Proforma Layouts

advertisement

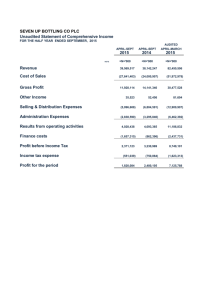

Photocopiable proforma layouts These pages may be photocopied for student use. The forms and formats include: ■ income statement of a sole trader ■ balance sheet of a sole trader ■ income statement of a limited company ■ balance sheet of a limited company ■ cash budget ■ ledger accounts © Osborne Books Limited 2012 Published by Osborne Books Limited Tel 01905 748071 Email books@osbornebooks.co.uk www.osbornebooks.co.uk SOLE TRADER: INCOME STATEMENT INCOME STATEMENT OF ............................................................ FOR THE YEAR/PERIOD ENDED ............................... Revenue £ £ Less Sales returns Purchases Carriage in Less Purchases returns Net Purchases Less Closing inventories Cost of sales ...... ...... ...... ...... ...... ...... Discounts received ...... Reduction in provision for doubtful debts ...... Bad debts recovered ...... Profit on sale of non-current assets eg ...... ...... Vehicle running expenses ...... Rates ...... Rent Heating and lighting Telephone Salaries and wages* Discounts allowed Carriage out Provision for depreciation of non-current assets Loss on sale of non-current assets Bad debts written off Increase in provision for doubtful debts Profit/(loss) for the year ...... ...... Add income: Less expenses: ...... ...... Gross profit eg ...... ...... Net revenue Opening inventories £ ...... ...... ...... ...... ...... ...... ...... ...... ...... ...... *Wages are sometimes listed as an expense in the trading section of the income statement ...... ...... SOLE TRADER: BALANCE SHEET BALANCE SHEET OF ................................. Non-current Assets Property Equipment Vehicles etc Current Assets Inventories Trade receivables Less provision for doubtful debts Cost £ ...... ...... ...... ...... ...... ...... ...... Prepayment of expenses (other receivables) Prepayment of income (other payables) ...... Less Non-current Liabilities Loans NET ASSETS ...... ...... ...... ...... ...... ...... ...... ...... ...... ...... ...... ...... Net Current Assets or Working Capital ...... ...... ...... Trade payables Bank overdraft Net book value £ ...... Bank/cash (cash and cash equivalents) Accrual of expenses (other payables) Depreciation £ ...... Accrual of income (other receivables) Less Current Liabilities AS AT ........................... ...... ...... ...... ...... ...... ...... ...... FINANCED BY Capital Opening capital Add Profit/(Less Loss) for the year Less Drawings ...... ...... ...... ...... ...... Practical point: When preparing handwritten final accounts it is usual practice to underline all the headings and subheadings shown in bold print in the example layout. LIMITED COMPANY: INCOME STATEMENT ................................................ LIMITED INCOME STATEMENT FOR THE YEAR/PERIOD ENDED £ Revenue Opening inventories ...... Purchases £ ...... ...... Less Closing inventories Cost of sales ...... ...... Gross profit ...... ...... Less Overheads: Distribution costs ...... Administration costs ...... Sales and marketing expenses ...... Profit/(loss) from operations Less Finance costs Profit/(loss) before tax Less Tax Profit/(loss) for the year ...... ...... ...... ...... ...... ...... STATEMENT OF CHANGES IN EQUITY (EXTRACT) Retained earnings Balance at start of year Profit for the year Less Dividends paid in year Balance at end of year ...... ...... ...... ...... ...... LIMITED COMPANY: BALANCE SHEET ................................................ LIMITED Non-current Assets BALANCE SHEET AS AT ................................................. Intangible Goodwill Property, plant and equipment Property Machinery Fixtures and fittings etc Cost/Reval’n £ Depreciation £ Net book value £ ...... ...... ...... ...... ...... ...... ...... ...... ...... ...... ...... ...... ...... ...... ...... Current Assets Inventories Trade and other receivables Cash and cash equivalents Less Current Liabilities Trade and other payables Bank overdraft Tax liabilities ...... ...... ...... ...... ...... Net Current Assets or Working Capital ...... ...... ...... ...... ...... ...... Less Non-current Liabilities Debentures NET ASSETS ...... ...... ...... x (number) ordinary shares of £x (nominal value) each Issued Share Capital x (number) ordinary shares of £x (nominal value) each, fully/partly paid Retained earnings TOTAL EQUITY ...... ...... ...... ...... EQUITY Authorised Share Capital Capital Reserves Share premium Revaluation reserve Revenue Reserve ...... ...... ...... ...... ...... Note: the balance sheet can be presented using a number of columns, as required. ...... ...... ...... ...... ...... ...... Closing Balance Opening Balance NET CASHFLOW TOTAL EXPENDITURE Loan repayment Operating expenses Purchase of non-current assets Payments to trade payables Expenditure TOTAL INCOME Cash sales £ £ £ £ £ £ month: ............................ ............................ ............................ ............................ ........................... ........................... Receipts from trade receivables Income CASH BUDGET for period: Name: LEDGER ACCOUNTS Dr Date Cr Details Amount Date Details £ Amount £ Dr Date Cr Details Amount Date Details Amount £ £ Dr Date Cr Details Amount Date £ Details Amount £