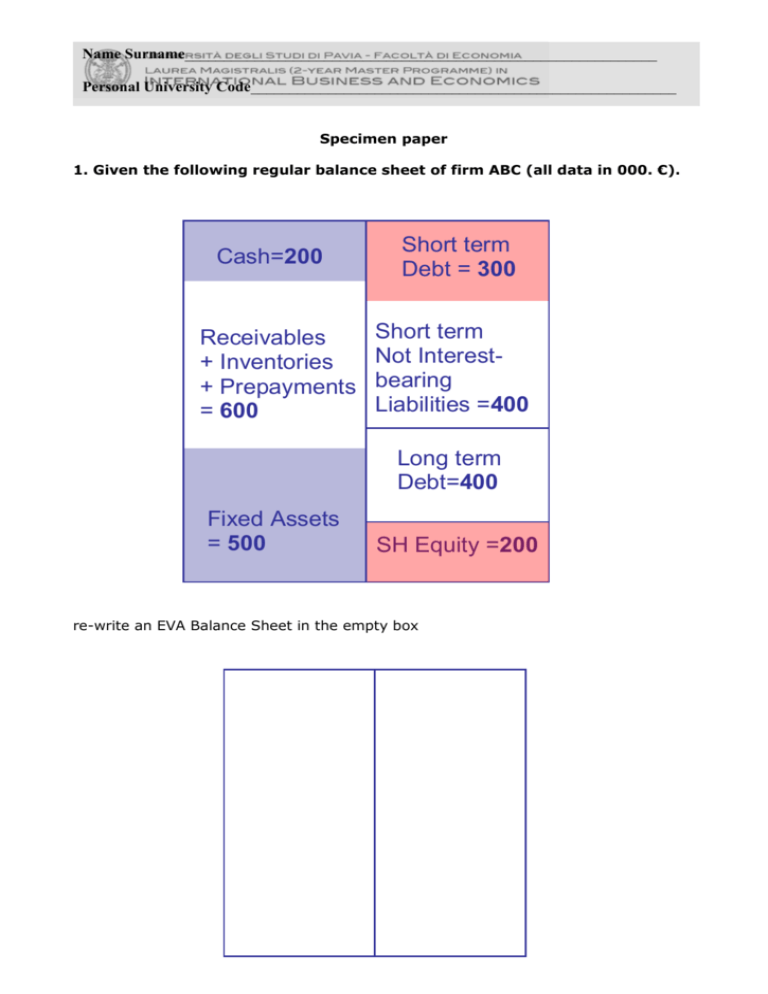

Cash=200 Receivables + Inventories + Prepayments = 600 Short

advertisement

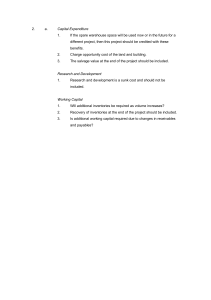

Name Surname_____________________________________________________________ Personal University Code_______________________________________________________ Specimen paper 1. Given the following regular balance sheet of firm ABC (all data in 000. €). Cash=200 Receivables + Inventories + Prepayments = 600 Short term Debt = 300 Short term Not Interestbearing Liabilities =400 Long term Debt=400 Fixed Assets = 500 SH Equity =200 re-write an EVA Balance Sheet in the empty box 2. Write the 2011 balance sheet and the income statement given the following 2010 data: Balance sheet (2010) Valuable intangible assets 0 Net fixed assets 3.000 EQUITY 5.000 Financial assets Long term assets 3.000 Payables 0 1.500 Financial debt ST 5.000 3.500 Financial debt LT cash 0 Inventory 2000 receivables 4.000 TOTAL ASSETS 11.000 11.000 P&L (2010) Net sales 16000 Total cogs (-) 10.000 Gross Profit (added value) HR costs & adm costs 6000 (-) 4.000 EBITDA D&A EBIT int costs Profit before Extr items Ext items PTP 2000 (-) 500 1500 (-) 300 1200 0 1200 Taxes 480 profit 720 And the following hypotheses for 2011: 1. inflation forecast for 2011 = 2% 2. sales 2011 + 10% 3. new investments 2011= + 1000 (5 yrs amortization period) 4. days receivables 2011 + 5 days compares to 2010 5. days inventories 2011 do not change compares to 2010 6. days payables+ 5 days compares to 2010 7. headcounts 2010 = 100 8. headcounts 2011 = 110 in order to compute the 2011 balance sheet assume a 2011 profit of 600. According to my calculation (after rounding) the day receivables, inventories and payables are for the year 2010: day receivables day inventories day payables 2010 91 45 110 3. Using the BSC approach consider the customer perspective and list at least 3 possible key performance indicators for this perspective: 1. ___________________________________________________ 2. ___________________________________________________ 3. ___________________________________________________ 4. ___________________________________________________ 5. ___________________________________________________ 4. In what differs the modified BSC proposed by Steven P. Landry,Wai Yee Canri Chan, and Terrance Jalbertin in their article on the "BSC for multinational" with respect to the Kaplan and Norton classical BSC? ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ 5. List the main characteristics of the Transnational model 1. _________________________________________________________________________ _________________________________________________________________________ 2. _________________________________________________________________________ _________________________________________________________________________ 3. _________________________________________________________________________ _________________________________________________________________________ 4. _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ 5. _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ 6. Explain the critique that Bennett Stewart does in his “EVA Momentum: The One Ratio That Tells the Whole Story” to the classical accounting ratio to measure profitability. _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ ________________________________________________________________________ 7. Please answer either part (a) OR part (b) of the following question. (a) or (b) Explain the distinction between absolute advantage and comparative advantage. What effects does globalization have upon the health of people in developing countries ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________