91404 Sample Exam Paper - Secondary Social Science Wikispace

advertisement

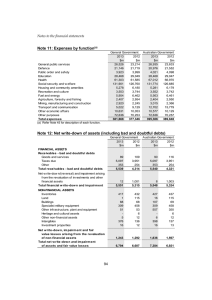

Level 3 Accounting 91404 (3.1): Demonstrate understanding of accounting concepts for a New Zealand reporting entity Credits: Four 2 Hallenstein Glassons 2012 Annual Report extracts and questions Hallenstein Glasson Holdings Limited (“Company” or “Parent”) together with its subsidiaries (the “Group”) is a retailer of men’s and women’s clothing in New Zealand and Australia. The Company is a limited liability company incorporated and domiciled in New Zealand. (a) State the act the company is incorporated under. (b) Explain fully what limited liability means for the shareholders of Hallenstein Glassons. These general purpose financial statements for the year ended 1 August 2012 have been prepared in accordance with the New Zealand Generally Accepted Accounting Practice (NZ GAAP). They comply with New Zealand equivalents to International Financial Reporting standards (NZ IFRS), and other applicable New Zealand Financial Reporting Standards, as appropriate for profit oriented entities. The financial statements comply with International Financial Reporting Standards (IFRS). (c) Explain why, as a reporting entity, Hallenstein Glassons is required to prepare general purpose financial statements. (d) Explain what NZGAAP means in relation to the preparation of the financial statements. (e) Explain in terms of comparability with other reporting entities why reporting entities like Hallenstein Glassons are required to comply with NZGAAP and NZIFRS when preparing their financial statements. (f) Explain why at the bottom of each financial statement the following statement is made. Notes to Accounts form an integral part of and are to be read in conjunction with these Financial Statements. (g) Explain the importance of each of the following two statements included in Hallenstein Glassons’ notes to the financial statements. (1) The principal accounting policies adopted in the preparation of the financial statements are set out below. (2) These policies have been consistently applied to all the periods presented unless otherwise stated. Historical cost convention These financial statements have been prepared under the historical cost convention, as modified by the revaluation of financial assets and liabilities. 1.12. Fair value estimation The fair value of financial instruments traded in active markets (such as trading securities) is based on quoted market prices at balance date. (h) Explain what preparing financial statements under the historical cost convention means. (i) In terms of relevance explain why financial assets such trading securities (eg shares in other companies) are revalued. (j) Explain in terms of reliability why quoted market prices are used to establish fair value. Accounting 91404 (3.1) 3 Land and buildings are recorded at valuation and are revalued at least every three years based on an independent valuation by a member of the New Zealand Institute of Valuers. (k) Explain how and why in terms of the recognition criteria for assets land and buildings are revalued at least every three years. In your answer refer to both parts of the recognition criteria (probable future economic benefit and reliable measure). (l) Explain fully why the Statement of Comprehensive Income for 2011 includes a $893,000 gain on revaluation of land and buildings as a component of ‘Other Comprehensive Income’. (m) Explain fully why each of the following statements is made about all classes of assets other than land and buildings. 1. All other classes of assets are recorded at historical cost. 2. Historical cost includes expenditure that is directly attributable to the acquisition of the items. 3. An asset’s carrying amount is written down immediately to its recoverable amount if the asset’s carrying amount is greater than its estimated recoverable amount. (n) Property, plant and equipment includes (store) fixtures and fittings. Explain in full why (store) fixtures and fittings are an asset of Hallenstein Glassons in terms of the definition and recognition criteria of assets. 1.3. Revenue recognition Revenue comprises the fair value of the consideration received or receivable for the sale of goods and services, excluding Goods and Services Tax, rebates and discounts and after eliminating sales within the Group. Revenue is recognised as follows: Sales of goods – retail Sales of goods are recognised when a Group entity has delivered a product to the customer. Retail sales are usually in cash or by credit card. The recorded revenue is the gross amount of sale (excluding GST), including credit card fees payable for the transaction. Such fees are included in selling expenses. Dividend income Dividend income is recognised when the right to receive a payment is established. (o) Use the definition and recognition criteria for income to explain why credit card sales of clothes at Glassons are recorded at the gross amount of the sale. (p) Use the definition and recognition criteria for an expense to explain why credit card fees payable are included in selling expenses. (q) Explain fully why dividend income is recognised when the right to receive a payment is established. Trade Receivables Trade receivables are recognised initially at fair value and subsequently measured at amortised cost, less provision for doubtful debts. Trade receivables arise from the sales made to customers on credit. Trade receivable balances are reviewed on an ongoing basis. Debts which are known to be uncollectible are written off. A provision for doubtful receivables is established when there is objective evidence that the Group will not be able to collect all amounts due according to the original terms of receivables. Accounting 91404 (3.1) 4 (r) Explain fully why trade receivables are measured at amortised cost, less provision for doubtful debts in the Statement of Financial Position. Include in your explanation why ‘the provision for doubtful debts is established when there is objective evidence…receivables.’ (s) Explain fully why credit sales to customers are reported as income in Hallenstein Glassons’ financial statements. (t) Explain fully why trade receivables are reported as an asset while uncollectible debts are reported as an expense in Hallenstein Glassons’ financial statements. (u) Explain why trade receivables are a current asset. Do not repeat any of your answer to (r). Inventories (accounting policy) Inventories are stated at the lower of cost and net realisable value. Cost is determined using the first-in, first-out Inventories (note) Inventory adjustments are provided at year end for stock obsolescence within cost of sales in the Statement of Comprehensive Income. (v) Use the above two statements relating to inventories to fully explain why there is an adjustment in cost of sales for stock obsolescence. You should incorporate the definition and recognition criteria for assets and expenses in your answer. (w) Justify why shareholders would be interested in each of the following three notes included in the Notes to the Accounts. 20. Capital expenditure commitments $000s Commitments in relation to store fitouts Group 2012 1,400 2011 2,461 21. Contingencies There were no contingent liabilities as at 1 August 2012 (2011 Nil). 27. Events subsequent to balance date Subsequent to year end, the Board has resolved to pay a final dividend of 19.0 cents (2011: 17 cents) per share (fully imputed). The dividend will be paid on 7 December 2012 to all shareholders on the Company’s register as at 5:00pm, 30 November 2012. 1.15. Trade and other payables These amounts represent liabilities for goods and services provided to the Group prior to the end of the financial period which are unpaid. (x) Justify why payables for services such as electricity and internet are reported as both an expense in the Statement of Comprehensive Income and as a liability in the Statement of Financial Position. (y) Explain why trade payables for goods are a current liability. (z) The Audit Report accompanying Hallenstein Glassons’ financial statements states that the financial statements “comply with generally accepted accounting practice in New Zealand (NZ GAAP); and give a true and fair view”. Explain how Hallenstein Glassons’ ensures its financial statements give a ‘true and fair view’. Accounting 91404 (3.1)