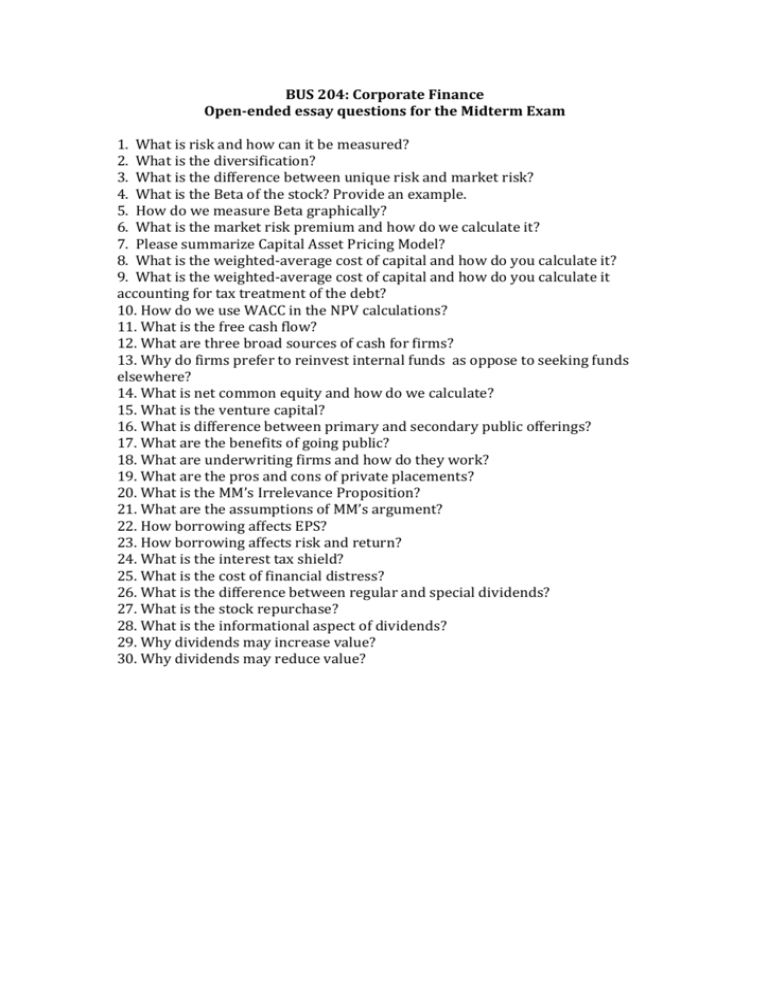

BUS 204: Corporate Finance Open-‐ended essay questions for the

advertisement

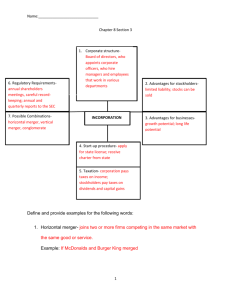

BUS 204: Corporate Finance Open-­‐ended essay questions for the Midterm Exam 1. What is risk and how can it be measured? 2. What is the diversification? 3. What is the difference between unique risk and market risk? 4. What is the Beta of the stock? Provide an example. 5. How do we measure Beta graphically? 6. What is the market risk premium and how do we calculate it? 7. Please summarize Capital Asset Pricing Model? 8. What is the weighted-­‐average cost of capital and how do you calculate it? 9. What is the weighted-­‐average cost of capital and how do you calculate it accounting for tax treatment of the debt? 10. How do we use WACC in the NPV calculations? 11. What is the free cash flow? 12. What are three broad sources of cash for firms? 13. Why do firms prefer to reinvest internal funds as oppose to seeking funds elsewhere? 14. What is net common equity and how do we calculate? 15. What is the venture capital? 16. What is difference between primary and secondary public offerings? 17. What are the benefits of going public? 18. What are underwriting firms and how do they work? 19. What are the pros and cons of private placements? 20. What is the MM’s Irrelevance Proposition? 21. What are the assumptions of MM’s argument? 22. How borrowing affects EPS? 23. How borrowing affects risk and return? 24. What is the interest tax shield? 25. What is the cost of financial distress? 26. What is the difference between regular and special dividends? 27. What is the stock repurchase? 28. What is the informational aspect of dividends? 29. Why dividends may increase value? 30. Why dividends may reduce value?