Getting familiar with Accumulator (Part 3) A s s e t V a lu a tio n B u

advertisement

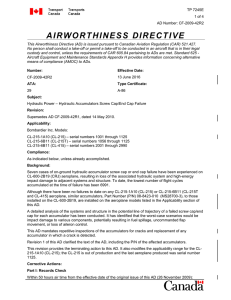

In the last bulletin, we illustrated how accumulator generates profit and loss. As explained previously the leverage effect of the structured product results in a much higher risk and return. In this bulletin, we will revisit a case in Hong Kong that have drawn quite an amount of public ‧‧‧‧ Asset Valuation Bulletin Getting familiar with Accumulator (Part 3) attention during the 2008 financial crisis. We will look into how a public company’s hedging essentially is an accumulator. Real-life Example CITIC Pacific entered into an Australian dollar accumulator in order to hedge against the currency exposure of the company’s iron ore mining project in Australia. The company also aimed to benefit from anticipating strengthening in the Australian dollar above AUS$ 1 = US$0.87. The Australian dollar’s value was rising when the contract was signed. However, after July 2008, the AUD’s value against the USD declined, sliding as low as 1 to 0.65. Eventually, the accumulator contributed to about HK$ 800 million loss. If the Australian dollar fell to AUS$ 1 = Corporate Valuation & Advisory decision turn sour when entering into a “dual currency target redemption forward contracts which US$ 0.5, the loss can escalate to HK$ 260 billion. The tremendous losses have shaken CITIC Pacific as well as the market. After reporting the loss, the firm was downgraded by rating agencies. Its shares also fall 82 percent on the Hong Kong Stock Exchange to HK$ 5.06 on 24 October 2008, compared with HK$ 28.20 a share on 2 July 2008. This case reflected the deficiencies of of awareness on the risk involved in these types of structured products. Some market participants thought that the company should not use the accumulator as the hedging instrument and alleged that it was more likely a speculation of foreign currency. A more conservative approach may involve the management to have a clearer understanding of the pay-off of the product under different scenarios by using sensitivity analysis, thus acknowledging the inherent downside risk. commodities at discount when the market condition is good. However, the financial market have become far more volatile which makes investment on these products only suitable to “professional investors” that truly understand its mechanism. Otherwise it will be yet another wild bet with limited chance of winning. CITIC Pacific’s Time Bomb “http://www.webb-site.com/articles/citicbomb.asp” December 2012 In summary, the accumulator may attract the investors to purchase stocks, currencies or