Learning

advertisement

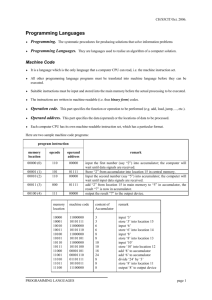

Learning Risky business Investors who used accumulator structures to buy cheap shares are paying the price By Naomi Martig W hen global equity markets plunged last year, many investors succumbed to a selling frenzy. The sudden market downturn has left even some of Hong Kong’s wealthiest tycoons and listed companies badly burned, as many were making investments through the use of “accumulator” structures, which allowed them to purchase shares or currencies at an originally discounted price. One example was CITIC Pacific Ltd., a Hong Kong-listed conglomerate that is 29 percent owned by CITIC Group, a state-owned investment company. CITIC Pacific reported an HK$808 million loss in October as a result of an accumulator bet on the Australian dollar, which slid in value against the U.S. dollar as financial markets seized up. The company later announced a further HK$14.7 billion mark-to-market loss on those currency transactions and the total losses were more than three times its HK$4.4 billion profits for the first six months of 2008. Market analysts say prior to the financial fallout, CITIC Pacific had planted accumulator land mines in foreign exchange trade, many of which failed to include a floor for losses. [ 48 ] A Plus + May 2009 The Hong Kong securities regulator has estimated that US$23 billion worth of these contracts were sold, The Economist reported. Because the contracts are private, it’s hard to tell the exact amount of money lost, but Hong Kong tycoons who reportedly suffered losses included Robert Kuok, head of Kerry Holdings, Joseph Lau, chairman of Chinese Estates Holdings, Lee Shau-kee, who controls Henderson Land, and Wu Man-san, chairman of Hopewell Holdings, according to Next magazine. J. Wong, a CPA who specializes in financial and risk assessment, is well aware of the risks of accumulator contracts and will be giving a CPD seminar on the topic this month. “Accumulator contracts are not very stable. They drive down the market and the result can be horrendous,” says Wong, who has more than 10 years’ financial and risk assessment experience for leading international banks. A typical accumulator contract involves an investor agreeing to purchase a fixed number of shares per day at a pre-agreed price. That price is usually set at 10 to 20 percent below the market price of the shares at the time the contract was made. The contract usually lasts three to 12 months. If the price of the stock or currency rises slightly or stays flat, the investor can benefit from being able to snap it up at a discount. But if the share price rises above a pre-specified level known as the “knock-out price” – normally 2 to 5 percent above the original market price – then the contract effectively ends. The extreme downside to an accumulator contract is when the market falls below the discounted price of the shares and the investor is still obligated to buy them at the pre-set price. “Say, for example, that I’m obliged to buy a company’s shares at HK$40.5, but it’s now only worth HK$30 in the market. Under the accumulator contract, I am required to buy those shares, which clearly results in an ongoing loss when the markets remain down,” Wong explains. In short, an accumulator contract offers an investor limited gains when the market is going strong, but Photo: AP Photo Larry Yung resigned as chairman of CITIC Pacific Ltd. in April amid a foreign exchange investment scandal that cost the company billions of Hong Kong dollars and prompted an investigation by the Commercial Crime Bureau and the Hong Kong Securities and Futures Commission. potentially massive losses when share prices start plunging. “The notion that the market will be flat is ridiculous, because the market will always move and you will eventually pay,” he says. So why did so many companies and tycoons still end up investing in such volatile contracts? Wong says accumulators are appealing when the market is stable and they can offer significant returns. Most investors are betting that the market will not decline enough to seriously damage their investment. But nobody can predict where the markets are heading and as the global economy has demonstrated during the last six months, such bets can be extremely risky. Indeed, over the past 12 months, China and Hong Kong share prices have fallen around 60 percent and 40 percent respectively in terms of local currency, MSNBC.com reported. Wong says a plunge in share prices is not only disastrous for investors with accumulator contracts, but they have a vicious cycle effect on the market. “When investors have to continue buying shares at a price that is above its current worth, they can only take so much before they have to cut their losses and get out of the game. So they sell their shares, all of them, and in doing so, further drive down the prices. Of course, other investors with accumulator contracts are eventually forced to sell out in similar fashion. “This snowball effect has helped create much of the volatility that we are seeing today in the markets. There’s a reason why an accumulator contract is called, ‘I’ll-kill-you-later contracts,’” he says. In South Korea, a number of companies have filed a collective lawsuit against a number of banks, including Standard Chartered and Citibank Corp., for damages caused by accumulator contracts, MSNBC.com reported. In Taiwan, WSF (Asia) Ltd., an offshore trading company, sued Chinatrust Commercial Bank for allegedly misleading the company into setting up two euro- and Australian dollar-linked accumulator contracts in October. The company demanded termination of the contracts and compensation of US$143,000 from the bank, according to Ming Pao. Wong advises accountants to pay extra attention to ensure the contracts they help draft are not accumulators. “These days there are a number of different names used to describe accumulator contracts. Some call it an ‘FX target redemption swap,’ others call it currency derivative contracts,” he says. Wong believes accountants who know the ins and outs of how accumulator contracts work can help their clients and companies better deal with the complex investment issues amid today’s volatile markets. Understanding accumulators for accountants Time: 9:30 a.m. – 1:00 p.m. Date: 16 May Language: Cantonese Speaker: J. Wong Programme code: W090516 May 2009 + A Plus [ 49 ]